Cryptocurrency FUD Is Real And That Is Why It Is Going To Make Most Steemians Rich!!!

2018 is an awful year for the cryptocurrency market. Hitting a peak around January 3rd, things tanked since then. Many tokens witnessed a 50%+ pullback. We are seeing prices back where they were before the run up at the end of 2017.

Such is the nature of markets. It is the ebb and flow. Markets are their own entities which move at whim.

Well not exactly.

The cryptocurrency market is not moving at whim. It is the victim of an orchestrated attack by the bankers. This was designed, intentional, and well thought out.

Some people seem to think that cryptocurrency is no threat to the banks. If that was true, do you think you would see all these attacks levied against Bitcoin? Do you see Netflix being destroyed by the mainstream media? The answer is no and the reason is because Netflix poses no threat to the bankers.

It is vital we understand how things work.

I have a buddy who makes his living off trading stocks. He uses his own money and pays his bills based upon the profits he generates. For this reason, he is a watcher of channels such as CNBC and visits sites like Marketwatch.

Yesterday I was talking to him and mentioned cryptocurrency. Even though he did not use this term, he brought up the FUD. Basically, after all these years of watching these channels, he understands how the message is manipulated. When the guests are consistently out there degrading something, it is a staged attack. He noticed that the entire message around Bitcoin and cryptocurrency is negative.

Here is someone who does not follow cryptocurrency yet follows Wall Street. To me, this shows the cryptocurrency FUD is real. This individual doesn't have skin in the game. It is an observation from a fairly astute person.

Wall Street is an interconnected web of players. Through this cross ownership, we see the bankers own the media. This is something that is literal.

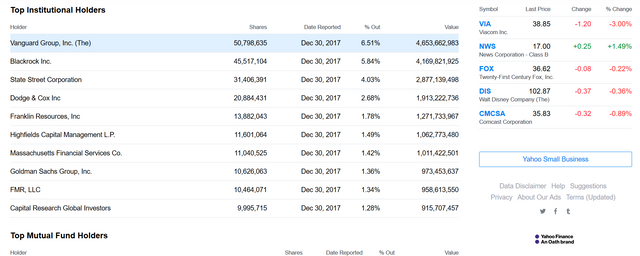

Taking a look at the major holders of the media companies reveals the truth.

