Analysis of the Cryptocurrency Exchange Landscape

Introduction

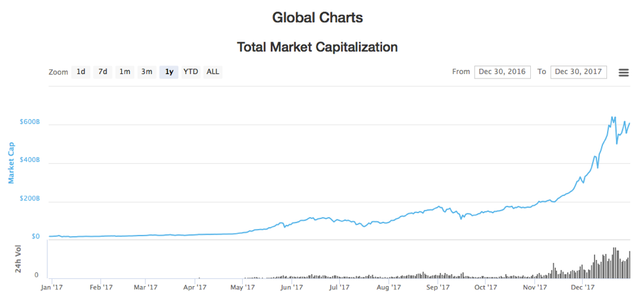

With the recent price surge in cryptocurrencies, it is no surprise that trading Bitcoin, Ethereum, Ripple and other crypto assets has become a mainstream obsession. Retail and institutional investors alike are increasingly gaining exposure to digital currencies for different reasons. Many buyers require a safe haven from inflationary fiat currency, some desire a hedged asset which is not correlated with price movements of traditional financial instruments like stocks or bonds, and others just display FOMO (fear of missing out). In 2017, Bitcoin’s market capitalization increased 15x and the total crypto asset market grew from approximately 17.5 billion to 612 billion, a 3,400% spike. So yeah, you could say this market is getting pretty serious.

Being that I am deeply interested in the cryptocurrency space, I am often asked about buying and trading bitcoin and other digital currencies. Clearly I am not a financial advisor or hedge fund analyst, so I do not feel comfortable giving investment advice. However, I do tell people that the most important aspect of investing in Bitcoin and other cryptocurrencies is to have a basic understanding of the underlying technology and best practices for safely securing tokens. When I say basic understanding, I do not mean “I know what a blockchain is, I’m good to start investing”. Jameson Lopp and CoinDesk both have great lists of educational resources on Bitcoin/Blockchain and I would recommend that beginners go through and read the relevant links. Do your homework before investing.

Exchanges

Many new speculators and “investors” are unfamiliar with how digital currencies are traded and how price discovery actually works. Unlike stocks, cryptocurrencies are traded 24/7 globally on different exchanges with few barriers to entry and minimal censorship. The price is determined by a free floating market exchange rate that is established by buyers and sellers on different exchanges around the world in different currencies and trading pairs. Cryptocurrencies can be traded against fiat currency, alternative cryptocurrencies and market pegged crypto assets which track the value of external real-world “things” (gold, USD, HK stock market). Many cryptocurrency exchanges are similar in structure to stock markets, in that traders can set limit orders, market orders, stop loss orders, and act as either a market maker or market taker. Very few exchanges offer lending, margin trading and short selling features. A large concern in the crypto market is the lack of shorting capability, leading to a one-sided long hodl or sell mentality. Now that Bitcoin Futures have launched on CME and CBOE, there is an opportunity for large institutional investors to short the Bitcoin market in a regulated way, which should improve volatility and price stability over time. For those interested, many crypto platforms offer visual charting tools allowing traders to apply traditional technical analysis strategies as well. Investopedia and Coinigy are both great places to start learning about chart patterns and trend analysis.

Because the same crypto tokens are traded on different exchanges meaning different price discovery markets, there is often price discrepancies across exchanges. For example, GDAX may trade LTC/USD at $300 while Bittrex trades it at $250, and therefore an arbitrage opportunity is created. In this case, a trader would purchase Litecoin with USDT on Bittrex, transfer it to GDAX and then sell it for USD to earn a profit. Because cryptocurrencies can be transferred around the globe cheaply and quickly (well not bitcoin), profitable arbitrage is possible and exchange prices quickly even out. If anyone has an arbitrage bot hit me up ;)

In this article I want to discuss the different types of crypto exchanges that exist, and the best trading platforms for each. I will be focusing on the main exchanges that can be accessed by investors in the United States and the benefits and costs associated with them. Full disclaimer: I am not a day trader and do not pretend to be, this is just my personal view on the exchange landscape and is not investment advice. This article is meant to be an educational tool for those unfamiliar with the crypto investing ecosystem.

