Bitcoin, Ethereum, Bitcoin Cash, Ripple, Stellar, Litecoin, Cardano, NEO, EOS: Price Analysis, March 8

News News pound continues cryptocurrency markets that are discouraging attempts at recovery. Bains Exchange's news has been hacked and requested trading platforms dealing with digital assets to secure SEC assets.

Later, Binanes rarely reported trades. There is also an interesting observation that hackers have lost some coins during the hack they tried.

The possibility of a possible SEC rule is that many parties have their own opinion about its benefits and losses. But the provisions also proved to be favorable for cryptocurrencies, attracting organizational jewelry, which is still far from the market.

In other news, Japanese regulators have been heavily cut on Coincheck and six other exchanges. Most cryptocurrencies are struggling to maintain their support levels by detecting these news.

Let's see if the difficulty lies in the source or bottom of the corner.

BTC / USD

BTC failed over $ 12,200 on three occasions in the last month and half. Therefore, this level assumes significance. The cryptocurrency only gains momentum after it breaks and continues to be above $ 12,200.

Over the past two days, the BTC / USD pair has broken the ascending channel and two moving averages. Its next major support is $ 9,500. If this level breaks, it is likely to fall to $ 8,404, which is $ 6,075.04 from $ 12,172.43 to 61.8 percent Fibonacci restoration levels.

The moving averages are two flat, so if they have $ 9,500 levels, the range bound can trade.

Intraday merchants get a chance to play a small bounce at $ 9,500, but swing traders should wait until the purchase of cryptographic currency interest.

However, bounce is not impressive. If the bulls do not come out of the 20A EMA and the resistance line of the descending channel in the next few days, ETH / USD will fall to $ 654 and fall to $ 565.

Cryptography will change positively when broken at $ 980 levels.

BCH / USD

Although the bears broke below $ 1,150 support levels, they were unable to sink Bitcoin cash for $ 950 levels, as they might expect.

If bulls do not take the BCH / USD pair up to $ 1,150, in the next two days, we can see the fall to $ 950.

cryptocurrency will be good until it moves below the moving average.

XRP / USD

The ripple is weak. Yesterday, March 7, the Bulls captured from $ 0.85 levels but could not build on profits.

As a result, the price has broken down to $ 0.85 level. If the bears under this support are successful, they are likely to fall to $ 0.7 if successful.

The lack of buying at lower levels indicates the possibility of further side effects in the XRP / USD pair.

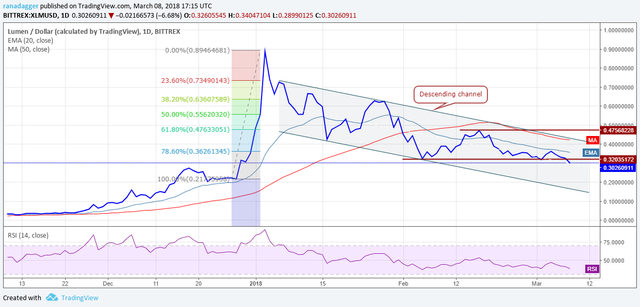

XLM / USD

Stellar is in a downtown and does not look strong. It is difficult to bounce the complex support level of $ 0.32. The bears are not allowed to cross the 20-day EMA.

Today, March 8, the bears have taken the XLM / USD pair under $ 0.32. If the breakdown persists, the lower end of the bottom of the channel will fall to $ 0.22. There we expect to buy emerging.

On the other hand, border borders must be between $ 0.32 to $ 0.47 to protect bulls at $ 0.32.

LTC / USD

After a few days of promising, the lycukon turned negative. We expected it to come towards SMA 50 days and that is what happened.

The LTC / USD pair forms a descent triangle model, which breaks down and closes (UTC) below $ 185. While it gives a sample target of $ 115 on the downside, we can expect some support at $ 160 and $ 140.

Our basic view is valid if Cryptocurrency is broken from $ 215.

ADA / BTC

Cardano is in a firm bear grip. Yesterday, March 7, price 0.00002460 critical level of support failed. The sale continued and prices were lower than support level. It's a bear sign.

Now, there is no major support level in the charts, and the chance to fall to 0.00001690 levels. The first sign of change in the trend is when the ADA / BTC war breaks down from the downtrend line. Until then, the bears have the upper hand.

Neo / USD

On March 7, Neo fell by $ 88.6, where the buyout emerged. The zone is important between $ 86 and $ 93 for bulls.

If they fail to manage this support zone, the NEO / USD pair will fall by $ 63.62 compared to February 6.

The cryptocurrency is positive, and it breaks down and depends on the DownRoad line 2.

EOS / USD

In our previous analysis, we assumed EOS to restore the February 6 nullity, and it happened.

If Bulls does not have $ 5.97 levels, subsequent support will be lower at $ 3. Our basic view is valid for EOS / USD pairing and rising at $ 8 levels.

Good Job Fri...