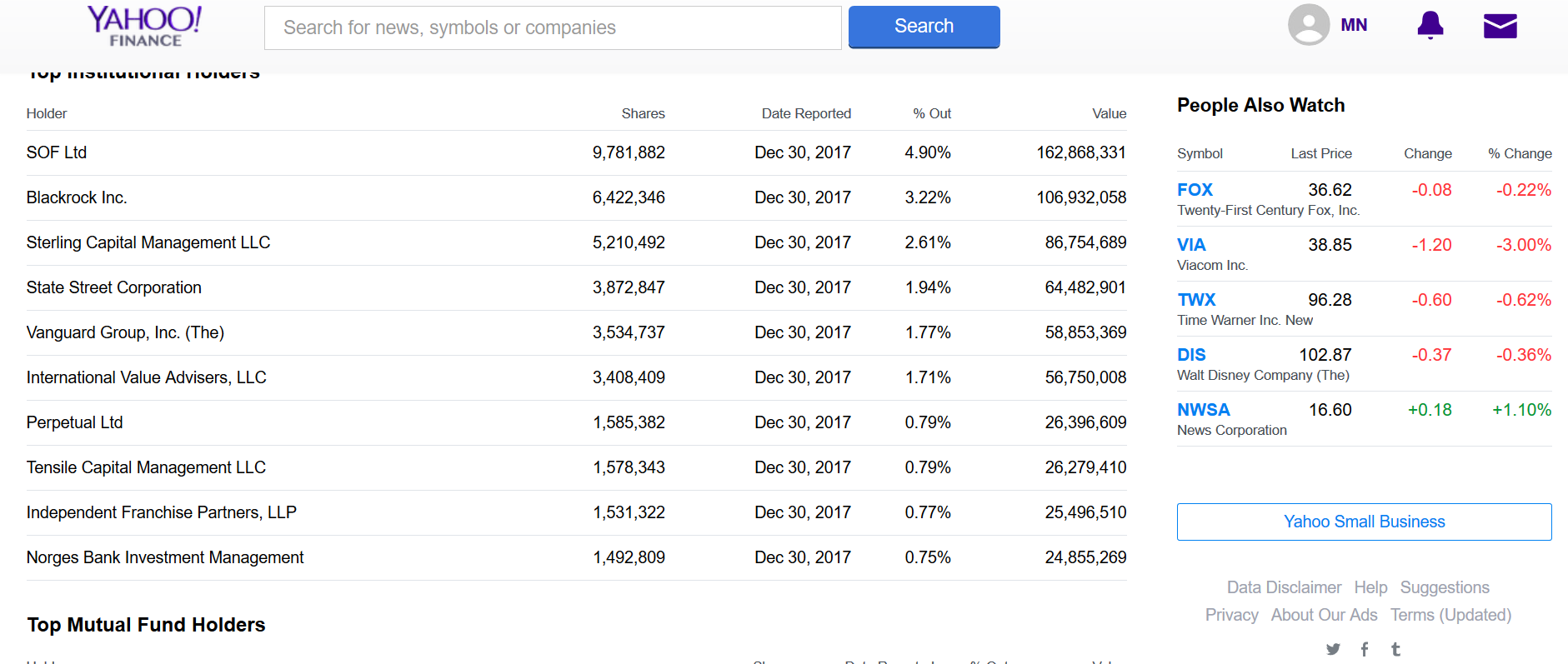

News Corp.

