Bitcoin Cash SV (BSV), a cryptocurrency created after the BCH hard fork on November 15, has recently started surging as its hashrate has seemingly started closing in on that of Bitcoin Cash ABC’s network.

According to CryptoCompare data, BSV is up by over 27% in the last 24-hour period, and is currently trading at $67.9, up from roughly $50. Most of the cryptocurrency's trading volume is from Binance

As CryptoGlobe covered, BCH’s hard fork saw the community split into two sides, as one supported Bitcoin Cash ABC – which got the BCH ticker on most cryptocurrency exchanges - and its attempt to improve the cryptocurrency’s technology, while the other sided with Bitcoin Cash SV and its move to increase block sizes to 128 MB.

While ABC was supported by mining pools like Bitcoin.com and Bitmain’s pools, the BCHSV side was supported by self-proclaimed Satoshi Nakamoto Craig Wright and CoinGeek. Shortly before the hard fork, BSV threatened to attack the BCH chain with its then superior hashrate.

Its goal was to mine empty blocks on it to then stop transactions from going through. This way it could create a significant transaction backlog, and potentially force users to abandon the cryptocurrency. To fend off the attack, BCH could wait it out, or even change its proof-of-work algorithm to avoid it.

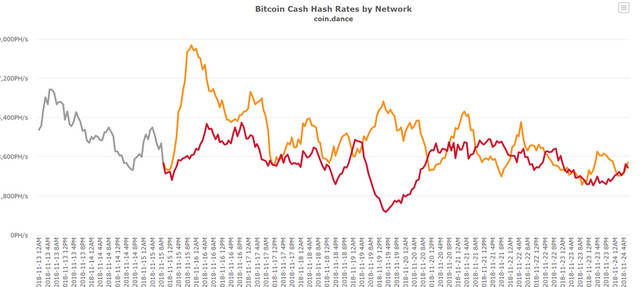

At the time of the hard fork, Bitcoin.com moved its hashrate from BTC to BCH in support of the network it supports. According to Coin.Dance data, however, BSV is now closing in on it, as it has a 3,100 PH/s hashrate, compared to BCH’s 3,330 PH/s.

This could mean the threat of an attack is still real. Some of the network’s supporters could, as a result, be buying the cryptocurrency as they believe Wright’s attack could have a significant effect on the competing network.

On social media, some users have speculated Craig Wright or Calvin Ayre – an online gambling mogul and the owner of CoinGeek – are artificially pumping the cryptocurrency’s price in what some are calling “trade wars.”

A “trading war” could be justified, as BSV’s pump has made it more profitable for miners to mine it instead of the competing cryptocurrency. Given the incentive, if miners turn to it they’ll make its network safer and will help BSV gain a majority of the hashrate. Currently, available data suggests it’s 277% more profitable to mine BSV than bitcoin (BTC).

Some have also pointed out that on November 28 CoinGeek is holding a two-day event in London. Their theory is that the cryptocurrency’s price is being artificially inflated ahead of it, presumably in a marketing stunt.