What is Cryptocurrency? A Beginner’s Guide

You probably have heard about it on the news, social media or from a friend, but what exactly is cryptocurrency? Don’t worry if you don’t yet have a firm grasp on this new asset class. Cryptocurrencies can be difficult to understand if you don’t know the basics.

To give you a better understanding of what cryptocurrency is and how it works, let’s go through the history of this relatively new technology, an overview of its inner workings, different types of cryptocurrency, and where this industry could go in the future. Once you get some background information on these subjects, you will gain a much more solid understanding.

- History

Cryptocurrencies have gone down a long, winding road in the past decade. Even though the general public has only stumbled upon cryptocurrencies over the past several years, there has been significant work that has led to this point. In fact, cryptocurrencies have a history that dates back more than a decade, to a time when Bitcoin didn’t even exist.

- Was Bitcoin the first cryptocurrency?

Back in 1998, computer scientist & cryptographer Nick Szabo, created a cryptocurrency named Bit Gold. While Bit Gold was never fully deployed to the blockchain MainNet (public), it was credited as paving the way for Bitcoin.

- When was Bitcoin created?

In October of 2008, a white paper by the mysterious Satoshi Nakamoto was released. This paper described a decentralized network used to fuel a new cryptocurrency called Bitcoin. It would take years before merchants would begin to accept the new form of money as payment, but slowly Bitcoin began to catch on. Over the next several years, more cryptocurrencies would be launched on the back of Bitcoin and ride the emerging cryptocurrency wave.

What I love the most about this new technology is that you don’t have to trust another human being to get the truth out of something. We are heading into what VC calls “Trustless” society. I highly recommend everyone reading this. Take some time of your day to read the Bitcoin's White Paper

- Cryptocurrencies go global

By 2014, there were already dozens of cryptocurrencies popping up. Some of these, like Ethereum, would continue to grow and thrive over time, yet others would go bust as quickly as they came into existence. When 2017 rolled around, cryptocurrencies were becoming the darling new niche of the financial world, hailed as a savior from the “corrupt” financial system. They were bought and sold on new trading platforms. Hundreds of tokens, another name for cryptocurrencies, had been created and their values were quickly rising. By the end of 2017, Bitcoin had skyrocketed in price from $900 to $20,000, and the entire industry hit a valuation of $600 billion. By 2018, it was clear: Cryptocurrencies were here to stay.

%20(1).png)

- What is cryptocurrency?

A cryptocurrency is a digital currency that uses cryptography as a means of security. Most cryptocurrencies operate without the need for a central authority like a bank or government, and operate instead through a distributed ledger to spread power among its community. A cryptocurrency has a set, defined monetary policy, whether it be a fixed limit of tokens or allowing the creation of new tokens based on predetermined rules.

Cryptocurrencies work using a technology called blockchain. Blockchain is a decentralized technology spread across many computers that manages and records transactions. Part of the appeal of this technology is its security.

-Why is cryptocurrency popular?

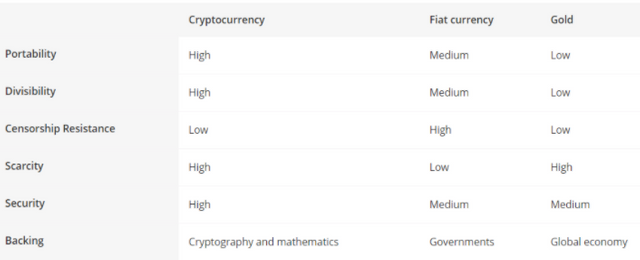

With cryptocurrency, there is a new way of transacting and storing value that is marked better than traditional fiat and gold. In fact, cryptocurrencies fare better in many of the properties that are needed for sound money:

Portability — How easily the currency can be transported

Divisibility — The degree to which currency can be divided into smaller amounts

Censorship Resistance — The ability for governments and regimes to censor its use

Scarcity — How prevalent it is in society and its future supply

Security — How secure it is to use

Backing — Who is backing the legitimacy of the currency

- Why do cryptocurrencies have value?