Fiat to Crypto Exchanges

The first type of exchange is the bread and butter “Fiat to Crypto Exchange”. This platform allows users to purchase digital assets with fiat currencies such as U.S. Dollars or Euros, usually with a bank account. Many beginner investors use these centralized exchanges as a way to introduce themselves to the crypto ecosystem. Most fiat/crypto markets allow customers access to a limited amount of cryptocurrencies, such as Bitcoin, Bitcoin Cash, Ethereum and Litecoin. For security and compliance reasons, these exchanges require users to perform unpleasant tasks to sign up and verify their identity. These include submitting a driver’s license photo, linking a bank account and giving away detailed personal information, all of which are extremely invasive. The exchanges usually set limits on the amount of digital currency you can buy and your verification level (determined by willingness to share personal info) determines the quantity you can purchase.

Advantages

There are several advantages to using a fiat/crypto model. First, the platform executes the trade for you, and therefore requires little technical trading knowledge. By clicking a few “Deposit” and “Buy” buttons on the exchange’s site, your wallet will be automatically funded, just as long as you don’t use Mt. Gox or Bitcoinica. Second, by placing your trust in the established exchange to make the trade, you are guaranteed the best market rate for your trading pair. Instead of becoming a market maker yourself and offering a bid price, the process is done on the backend by the exchange.

Disadvantages

However, there are a few drawbacks to using a centralized fiat/crypto model. First, the fees can be expensive because the platform takes a percentage of the initial investment. The second disadvantage is that users must place a large amount of trust in the exchange. When purchasing cryptocurrency on a centralized exchange, the platform actually holds the private keys to the tokens (THIS IS BAD) and essentially issues you an IOU. A private key is a string of numbers that enables a user to spend the coins from a specific address, and without it the user is not in control of the funds. Hacks of centralized exchanges like Mt. Gox and Bitfinex are not uncommon. Users who leave coins on exchanges are vulnerable to single point-of-failure attacks, and often times site failures leave them with nothing but an apology. To combat this, it is recommended to transfer cryptocurrency to a wallet where you own your private keys. Here is a link to some good desktop, online, and hardware wallet options → https://www.digitaltrends.com/computing/best-bitcoin-wallets/ .

If you are interested in purchasing digital coins with cringeworthy paper “money”, the following exchanges are some good places to start →

Coinbase was started by Brian Armstrong and Fred Ehrsam in 2011, and is arguably the most reputable and funded company in the digital currency space. GDAX, the cryptocurrency exchange owned by Coinbase, processes about $700,000,000 of transactions daily, and has extremely large order books for major trading pairs BTC/USD, LTC/USD, and ETH/USD. Coinbase recently reported that they add over 200,000 users per day, and the app is currently #1 in the Apple App Store. It recently added Bitcoin Cash (BCH) trading support, and is expected to add several other currencies in 2018. Feel free to comment your speculative guesses on which tokens those will be lol.

To start using the Coinbase exchange, a user can navigate to Coinbase.com and follow the steps to create an account. The deposit and withdrawal transfer fee for fiat currency like USD is 1.49% for a bank transfer and 3.99% with a credit card. Trading fees on GDAX vary depending on trader volume, specific currency, and maker/taker model. Maker fees are 0% and taker fees are .25% for BTC and .3% for ETH and LTC. Coinbase is obviously the most popular choice right now for fiat/crypto exchanges, and is arguably the most user-friendly way to purchase digital assets. They have huge books and tons of liquidity, so as long as they are able to keep up with website traffic and improve customer support, they will be the go-to platform for United States crypto investors.

Gemini is another exchange that allows investors the opportunity to purchase digital assets with fiat currency. The exchange was launched in 2015 by the Winklevoss twins, and is one of the highest volume exchanges for Bitcoin/US Dollar purchases globally. It currently offers three trading pairs, BTC/USD, ETH/USD and ETH/BTC, with volumes of $93 million, $40 million and $3 million respectively. Like other centralized exchanges, Gemini has had recent issues with service disruptions due to massive amounts of users migrating to the platform.

