TRADING LESSON: WHAT IS IT A DOJI? AND HOW DO WE TRADE A DOJI? 27 June 2107 @supertrader

*** please RESTEEM and VOTEUP if you like this post ***

The markets consist of a constant battle between the buyers and the sellers and is not much different to a game of tug-of-war

Sometimes this results in a stalemate when both the buyers and sellers reach an equilibrium point, with no party being able to assert its authorithy on price action.

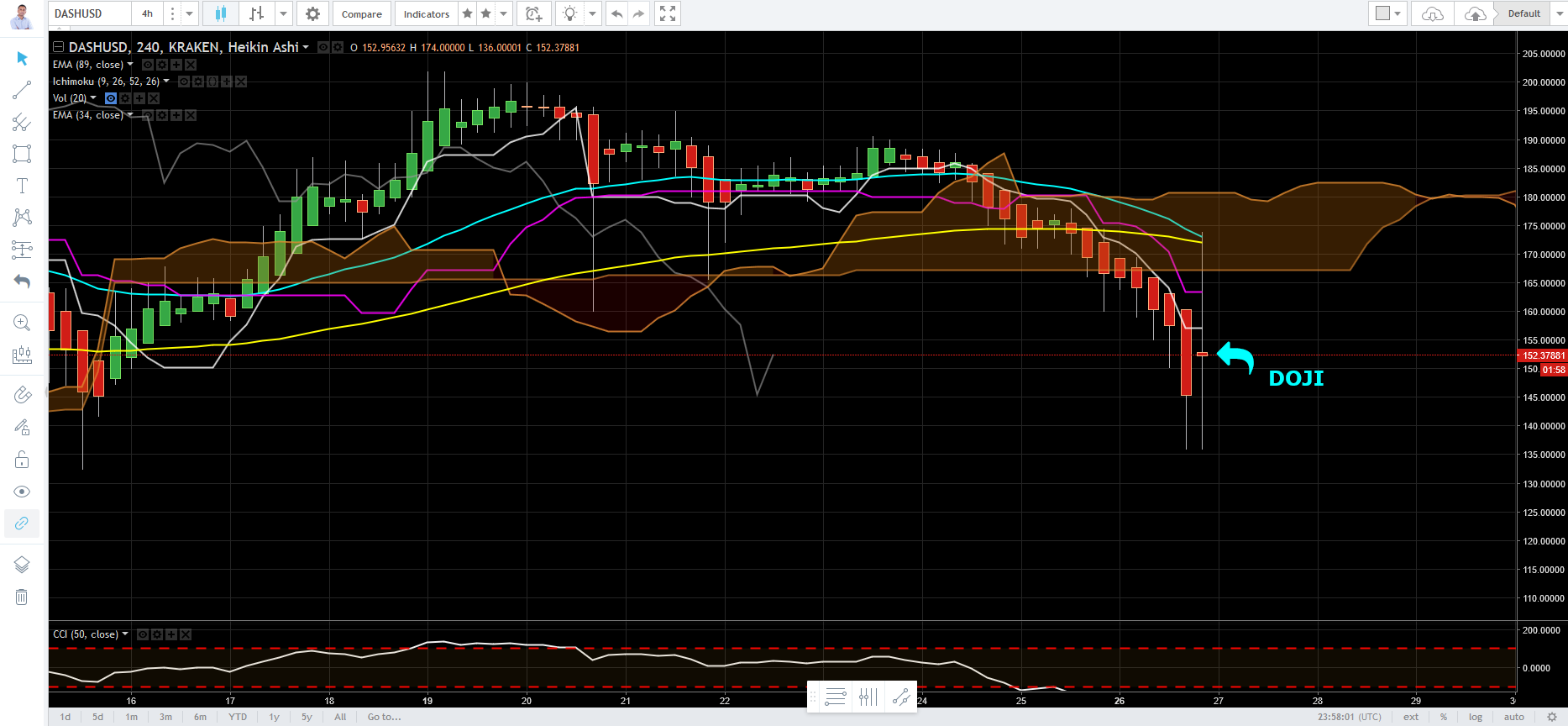

If we look at the chart below we can see how this is represented in a candlestick.

The body of the candlestick is repesenetd by the red box.

We can see a long wick ABOVE the body shows where the buyers tried to push the market up only to be pushed DOWN by the sellers.

We can see a long wick BELOW the body shows where the sellers tried to push the market down only to be pushed UP by the buyers.

The representation of this buyer seller struggle we call a DOJI.

The equilbrium point is represented by the body of the candle with long wicks either side. The smaller the body is the more indecision has occured as to which direction the market truly wants to go, in the future.

As professional traders, we can use this information to our advantage to make a profit. How?

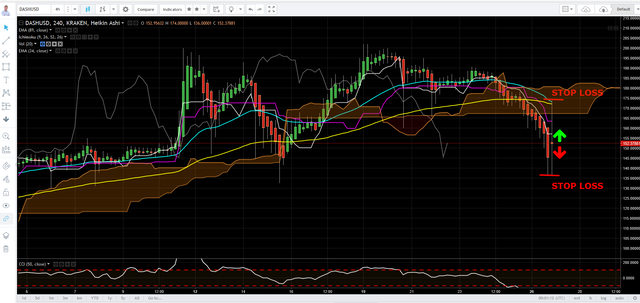

We place two contingent orders:

Order 1 - one above the top of the body going long and

Order 2 one below the body of the candle going short.

Both orders are placed at the same time.

The idea is we don't know and don't care which direction tehe market wants to go, we just go with the flow.

So dont care which direction it goes (up or down) but what we can have a level of confidence that tells us whichever of the buyers or sellers are stroonger. We can say with a level of confidence that whomever breaks the deadlock of this indecision and move the market in a more definite direction (either up or down) are the ones in control.

NOTE: If one order is triggered the other order is removed. Most trading platforms can place contigent orders called OCO (one cancels the other) orders .

For our long trade our stop is placed BELOW the bottom of the wick.

For our short trade our stop is placed ABOVE the top of the wick.

We remain neutral in a "zen like" pose as we allow the market to declare itself as to which direction, up or down, it really wants to go. In short, we let the market "do its thang".

My recomendation is that whichever trade entry is triggered, when you have achieved a 2:1 risk reward that you lock in your profits. Although, there may be signals to indicate to stay in the trade for a greater profit, in which case just move your stop to break even so you can ride a "free trade", with zero risk.

Hope this helps.

If you like this post, you know what to do VOTE IT UP and FOLLOW ME, You get paid just for voting or commenting and I get paid for my time.

Analysis by: Sean Vengan 27 June 2017

To have a larger view of the chart, just right click on the chart image and select "View Image"

If you are interested in learning how to trade in this exciting new cryptocurrency market, from a 10+year Veteran Trader, I would love to share my knowledge, experience mistakes and journey. The trading value I can offer you covers:

- PROFESSIONAL STRATEGIES

- RISK MANAGEMENT and

- TRADING PLANS

These strategies will EMPOWER you to trade ANY MARKETS - Forex, Stocks, Futures, Options, ETFs

If this of interest to you, then register your interest with my site I would be privileged to educate you.

Click the link on my profile or here it is: http://cryptotradingmastery.com/

Nicely written. Very helpful and easy to understand how to act based on this particular candle stick.

Thank you once again. If you please vote and resteem we all win.

Yep already upvoted :)

Thank you