Fox

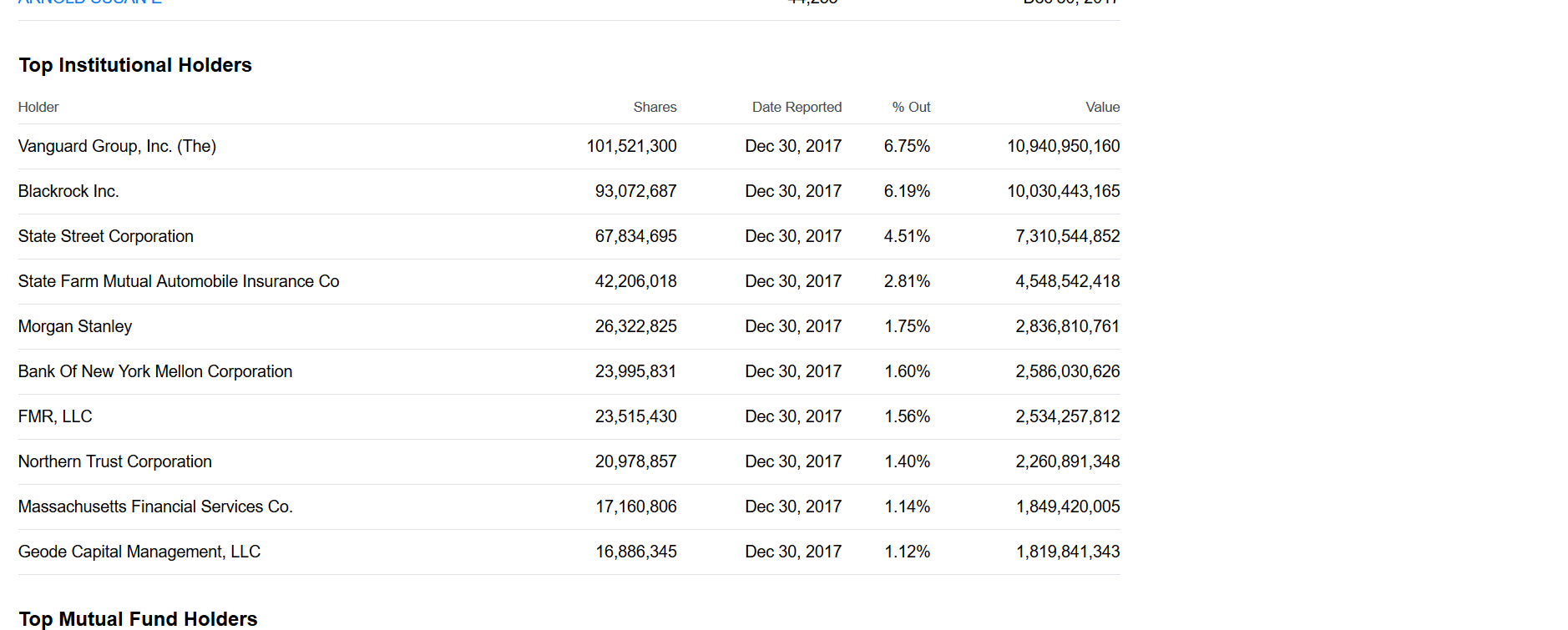

Disney

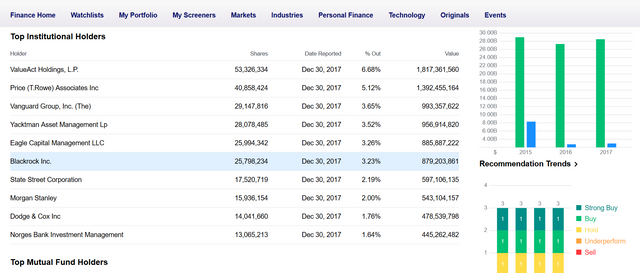

Time Warner

Notice any similarities?

Many of the same companies show up. Blackrock, Vanguard, Morgan Stanley, and State Street. They are the largest holders in four of the major media companies.

The situation only gets worse when you follow the path to find out who biggest holders are in those companies holding these institutions.

It does not matter if you believe in conspiracies or that there is a select few who seek to keep humanity enslaved. What does matter is that there are a small group of people who control the largest corporations, including the media. These people are not your tech titans or real estate moguls. They are bankers from Wall Street.

At the core of it all is the bankers.

Therefore, it is easy to see how they orchestrated an attack on Bitcoin (and cryptocurrencies). The assault is relentless. When a non-investor is noticing the negativity launched at a particular asset class, you know it is bad. We are witnessing a planned FUD meant to turn people away.

Which means that anyone who understands this is in the best position in the world.

Cryptocurrency and blockchain are going to crush the bankers. This action proves it. There is no way to defend against the Internet coming to your industry. When it does, the fallout is great. Just ask the newspapers, magazines, record companies, and video cassette rental places how that worked out. While we are at it, perhaps we could look at how AT&T's long distance division is doing. All these were obliterated by the Internet.

The bankers are on the path towards the same fate. That is why there reaction is so violent. Perhaps your friends will say that cryptocurrency is not real yet the bankers know it is. They are doing all they can to control.

So congratulations!!! If you have some cryptocurrency, you are destined for massive wealth. We are going to see a huge run over the next few years in this market. The FUD will only last so long. Like the record companies suing their own customers, the tactics used are futile.

This is why the idea that we are seeing a bubble is absurd. The bankers launched an major offensive against cryptocurrencies in an effort to make them unattractive to people. There is a lot of fear instilled in the average person about this. However, when we look at the development that is taking place, it is growing. Therefore, while the media is going to beat the same drum, we are going to see, over time, radical advancements in this technology.

While the mainstream media is busy blasting Bitcoin as a headline, companies and developers around the world are making major moves which are pushing cryptocurrency closer to mainstream adoption. It is going to take a while yet the process is started. There are deals announced on a regular basis, ones that get into hundreds of millions of dollars, in the crypto space.

This is not a passing fad. Bitcoin first appeared on the scene 9 years ago. This is not an industry that was started in the last year or two. Since that time, many different blockchains were created, some improving upon what Satoshi laid out a decade ago (Bitshares and STEEM being the main ones). We are awaiting the introduction of EOS which is anticipated, by many, to be a technology that creates interoperability within the space while improving what already exists.