Gemini allows for free ACH bank transfer deposits and withdrawals, unlike the 1.49% fee that Coinbase charges. The exchange itself uses a dynamic maker/taker fee schedule based on volume. For most of the readers my age that are not Bitcoin billionaires, the fees will be .25% taker and .25% maker. This is assuming monthly volume <= 1000 BTC and <= 20,000 ETH. Gemini has gained notoriety in recent months, as trust in Coinbase continues to suffer due to website crashes, rumors of insider trading associated with the Bcash launch, and lackluster customer service. If Gemini is able to withstand large amounts of volume and new customer inflows, it has the potential to capture a large portion of the fiat exchange market in the short-term.

Kraken is a San Francisco based Bitcoin exchange that allows user to buy digital currency with fiat money. Kraken offers EUR, USD, JPY and CAD deposits, and the fees for USD deposits are $5 for domestic transfers and $10 for SWIFT transfers. Because there is a flat deposit fee it is suggested that you pre-fund your account in bulk, instead of purchasing incremental amounts at various times on the exchange. Cryptocurrency deposits are free of charge, with the exception of Ether, Ether Classic and some other wallet setup fees for various currencies.

Kraken has recently suffered from DDoS attacks that have created performance issues for the exchange. As a result, user trust has taken a big hit, however, Kraken is still currently trading about $396 million USD per day on the exchange. Maker trading fees range from 0.00% to 0.16% based on monthly volume, and taker fees range from .10% to .26%. Kraken is the largest BTC/EUR exchange in the world, and therefore euro volume accounts for a large portion of the exchange’s trading. Bitcoin/euro 24h volume is currently $75 million and Ripple/Euro volume $65 million. Although they have certainly had their struggles, Kraken will continue to be a high volume exchange because of a lack of alternative liquid EUR markets elsewhere.

Over-the-Counter Markets

Over-the-counter cryptocurrency trading is another way users can purchase bitcoin and engage with the Bitcoin protocol. OTC trading is essentially peer-to-peer exchange, platforms connect you with trading counterparties and leave the execution of trades up to you. This means the trade does not occur in an actual market, but rather takes place peer-to-peer outside of the exchange. For reference, the OTC markets I refer to in this blog are not institutional OTC liquidity providers like Genesis Trading or Octagon. Instead, I will touch on P2P platforms that connect buyers and sellers of digital currency for small to medium sized transactions.

Advantages

The greatest benefit to using OTC platforms is the anonymity associated with transactions. There is no need to provide identity verification measures such as personal information or bank accounts. Money launderers and tax evaders are likely to trade OTC to avoid regulatory on-ramping and off-ramping of cryptocurrency exchange, especially since the IRS recently ordered Coinbase to report 14,355 users’ information. However, as I explained in my previous post, privacy is vital for crypto asset transactions, even for honest citizens. The second advantage to P2P exchange is zero counterparty exchange risk. OTC exchanges do not actually hold your tokens when you purchase them, but instead deposit them directly to your individual wallet from escrow.

Disadvantages

There is some downside to P2P exchange as well. Many decentralized OTC markets don’t have sufficient liquidity, mainly due to lack of convenience and awareness. New U.S. crypto adopters seem to be automatically drawn to Coinbase, and do not even know that P2P exchanges such as Localbitcoins exist. The second drawback is the lack of fair price discovery. Because there is not an adequate order book market for cryptocurrencies on OTC exchanges, the price is unfairly set by the local seller’s ad. Often times in local area cash/crypto meetup trades, specifically in rural areas with little competition, buyers could end up paying upwards of 10% above the global market average. The final problem with OTC trades is fraud and credit card/Paypal/Venmo reversal. So basically all the reasons that crypto exists lol. This is more of a problem on the vendor’s side, as an inexperienced seller may sell bitcoins in exchange for a credit card payment, and find out a month later that the transaction was reversed by Visa. Be cautious of this if you decide to sell via a P2P exchange.

The most common OTC exchange is Localbitcoins, a global peer-to-peer Bitcoin exchange launched in 2012 by Jeremias Kangas. Bitcoin sellers pay Localbitcoins for advertisement space to post prospective trades. The ad lists the seller’s BTC/Fiat exchange rate and preferred method of payment. Methods of payment on the platform include cash, bank deposit, Western Union transfer (gross), gift cards, Paypal and more. It is important to note that buyers do not pay direct fees to Localbitcoins, however, exchange rates tend to be a bit more expensive than global market averages. Buyers have two choices when transacting: 1) Meet sellers in person and pay them cash for bitcoins or 2) Exchange online with Paypal, gift card, bank deposit etc. Once a transaction amount is agreed to, Localbitcoins locks up the BTC in an escrow wallet. As soon as the buyer pays and the seller verifies the payment on the platform, BTC is transferred to the purchaser’s wallet. My favorite feature of Localbitcoins is the ability to rate other users. After completing a trade with someone you can rate them on a scale of 1–5 and write a review about the experience.

