Why Bitcoin's price will rise $150,000

We're witnessing a revolution in the financial industry, with professional market participants and regulators recognising decentralised cryptocurrency as an investment asset and a former US president including cryptocurrencies in his election platform.

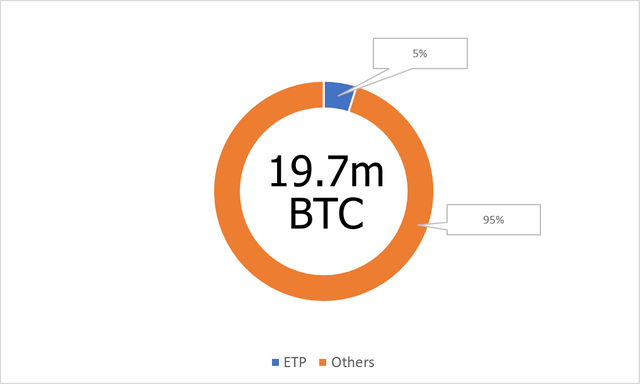

One clear indication of the recognition is the rise in Bitcoin ownership by licensed exchange-traded funds. Today, their combined holdings exceed 1 million coins or $68 billion. That's 5% of the total circulating supply of 19.7 million BTC.

Image source: StormGain infographic

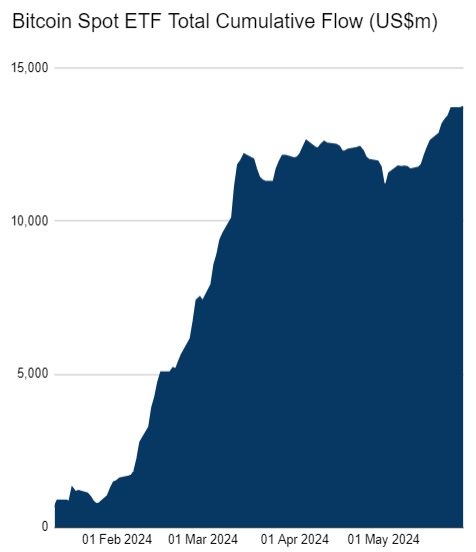

Canada, Germany, Switzerland, Brazil, China (Hong Kong), Australia and others are among the countries that have launched crypto funds. The US leads the way with an 85% share, where spot ETFs that have emerged this year have attracted $13.7 billion in investments. One-third of this amount was provided by large institutional investors, whose assets under management start from $100 million.

Image source: farside.co.uk

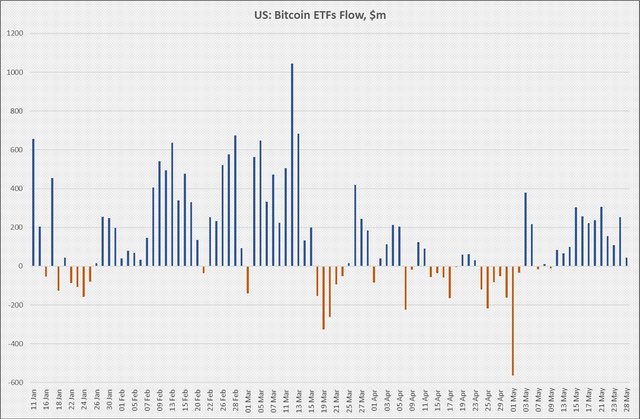

In the past three weeks, US funds have seen a return to pure accumulation, gathering $2.1 billion in investments.

Image source: StormGain infographic

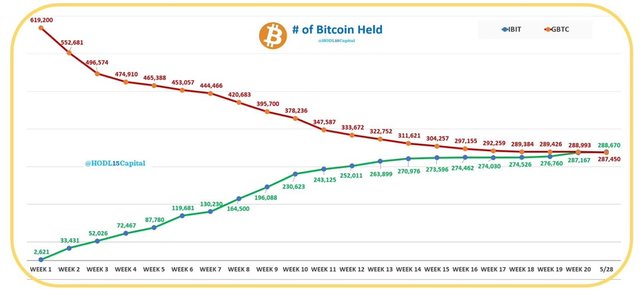

Notably, BlackRock's fund will soon overtake Grayscale, which has been in operation since 2013 and converted from a trust to a spot fund. Grayscale is experiencing outflows for a number of reasons, totalling $17.7 billion this year. Its velocity is weakening, which will further favour the overall ETF statistics.

Image source: x.com/HODL15Capital

Analysts at Bernstein suggest that cryptocurrency funds will see an inflow of $100 billion over the next two years. Significant demand pressure will see Bitcoin's price rise to $150,000 as soon as next year.

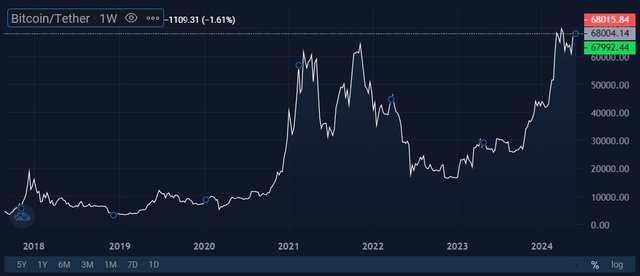

Image source: cryptocurrency exchange StormGain

The growing acceptance of Bitcoin is evident in the interest from professional market participants and the changing political agenda. In May, the US Congress approved the FIT21 digital asset bill, which was opposed by SEC Chairman Gary Gensler and President Joe Biden. But it'll be hard for the president to veto since his election opponent Trump has made supporting crypto innovation one of the planks of his campaign platform.

Recent polls in the US have shown that 48% of cryptocurrency-owning voters would support Trump, while only 39% would vote for Biden. Although Trump had a negative view of cryptocurrencies in the previous election race, they've taken a key spot among his positions, posting in recent days:

"Crooked Joe Biden, on the other hand, the worst president in the history of our country, wants IT to die a slow and painful death. That will never happen with me!"

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)