A History Of Bitcoin Price Collapses Over the Years

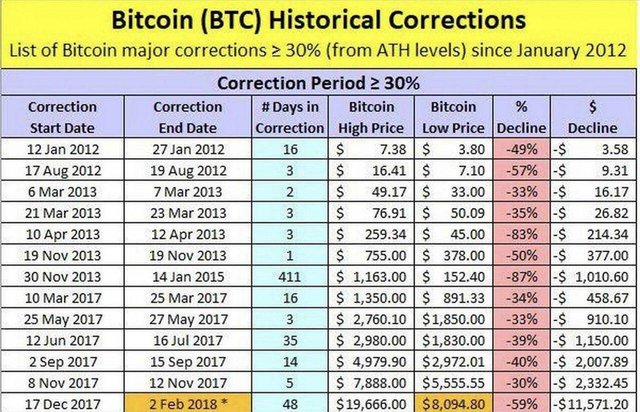

The cost of Bitcoin has fallen a stomach-twisting 64.5% since December 17, 2017. The consolidated market capitalization of the business now remains at just $338 billion. A photo tells a thousand words:

That is a major drop for any market. Be that as it may, a value crash in Bitcoin or some other digital money is just the same old thing new. Bitcoin dies and returns to life on regular basis. One site appraises Bitcoin's loss of life remains at 249 and tallying, going back to 2010.

2017 has been the most dangerous with 109 stories broadcasting the finish of bitcoin.

What's Causing The Bitcoin Crash?

An entire slew of awful news has prompted a tremendous downturn in the crypto economy. Bitfinex is get under the skin of the US Commodity Futures Trading Commission in light of the fact that the trade site offers clients an alternative to tie their money to the American dollar. The suspicious thing about that is neither Bitfinex nor Tether can fundamentally demonstrate they have enough cash in ledgers to go down the USDT token.

Abroad, India is getting serious about merchants. The nation's legislature is looking over exchanges on various trades with a specific end goal to attempt and gather tax revenue. Evaluations indicate that $3.5 billion in exchanges has discovered its way through India over the most recent 17 months driving into 2018.

And after that there is South Korea. The nation has no aim to boycott cryptographic money exchanging outright . Yet, the legislature has found a way to expel obscurity from the condition. South Korean brokers should now utilize their genuine names.

The majority of this has added to the crypto bloodbath.

Coincidentally. The Dow Jones Industrial Average simply hit a three-week low on account of rising US government security yields. It's not only the crypto showcase that is feeling the consume. So is the fiat world.

Finding Rock Bottom:

Indeed, even most tenderfoot investors know about the familiar proverb 'buy low, sell high'. The inquiry is, when will low be sufficiently low? The fact of the matter is nobody truly knows. Taking a gander at the above diagram, Bitcoin's most exceedingly terrible crash endured 411 days, finishing off with January of 2015. The crash sent bitcoin's cost diving 87%.

Starting today, the cost is down 64.5% in simply the most recent 51 days. In the event that that occurred in the share trading system, news media outlets would bring it 2008 once more. Obviously a significant part of the worldwide monetary emergency 10 years prior was because of the American government giving out subprime home loans to customers who couldn't bear to pay for the homes they were living in.

On account of cryptographic money, expanded control is the explanation behind the crash. That is certainly terrible news for short term investors. Those bullish on the long-run however consider control to be a fundamental advance in the proceeding with battle to legitimize cryptographic money and bring it encourage into the place where there is mass selection.

Good fortunes riding the rollercoaster regardless of what your venture vehicle of decision.