Because Localbitcoins attracts a lot of scammers, I will give a few recommendations for using the platform. First, ensure the seller has a good amount of ratings and has “real name verifications”. If they are trying to stay anonymous from localbitcoin’s management, that is a red flag. Second, any buyer advertisement that lets you sell 1 bitcoin for $50,000 USD in exchange for some gift card numbers is most likely a scam. Free money does not exist. Third, as a seller, it is much safer to transact in person and accept cash for bitcoins. This eliminates the possibility of chargebacks and credit card fraud. Localbitcoins is a great platform to interact with other bitcoiners and possibly save some exchange fees in the process, however, beware of fraudulent listings and obvious scammers.

The second OTC exchange I use is Bitquick. It was launched as BuyBitcoin.US in 2013 by Jad Mubaslat, the former founder of the Ohio State Bitcoin Group and current employee of 10:XS, a Cincinnati blockchain consulting firm. The platform rebranded as Bitquick and was thereafter purchased by Athena Bitcoin in June, 2016.

Buyers on Bitquick can initiate a transaction from the seller order book, which lists the seller’s exchange rate and bank account information. The buyer will then visit their local bank to deposit cash into the seller’s account and scan their deposit slip. After they provide proof of the deposit slip to the seller and Bitquick, the funds are sent from escrow to the BTC purchaser’s wallet within three hours. The seller fee is 0% and the buyer fee is 2%. OTC trades on Bitquick are great for users who do not wish to interact with sellers in person like you would see on Localbitcoins.

Paxful is a bit different than the other two exchanges, as the buyer initiates the terms of the trade themselves. After creating an account and logging in, a buyer can choose from 300 different payment options and enter the amount of USD they wish to spend. Depending on the vendor who is filling the order, Paxful will list the equivalent BTC the buyer will receive in return. Exchange rates may range anywhere from 5% to 50% over the global mid-market spot. The more common the payment mechanism, the more likely it is you will get a better rate, as there will be more sellers and better competition.

The fact that their F.A.Q. page states premiums range from 5%-50% is a huge red flag for me. Most bitcoin exchanges want to entice buyers, and it seems as if they are not even trying to hide the outrageous transaction costs which is quite odd. I have personally never transacted on Paxful, but it seems to be as expensive as using a Bitcoin ATM. Paxful is convenient and good enough for people experimenting with the technology, but is probably not well-suited for investors concerned with turning a profit.

Altcoin Exchanges

So far in this blog post I have discussed fiat to “large-cap crypto” exchanges exclusively (BTC, ETH). Altcoins, the crypto maximalist term for “Alternative coins besides Bitcoin”, have captured the eyes of many investors in recent months, as the altcoin market cap has skyrocketed from $2.2 billion to $367 billion in 2017 alone. And no, that is not a typo. An initial coin offering (ICO) is a crowdfunding strategy that allows blockchain startups to bypass traditional VC financing by issuing digital tokens to a worldwide network of investors in exchange for Ether, Bitcoin and other large cap cryptocurrencies. This is how the majority of newly created cryptocurrencies are brought into trading markets. The ICO market has raised a whopping $5.8 billion this year and shows no signs of slowing down anytime soon.

What is interesting about altcoins is that many of them are not freely traded with fiat currency, but instead trade against large cap cryptocurrencies like Bitcoin and Ether. Many traders believe this restricts volume because the smaller cap altcoin must outperform the currency it is traded against, and everyone knows it is not easy to beat Bitcoin’s price performance. Many argue the solution to trading volatile cryptocurrencies is a stablecoin such as Tether, which provides a non-volatile pairing for a trade. Several altcoin exchanges have popped up over the past few years and I will touch on the main centralized ones. If you are interested in learning about decentralized altcoin exchanges like BitShares, EtherDelta, and others, check out @george harraps article discussing what makes a good DEX and where the future of altcoin trading is headed.