Some say that cryptocurrency 2018 is akin to the Internet circa 1993. That analogy might be true. It took the Internet 6 or 7 years to get mainstream adoption from that point. While that is not a long time to wait, I believe it will be quicker in this realm. Technology advances at a greater pace 25 years later. The next 2-3 years will see major penetration done by blockchain/cryptocurrency.

So embrace the FUD and take solace in it. If this were not real, the bankers would simply ignore it.

If you found this article informative, please give it an upvote and resteem.

To receive the free basic income tokens you are entitled to and help end world wide poverty, please click the following:

Pictures by Google Images

good job man

I agree about cryptocurrency success soon in the future but I think the banksters have a lot of money and they'll join the party and screw us again.

I don't see how that is possible since technology empowers everyone. When everyone has powerful tools in their hand no bank or person can control you.

Banks can buy all crypto coins in existing in one trade if they want.

Except if they did that, someone would simply fork the blockchain meaning that their purchase of the crypto could be made worthless if everyone moved over to the new fork.

They can join exchanges, payment cards, add a crypto account to our existing bank accounts. They always know where to earn. They can give us loans in crypto... I don't like or support that. That's just how the world spins. Look at steemit. Lending, delegating, vote buying. How is that different?

That is too much idealism money has less power these days. It's starting to become pointless. People don't need money as much as back in the days since there is more abundance now.

Where do you live man? I want to move there.

I can see a major upsurge again in BTC price once bankers and major financial or business institutions starts to buy in for the cheap cryptos and begin the cycle again as they already knew how these markets tick.

Good write up! I agree that the bankers control the media and spread FUD on purpose. Idd they can't stop it, maybe delay a bit. I think the adoption of Bitcoin will go way faster than the adoption of the internet because now we have the entire internet infrastructure already where Bitcoin is communicated on. I think really soon we go main stream, and another difference with the internet is that here a lot of money is to be made by coming in earlier than others (at least in a more direct way). This could cause a 'race' where adoption happens hyper fast.

I agree @michiel.

Although the Bitcoin adoption has taken 9 years to get to this point, so it was not exactly quick. In general, there is a section of the masses who are willing to accept newer technologies at a faster pace than in the past. With the barrier of entry being rather low, like signing up for steemit and posting, this is a much easier decision than deciding to take on an added expense by getting with an ISP and learning the Internet.

While there is bit of a learning curve with Steemit (less with D.tube and Zappl), it is nothing compared to learning how to use the Internet 20+ years ago.

If we consider how long the banks have been here for a couple hundred years the Bitcoin 9 year bull run has been going very fast. And I'm very curious how much faster things could go because it's hard to see evolution ever would slow down once the speed starts to pick up.

This is actually totally heartening to read TM. As a traveler, I'm a huge believer in the power of crypto.

Yesterday I wanted to move some money from my account in Australia to my account in the US. I've now learnt not to use the Banks SWIFT system because it takes a long time, and they'll often charge a $26 fee. I've got a Paypal account linked to my Aussie bank and a different Paypal account linked to my US bank.

The actual transaction within Paypal was quick... a matter of minutes... but the transfer to bank to Paypal... and then Paypal to US bank is taking days each.... AND Paypal charged a $7 fee to transfer to 'friends and family'.

Add in the confusion of the AUD/USD conversion, and I have no idea how much money I've lost in this whole process.

Yet... I can transfer STEEM to anyone, in seconds, without fees, and there's no conversion math.

Investors might be scared at the moment, and that's fine. The price of crypto shouldn't concern us. It's a better system, it's a better product and it will win out.

All those news channels will eventually run out of viewership as their biased reporting drives people to independent media. I love the Phillip DeFranco show on YouTube. He is completely unbiased and is paid via his fans. That's how the news should be.

The first unbiased news channel to gain traction on @dtube is going to make a lot of money.

Your title indicates that most users will get rich. I assume you only mean active users. But even then, the numbers from your post yesterday seem to indicate something totally different.

Based on your numbers from yesterday, 5% of active users own 98% of MVests. The influence of whales is very slightly decreasing, but at current pace we might be lucky if 10% or 15% of the users will enter the group that owns 98% of the Steemit value.

