Bitcoin needs government regulation to rise further, Morgan Stanley says

Investment bank suggests speculation has fueled recent price gains

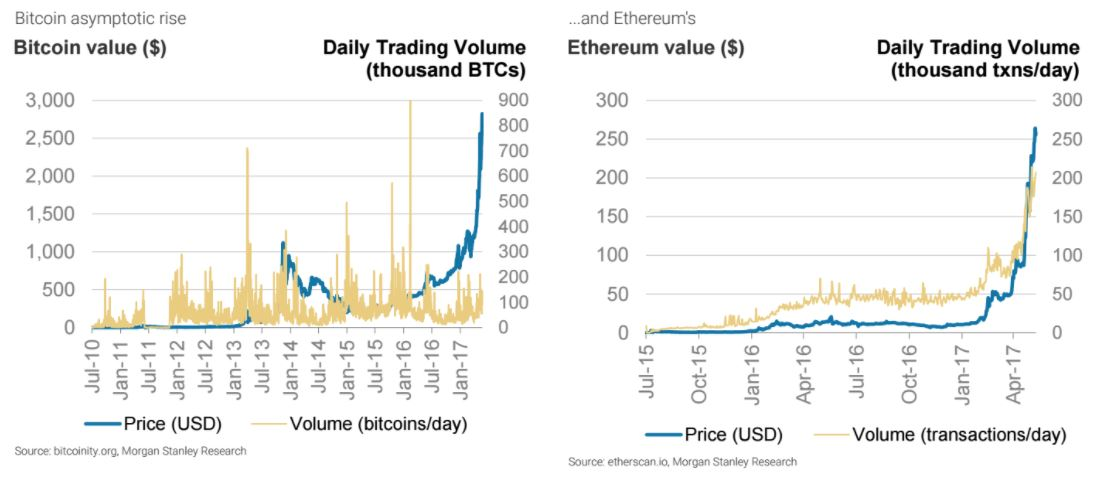

Proponents of the digital currency bitcoin frequently cite its decentralized nature as one of the primary attributes that excites them about the technology. Meanwhile, bitcoin investors are no doubt thrilled with its rapid price appreciation, which has seen it nearly triple in 2017 alone.

According to Morgan Stanley, however, the latter group may not be able to see further gains unless the former gives up some of its autonomy.

The investment bank noted that the “rapid appreciation” of bitcoin and other cryptocurrencies, like ethereum, had “elicited many inbound phone calls to both our banks and tech teams” as the gains entice prospective investors and adopters. However, it added, “governmental acceptance would be required for this to further accelerate, the price of which is regulation.”

Cryptocurrencies as a category recently topped $100 billion in combined market capitalization, thanks to blindingly fast surges by bitcoin and ethereum, the two largest digital currencies.

Bitcoin BTCUSD, -3.07% rose 2.4% to $2,746.83 on Tuesday; recently, it hit an all-time high above $3,000. Ethereum fell 1.7% on Tuesday, but has seen an even bigger year-to-date rise than bitcoin. Both have seen spikes in trading volume.

Both the size and speed of bitcoin’s recent rally, as well as the recent pullback, has some investors wondering whether a longer-term downtrend is in store, even though one metric—a kind of modified P/E ratio that has been developed by analysts—suggests its valuation isn’t currently at an extreme.

“It is not clear why cryptocurrencies are appreciating so rapidly (apart from the appreciation itself drawing in more speculation against a potentially inefficient ability to sell),” Morgan Stanley wrote, though it was skeptical that further gains could continue in the current regulatory environment.

The investment bank didn’t specify what types of regulation might be necessary to further push bitcoin higher, noting that the specific changes needed may be different for different cryptocurrencies, all of which use blockchain technology, the centralized “ledger” that records all such transactions. For blockchain overall, “regulators are involved and watching closely,” Morgan Stanley wrote. “Some have suggested privacy could be improved. Regulators are looking to have a master key so all transactions are visible to them.”

Blockchains are peer-to-peer networks that record and verify transactions, and while they were designed to be open—meaning anyone could see the history of various trades—some institutions have created private blockchains that aren’t publicly accessible.

Bank of New York Mellon Corp. BK, -0.52% for example, developed a blockchain-based platform for U.S. Treasury bond settlement that has been running internally since March 2016. The bank was “unlikely to have involved regulators given [the] internal nature of the transaction,” Morgan Stanley wrote. Bank of New York Mellon is planning to roll this service out to clients, but it “will have to engage in dialogues [with regulators] if moving to commercial applications.”

Bank of New York Mellon didn’t immediately return requests for a comment.

Talk of regulation in bitcoin comes months after the SEC back in March rejected a proposal that would have led to the creation of bitcoin-focused exchange-traded funds, the Winklevoss Bitcoin Trust, citing a lack of. The SEC has since said they would review that decision. Meanwhile, a separate proposal Grayscale Bitcoin Investment Trust to begin trading on the New York Stock Exchange’s ETF platform is still under review. Both events might provide the regulatory underpinning that could further legitimize the digital currency in the eyes of investors, as well as increase its liquidity.