Bitcoin, Ethereum, Bitcoin Cash, Ripple, Stellar, Litecoin, Cardano, NEO, EOS: Price Analysis, April 13

On April 12, Bitcoin saw the largest one-hour trading value in its history, rising to over $ 1,000 for thirty minutes. Prices are not mentioned before any of these spikes, which can be possible to buy bitcoins or sell to a larger company player.

The other reason is that selling pressure is declining and most of the day's sales are behind us.

From April 11 on April 11, 26,000 contracts decreased from 44,000 contracts. While some shorts were closed due to price rise, some closed, as Bitcoin successfully held on top of February 06.

Although the difficulty is to find the exact cause of growth, this move has raised the sentiment in the main mallons. As a result, the market capitalization of all cryptocurrency has once again increased to $ 300 billion, falling below $ 250 billion on April 01.

Let's see if we can find any purchase settings on the charts.

BTC/USD

In our previous analysis, we suggested long-standing positions in Bitcoin after closing the 20-day EMA. The prices met yesterday, as the over zoom resistance last zoomed. So, cryptocurrency finally came out?

The previous attempt to leave the channel on March 03 failed three days. During this time, things are positively because the BTC / USD pair will be removed from the descending channel. It should soon be moved to a 50-day SMA, which provides some resistance.

Once on the 50-day SMA, the next move must be $ 10,000. Benefits should be booked as major resistance to $ 12,172.43. We do not expect this level to pass in a hurry.

Merchants who set up long standing positions will stop the stop loss at $ 6,700. If Bitcoin is struggling to break 50 days from SMA, they can increase their stops.

It looks like a bottom, but it is necessary to sustain high levels to ensure the price sentiment.

ETH/USD

Our bullish view view on Ethereum has been determined since the 20-day EMA and Descending Channel's Resistance Line ended. The move should now be extended to SMA 50 days.

This is the first time that the ETH / USD Duo descendant was removed from the Resistance Line, which was developed by Bullish. If Bulls succeeds in breaking $ 600 levels, the next step is to be $ 725.

Any dip, as long as it is above $ 420, can be used as a purchase option.

BCH/USD

Bitcoin cash $ 778.2021 and 20 days broken from overhead resistance at EMA, which is a quick short-term commercial

Merchants can keep the loss of loss under $ 610 by the recent lows of $ 610 starting long positions at current levels of $ 779. A move to upside down the target $ 974 targeted upside down.

On a 50-day SMA, BCH / USD can be attached to $ 1,115 levels. Instead of booking profits at overhead resistance levels, merchants need to increase their stops because of making bigger moves when Wikipedia's cash becomes positive.

XRP/USD

The habit of the first target of $ 0.7 mentioned in previous analysis has already reached the habit. Markets declined to lower levels, which is a bullish mark.

$ 0.7 to $ 0.73 Resistance, and $ 0.453 will be used as a chance to buy any dip towards $ 0.56270 at a stop loss. If the next move does not break down to $ 0.56270, we can confirm below.

The XRP / USD pair will trade wide range.

XLM/USD

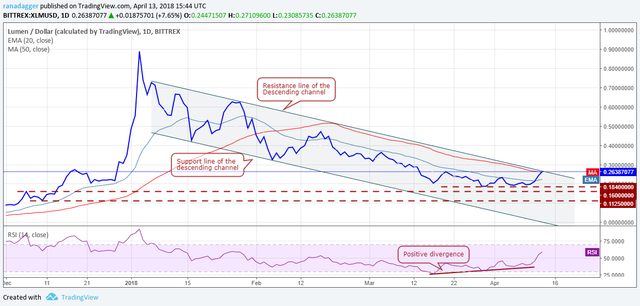

We're bullish on Stellar because of the positive disagreement in the RSI. Friday's price confirmed our positive view as the 20 days broke from EMA.

The XLM / USD pair currently traded at the descending channel's Resistance Line. If it breaks out of the channel, we think that the trend will change from bullish to bullish.

Merchants can enter long-term breaks on the channel's resistance line and close in (UTC time frame). Based on the closing of the initial stop loss (UTC time frame) can be placed at $ 0.18.

Targeted target targets have been moved to $ 0.36 and $ 0.47. The risk of being rewarded is not attractive, therefore, merchants must register partial benefits at $ 0.36 and the sidewalks are more likely to reduce their risk.

If the entire market is slow, we should shut down before the breaks hit. Our bullish view is valid if prices are within the channel.

LTC/USD

Litecoin is struggling to clear the first barrier of Doundrand Line 1 but 20 days out of EMA.

Once a 20-day breakdown from EMA, it is another parallel resistance at $ 141.026. The LTC / USD allegiance Bullish will reach the top level of $ 142.

On the up, it faces resistance at Downtrade Line 2, at $ 165 again. At present, we do not have a good loss to represent the ratio of trade, so we have not proposed any business on it.

ADA/BTC

We propose a long position in the cordano at a very breakout, close to 0.00002460 mark. Digital currency closed at 0.00002722, yesterday, commercial live stream. However, the design of the ascending triangle is 0.0000323, but we expect a move in 0.000035 levels. 0.000021 Our bullish view is valid within the interval below.

20 days EMA and 50-day SMA are on the edge of a positive crossover, which is another positive. The ADA / BTC pair must have 0.00002460's breakout levels, which is retest.

Merchants have their positions and can add more to the successful retest of breakout levels.

NEO/USD

We indicated long-term positions on the NEO in the breakout above $ 64. That trade was yesterday.

The neo / USD pair should find strong support in the zone between 20 days EMA and $ 63.62. Early stop loss can be put at $ 44.

Although the 50-day SMA $ 78, it did not appear to be a major challenge in the past. Therefore, we believe that the virtual currency will drop the descent line down at $ 88 at the triangle.

As the trend is still declining, the price still remains in the triangle. Therefore, traders should put the normal level only 50 percent.

EOS / USD

Our suggested purchase level is over $ 7.5 yesterday on EOS. Our goal of running is a move to $ 11. The moving average is on a bullish crossover edge, indicating a new trend.

Merchants can reduce their loss and book partial benefits at $ 9.5 to increase stop loss to the rest of the $ 5.5.

We want to recover the breakout level of $ 7.28 we have to catch. However, if the EOS / USD fails below this support, it may become negative and we can recommend opening closures.

You got a 5.47% upvote from @dailyupvotes courtesy of @steemitblog12!

Please upvote this comment to support the service.

Thanks for excellent analysis. This recovery was expected and it was just having patience and waiting will continue to rise. @steemitblog12

You got upvoted from @adriatik bot! Thank you to you for using our service. We really hope this will hope to promote your quality content!

Thank you my Fellow Steemer

You got a 60.39% upvote from @brupvoter courtesy of @steemitblog12!