Binance seems to be the fastest growing crypto exchange in the world right now. It is the “modern altcoin exchange” that many investors seem to be gravitating towards. Binance is based in Hong Kong, and because it only supports crypto/crypto trading, it is most likely safe from regulatory scrutiny for a while. The coin-only exchange started live trading on July 15, 2017 after launching an initial coin offering that raised approximately $15 million USD. The token sale launched $BNB, an ERC-20 token running on top of the Ethereum blockchain, which is used as a payment token on the Binance exchange. Traders on the Binance platform who choose to use BNB as their fee payment earn discounts on their fees of 50% for the 1st year of trading, 25% in year 2, 12.5% in year 3, etc.

Binance currently lists 232 trading pairs, consisting of altcoins traded against BTC, ETH, USDT and BNB itself. The largest markets are currently XRP/BTC and XVG/BTC, although I am sure this is due to the massive speculation and gains both Ripple and Verge have seen in recent weeks. Top market cap coins such as NEO, Cardano, Ethereum, Bitcoin, Bitcoin Cash and IOTA all maintain significant 24h trade volumes above $60 million. Overall market liquidity has consistently increased since platform launch, and total 24h exchange volume is currently $3.875 billion at time of writing. Binance fees are as follows: a constant 0.1% trading fee, free deposit fee, and set withdrawal fee based on cryptocurrency withdrawn.

Another interesting feature on Binance is the LaunchPad module. LaunchPad allows traders to directly invest in ICOs on the Binance platform with funds held on the exchange. Once trading commences on the Binance exchange, the trader’s account is funded with the corresponding amount purchased during the token sale. I expect to see them continue adding trading pairs, increasing user adoption and improving UI within the coming months (if that’s even possible). Binance FTW!

Bittrex is an altcoin exchange based in the U.S. and has been around a lot longer than Binance, but due to recent issues has faced heavy criticism. On December 15, Bittrex management halted new user registrations due to its inability to handle new traffic and volume caused by crypto mania. As far as the exchange itself goes, when operating correctly, Bittrex is a well-regarded altcoin marketplace. It currently lists 190+ cryptocurrencies, all of which are traded for either USDT (Tether), ETH, or BTC. Bitcoin markets tend to see the greatest volume, as BTC trading pairs account for 21 of the top 22 volume pairs on Bittrex right now, Ripple/USDT being the exception.

Daily Bittrex volume is hovering around $2.6 billion. The fee is .25% on all trades which is relatively high in the altcoin world, albeit deposit/withdrawal fees are free. Besides the semi-high fees, the other annoying problem I run into on the platform is signing in. Every time Bittrex identifies a new IP address associated with an account login they force the user to verify the login through their email and sign in again. Pretty irritating and time-consuming if you ask me. Anyways, once registrations open again I am sure we will see tons of new accounts being added daily and volumes to continue increasing.

Poloniex is another altcoin exchange based out of the United States that has been around for a long time, and has gained a ton of notoriety in the space. Once again, this exchange does not support fiat deposits and withdrawals, but rather allows customers to trade virtual currency for other virtual currency. Currently, Poloniex offers BTC, ETH, XMR, and USDT markets, however, XMR and ETH trading pairs have virtually zero volume. Total Poloniex 24h volume is $1.248 billion, a slight step down from the volume seen on Binance and Bittrex. Approximately 70% of Poloniex’s current volume is traded through Ripple, Ether, Bitcoin and Stellar Lumens. Out of the 100 trade pairings listed on coinmarketcap.com, only 19 display 24h volume above $10 million. Poloniex uses a dynamic maker/taker fee schedule to charge customers. Maker fees range from 0.00% to 0.15% based on volume, and taker fees vary from 0.05% to 0.25%.

The greatest competitive advantage Poloniex has is lending and margin trading accessibility. Poloniex is the only major altcoin exchange that allows users to trade on margin (yeah I know bitfinex offers it but they are sketchy). Margin trading means that customers borrow loans from other users to fund trades they make on the platform, and pay interest to the lenders for borrowing the tokens. Margin traders can open short or long positions, a feature which opens up a two-sided market, not currently available on most cryptocurrency exchanges. Because borrowers incur forced liquidations on bad trades, there is virtually no risk involved with defaulting on loans and lenders should receive their money back at a minimum. Poloniex is a historical gem in the crypto community, but at this point the lending and margin trading functionality is what is keeping them relevant in my opinion. Updates to the UI and perhaps lower fees will allow them to gain some market share back from newcomers like Binance and soon to be Altcoin.io.

