what is Candlestick? why you should learn it

Put simply, candlesticks are a way of communicating information about how price is moving.

Candlestick charts are available on ThinkForex trading platforms for all assets individuals can trade

on the platforms. Below is a sample of a candlestick chart derived from the ThinkForex web trading

platform:

This chart shows price on the right (vertical) axis, and time on the bottom (horizontal) axis.

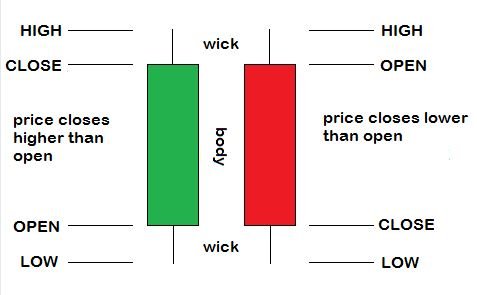

Moreover, the chart is made of bars that have little lines stemming from the top and the bottom; these

are known as candles. The candle conveys four pieces of information:

- The open price 3. The high price

- The close price 4. The low price

Candles refer to that information for a specific unit of time. For instance, the chart above is a daily

chart; each chart represents one day. And thus, each candle constitutes, the open, close, high, and low

price for that given day. The horizontal axis at the bottom of the chart can be used to understand

which day corresponds to which candle. Below is an image that illustrates how those four pieces of

information the open, low, high, and close for a given period of time are visualized in the context of

a candle:

The wicks, or shadows, are the thin lines that go outside the rectangular body of the candle.

They represent the high and the low price during that time period.

The color of the candle is also significant in understanding whether the open price was higher or

lower than the close price. If the candle is red, or denoted as bearish in some other manner, this

means that the open price is lower than the close; and the opposite is true if the candle is green, or

denoted as bearish.

@stockmarketinfo You can read ....