And even if that happens, the majority of those 5% that have a little something are minnows. Currently their account value is on average $4k. Even if this goes up by factor 10, they are far from rich!

Thanks for your comment.

To start, the pace of distribution will increase as more users sign up. The reward pool is set up that way. It is impossible for that 95% to maintain such a huge percentage.

We already saw a massive drop in the last year in the percentages as the active users base increases.

And yes it is active users since inactive users do not have STEEM for the most part.

I think STEEM will go up by much more than a factor of 10. A $20 token for what is being created on this blockchain is nothing.

I was not aware of the fact that the reward pool works like that. I always thought it was based on a fixed amount of SP, called inflation in the white paper.

But if I combine that with a large price increase and also whales+orcas powering down, there could indeed come a lot more people that get a very nice account value.

And for most Western counties you could say rich means at least $1mln. But for countries in Africa this amount would be much lower.

I prefer healthy and happy as definition of rich 😀

Considering the saving rate is at an all time low in the western countries and wages havent really moved up in 20 years, I would say that rich is a much lower level since many cannot put their hands on any money.

This is a bit dated, but from what I can derive, the main premise hasnt changed much when the debt load of American, at least, is accounted for.

http://business.time.com/2011/06/01/nearly-half-of-americans-would-struggle-to-come-up-with-2k-in-30-days/

Since $2K is hard for almost 70% of the people, I would say $250K would be a major windfall for people. In fact, $100K is more money than they have in their retirement accounts according to the statistics.

So while the west appears richer than many other countries, the net is still the same...people are broke. They might not be starving like in 3rd world countries but they are far from getting ahead.

So I think even a few hundred in SP, at some point within the next 5 years, will be worth a couple hundred thousand dollars.

Hmzz things in Holland are neither very well for every one. But I think the average net income is around $2,500.

For my generation retirement will be a big question mark. But for people that are already retired, most of them have a few hundred thousands USD for their retirement. Some believe we have the best retirement system. I think there are some disadvantages, but compared to the rest of the world it's almost divine.

When people parallel this to the tech bubble I remind them that out of that bubble we now have Amazon, Google, Applle etc. There will arise industry disrupters out of the blockchain/cryptocurrency "bubble".

I wonder if the fud is basically market manipulation... Wasn't it Wall Street (controlled by banks) that boosted the market in November? They've obviously taken profits, but I have a feeling they'll be back, and the media will temporarily 'forget' how 'evil' digital currencies are... just long enough to pump them again...

I cant say it is market manipulation but I believe it is.

A $300B market is easy for them to move. Rumors are they control the silver market which is much bigger than crypto.

This all leads to a situation where they are playing their games. The way to overcome this is for development to continue to the point where the ecosystems simply become too large for them to hold back. With more activity showing up on the blockchain, over time, the less they can do.

https://steemit.com/busy/@fsl/holiday-villas-on-holiday

I just hope I don't have to kill any cops in self defense. But I suspect that when they start to drown and get desperate that they will stop at nothing to steal from those of us invested in this now. They will of course have to use the $5.00 wrench attack.

It depends upon how fast it happens. If it goes down by 2020 like you guess, it could be nasty.

A slower demise, which is the banksters m.o., means people will have time to adjust. You just might find some of those cops in cryptocurrency.

Before anything great comes to fruition, there are always obstacles and this obstacle is just a phase for crypto. We can't face this twice. If it didn't happen now, it will happen later in the future but the truth is that the FUD must happen so we need to be patient and embrace it.

The internet actually faced it's own share of rejection. Read about it Sometimes ago and I was surprised because I only got to know about the internet when it had been generally accepted so didn't get to know what really happened behind the scenes but for crypto, I am part of this and will get to share our success story to many generations to come.

Yeah the mantra around the Internet when it started was it is only used for porn, drug deals, and illegal activities.

Same thing we hear about blockchain.

The masses might reject right now...and then when they do get in, they will complain they got in too late.

Crypto is not hidden from anyone...it is available for all to see.

Yet most buy into the FUD the banksters espouse.

Great post. Banksters feel threaten. Resteem.