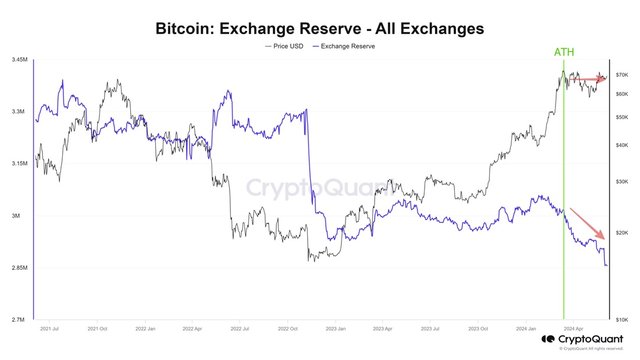

Bitcoin is leaking from cryptocurrency exchanges

After setting a new price high in mid-March, Bitcoin went into a prolonged consolidation. During this time, cryptocurrency exchanges' combined BTC balance decreased by 5% to 2.85 million. The decrease is primarily due to withdrawals to cold wallets, which demonstrates traders' anticipation of Bitcoin's price increasing further.

Image source: cryptoquant.com

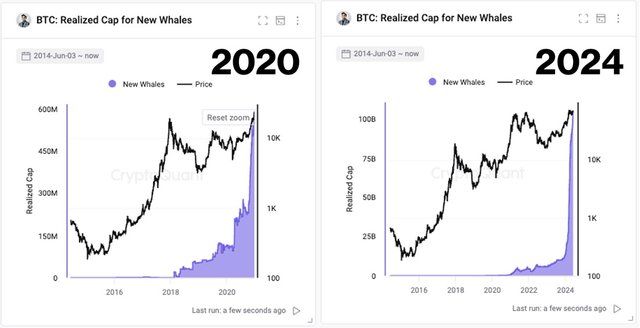

Young whales showed significant accumulation, adding $1 billion to their wallets every day. The head of the analytics firm CryptoQuant, Ki Young Ju, notes the high similarity in their behaviour to 2020.

Image source: x.com/ki_young_ju

Back then, the consolidation phase around the price point of $10,000 lasted for about half a year. After that, the price increased 2.5-fold in three months.

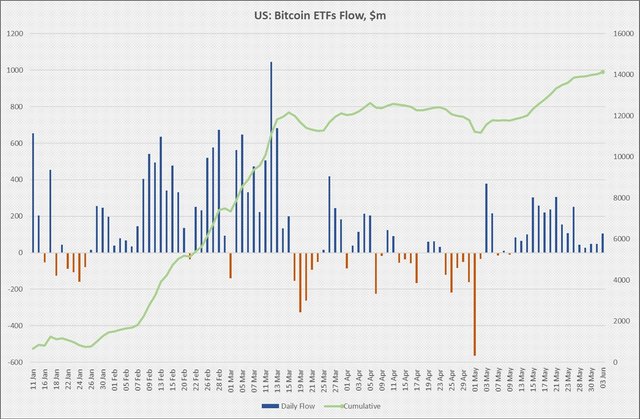

Image source: cryptocurrency exchange StormGain

Large institutional investors from the US are some of the prominent young whales. 13F reporting showed that one-third of all capital inflows into spot ETFs in Q1 2024, which amounted to $4 billion, came from companies with more than $100 million in assets under management (AUM).

US ETFs continue to grow and now have a value of $14.1 billion.

Image source: StormGain infographic

But the big players are just starting to whet their appetites. For example, Marquette University finance professor David Krause believes the State of Wisconsin Investment Board (with an AUM of $156 billion) is currently pricing in public opinion after buying $150 million in shares of BlackRock and Fidelity funds in Q1. If the response is favourable, Krause is confident that investments in cryptocurrency will increase and that the other pension funds will follow Wisconsin's example.

Institutional capital's interest in cryptocurrency and the renewed outflow of coins to cold wallets are creating favourable territory for Bitcoin's continued growth. The closest event that has the potential to be a catalyst is Franklin Templeton's spot ETH ETF application. The final decision on whether to approve it is due on 11 June 2024.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)