The value of crypto is that it does exactly what users want money to do: store consistent value and act as a medium of exchange for goods and services globally, not just locally. Cryptocurrency, like any other currency, must be able to hold value effectively before it can work well as a medium of exchange. But where does that value come from and what makes for good storage of it?

Both Bitcoin and Ether (ETH; the digital coin of a leading blockchain called Ethereum) derive value as a result of supply and demand, making both volatile assets. Bitcoin’s volatility is legendary. ETH is volatile too, but its value is tied not just to the market, but also to its usefulness to both the Decentralized Finance (DeFi) and Centralized Finance (CeFi) movements. ETH supports the many smart contracts platforms built on the Ethereum blockchain, including the Maker Protocol and the dapps built by developers to work with Dai and the Protocol.

It seems strange to some people that cryptocurrencies have value when most of them are not official products of a sovereign nation. However, the misunderstanding goes hand in hand with a misunderstanding of the definition of currency. Simply put, currency is anything that buyers and sellers agree will serve as a form of exchange between them. There are enough investors and traders of cryptocurrency to make it an attractive form of currency to people around the world.

- Stablecoins

Stablecoins are tied to the price of another asset (or grouping of assets) in order to minimize volatility, while maintaining the benefits of a cryptocurrency. The argument for stablecoins is that even though fiat cryptocurrencies are better than fiat currency because of their portability, security, and anonymity, they are unusable because of extreme fluctuations in their price.

Since their inception, cryptocurrencies have been considered particularly volatile investment instruments when it comes to their price. That's led to price jumps and crashes, preventing cryptocurrencies from being used for everyday goods and services in some cases, due to the risks for vendors and merchants.

That's where stablecoins come in. The theory goes, if you create a currency that is 'pegged' or attached to a regular fiat currency like the US dollar or something else with a relatively stable price, it will prevent price swings.

- Utility tokens

Some cryptocurrencies are used to power business and other functions on a blockchain network. These utility tokens aren’t necessarily currency in and of themselves, but because they have a predetermined use which has demand, they hold monetary value.

Some of the most popular utility tokens include:

Ether — Pays for computational power on the Ethereum blockchain

Chainlink — Facilitates the transfer of any digital asset on the ethereum blockchain

EOS — Similar to Ether, EOS is used to perform tasks on a decentralized network

- What might the future hold for cryptocurrency?

Is cryptocurrency going to continue growing? No one really knows the answer for sure. Still, you can rest assured that as long as there are use cases for cryptocurrencies and these assets provide an improvement over fiat currencies, they will hold a place in the global economy.

First, cashless and mobile payments will continue to grow globally, helping in cryptocurrency adoption and usage. Cryptocurrencies, like Bitcoin, will see their technology advance and use cases grow, leading more and more merchants to accept cryptocurrencies as a form of payment. Utility tokens will undergo their own battle to convince regulators they are not securities, while stablecoins will prove that you can have cheaper, faster transactions using cryptocurrency rather than fiat.

The main issue with cryptocurrencies is their ease of use. Today, it still requires some level of technological understanding to utilize cryptocurrencies to their fullest potential. As more projects and developers work on user interface and design, cryptocurrency offerings will become easier to use for the average person with little to no technical knowledge. Once this happens, watch out, because there will be no limit to how high cryptocurrencies can grow.

- How to buy and sell cryptocurrency

Now that you know what cryptocurrency is, it is time to buy some for yourself. Unfortunately, cryptocurrency can’t just be bought on any exchange; it requires the use of a cryptocurrency exchange or online trading platform to make a purchase.

There are many cryptocurrency exchanges available for you, but few are as easy and secure to use as with (Crypto.com - Use referral code: evwje67bmi and get $25 as reward) You can buy and sell the most popular cryptocurrencies — such as Bitcoin, Ethereum, Litecoin, Chainlink, and more — in an instant and with low fees.

Hello techvolutions!

Congratulations! This post has been randomly Resteemed! For a chance to get more of your content resteemed join the Steem Engine Team