Over-optimism and signs of a Bitcoin correction

In September, one of the leading growth drivers for risk-on assets was the Federal Reserve's 0.5% interest rate cut, the biggest such change to the rate in the past four years. The move caused Bitcoin to strengthen for nine days by 9.3% to $65,800.

Image source: StormGain Cryptocurrency Exchange

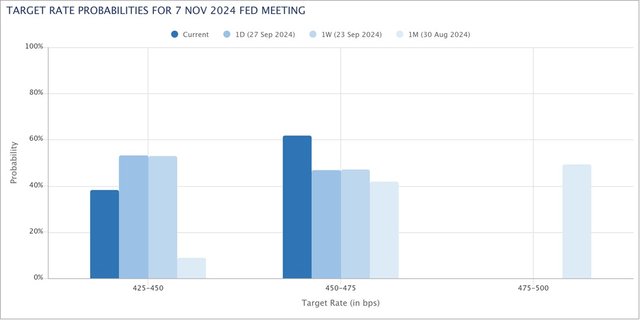

CME's FedWatch tool gives a 50/50 chance of the regulator making the same move in November, which, when coupled with the 21% average yield in October, gives investors high hope that Bitcoin will soon set new highs. The counterargument is that a number of metrics hint at a potential correction.

Image Source: cmegroup.com

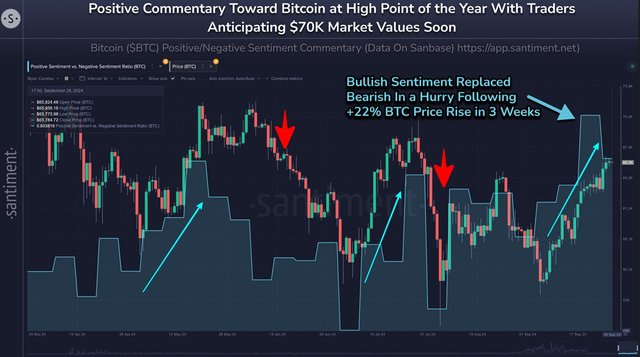

Sentiment

Over-optimism is reflected in the elevated funding rate (indicating a predominance of buyers in the futures market), the rising premium on Coinbase, and the prevalence of bullish expectations in social media posts. According to calculations by the analytical company Santiment, for every bearish post about Bitcoin, there are 1.8 bullish ones. At the same time, every time optimism went off the charts, the market went into correction.

Image Source: x.com/santimentfeed

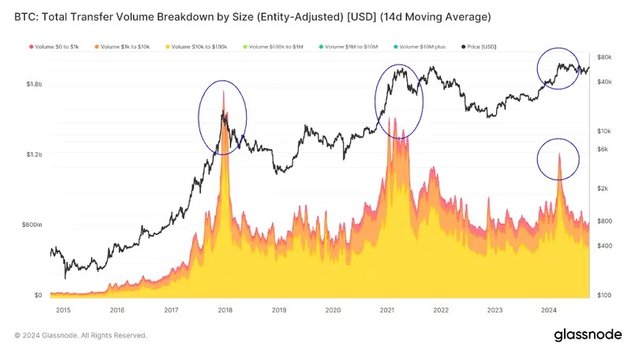

Low market activity

Bitcoin's significant growth has always been accompanied by an influx of new players, growth in retail capital and network activity. Right now, despite the consolidation around the high, this isn't being seen. The current volume of retail transfers is half the highs seen in the spring, and the difference with the rallies of 2017 and 2021 is even more significant.

Image source: glassnode.com

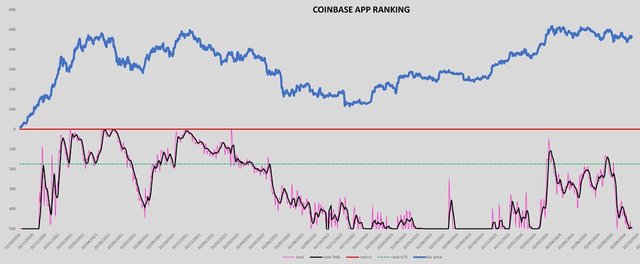

Lower network activity

The number of active network addresses is below the annual average, another sign of a potential correction.

Image source: glassnode.com

It correlates to the number of downloads of Coinbase's mobile app. During the 2021 bull run, the app was the most downloaded in the App Store. In the activity seen in Spring 2024, it reached the Top 200. The number of downloads is currently at its lowest level in the last four years.

Image Source: x.com/bitcoindata21

The arguments laid out above don't diminish the importance of long-term factors such as the growth of global liquidity or halving events. Nevertheless, they serve as a warning to investors who rely too heavily on 'Uptober'.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)