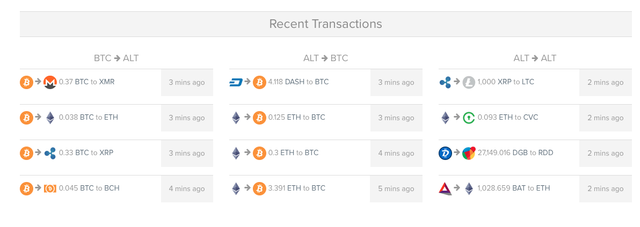

Instant Exchanges

Another emerging trend in the bitcoin world is that of instant exchanges. Instead of connecting buyers and sellers, instant exchanges like ShapeShift offer users the ability to swap one crypto for another with the click of a button and without registering an email or account. Shapeshift lists the exchange rate the user will receive before the swap so they can decide if it is a fair market rate or not. ShapeShift’s fee structure is a “fixed miner fee”, meaning that their profits most likely come from the spread between actual miner fee and the standard fee they charge customers. An advantage to using ShapeShift and other instant exchanges is that there is no price slippage. When dealing on traditional exchanges, the volume you place on a trade may drastically alter the exchange rate you receive depending on the order book depth. ShapeShift gives you an exact exchange rate no matter the amount you are converting.

Changelly, another popular instant exchange, has a similar model but charges its customers 0.5% per transaction. On top of that, I would argue that the exchange rates between currencies are pretty horrendous. Instant exchanges are interesting models, and I am confident that more and more will pop up in coming years as they are often more user-friendly, quicker and cheaper than centralized exchange alternatives.

Closing Thoughts

The crypto investing space is an exciting ecosystem to be a part of right now, and I think most people realize this is a once-in-a-lifetime market. With that being said, investors must be careful and diligent not only about tokens, but exchange platforms as well. A lot of people asking me about investing in certain coins have not even read the white paper or token summary yet. Do not let yourself be the greater fool. Do some research, learn as much as possible, and get involved in promoting cryptocurrency and blockchain technology to others if you are passionate about the space.

Here are a few final thoughts I have regarding crypto investing:

1.) After purchasing digital tokens on an exchange, ensure you move a majority of them offline to a cold wallet like a hardware wallet (Ledger Nano S, Trezor) or a paper wallet (link here to make one). Leaving crypto on an exchange opens you up to all the systemic single point of attack risks associated with the current financial system. Make sure the tokens (private keys) are under your control.

2.) When dealing in centralized exchanges, always enable 2-factor authentication to log in to your account. I recommend downloading the third-party app the exchange uses, such as Google Authenticator or Authy. With the recent gmail phone number hacks, it is probably better to avoid cell phones, but text verification is better than nothing at all.

3.) Do not invest more than you are willing to lose. This space is brutal and often times heartbreaking, so do not put your life savings into this crazy volatile market. Is it a bubble? No one knows, and if I did I would be writing this post from a beach in the Bahamas, not from my college dorm room. Anyways, be mentally prepared for your coins to go to zero at any time and invest accordingly.

4.) If you plan on buying into ICOs, make sure to do your due diligence. Read the white paper and get a feel for the project’s solution and problem it is trying to fix: “Is there a real-world problem this solves and if so, is someone already tackling it?”. Check out the development team to see if they are qualified to hit the roadmap objectives in a timely fashion, and if they have been involved in successful projects before or have a live working product already.

As always, I hope this article was helpful and feel free to reach out to me at [email protected] or on Twitter @SpencerApples. I look forward to any questions, comments, concerns and criticisms you may have.

Please don’t be a shitcoin shiller,

Spencer Applebaum

Great overview of the exchanges landscape. I also think decentralized exchanges are worth looking into, or at least exchanges where you retain control of your private keys.

Congratulations @spencerapplebaum! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @spencerapplebaum! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!