The Next Bitcoin?

The Next Bitcoin?

IOTA has skyrocketed to 6th place with a market cap of $2.4 billion dollars three weeks ago. Because of the bad news out of China the whole market made a dip, IOTA now has a market cap of $1.7 billion dollars. Before I tend say that is a huge opportunity to buy IOTA, what is IOTA exactly?

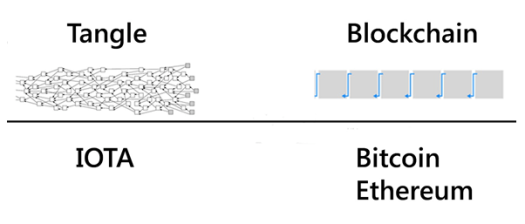

IOTA was designed to help machines communicate and settle transactions without fees. It has something called “the tangle” rather than a traditional blockchain. It is still a ledger system but one that self regulates and can process micro/nano payments without any fees.

Ok sounds very cool, but why did the price skyrocket in the last half of August? The only thing that makes sense is because the only exchange that supports IOTA is concluding that they no longer want to do business with U.S. customers.

On August 11th, Bitfinex released a statement saying they would be closing their doors to U.S. customers. The announcement not only brought panic selling but in IOTA’s case, it seems to have brought panic hoarding.

The statement from Bitfinex:

"We regret to announce that, effective immediately, we will no longer be accepting verification requests for U.S. individuals.

We have for some time considered pulling away from the retail marketplace in the U.S., and now with a current backlog of verification requests and ongoing difficulties in providing USD deposit and withdrawals for U.S. individuals, we feel that the time has come to begin disengaging from U.S. retail customers.

[…]

Furthermore, over the next 90 days, we will be discontinuing services to our existing U.S. individual customers. We will be communicating further with affected users on timing and specifics. Our intention is to reduce disruption as much as possible for our U.S. customers."

For U.S. investors, getting IOTA seems to be a moot point until another exchange picks them up. For investors in other countries, you definitely can get in. I think, when Bitfinex opens up again, there is a real good chance IOTA jumps in price, even so if say Kraken or Bittrex all of sudden start trading IOTA.

I suggest it is a really good time now to get some.

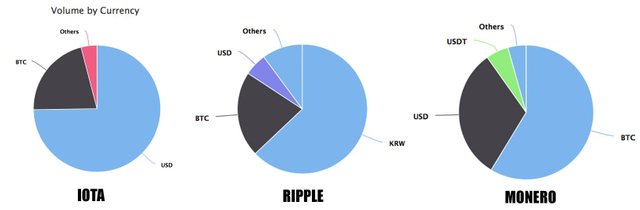

The prevailing pair on bitfinex is IOT/USD, not IOT/BTC. That is a healthy characteristic of the big coins, like Ripple, Monero and even Bitcoin. Buying IOTA with real money shows that it will be a real need in the future, and there are no short-time gamblers generating pump-and-dump prices.

TANGLE

Tangle is an open source distributed ledger that has no transaction fees and no limits on the number of transactions that can be confirmed per second. Unlike the blockchain which uses blocks, the tangle takes the form of a Directed Acyclic Graph (DAG). The network becomes quicker and more secure with more people that implement this service. With IOTA there is no separation between users and validators as you get with blockchain infrastructures.

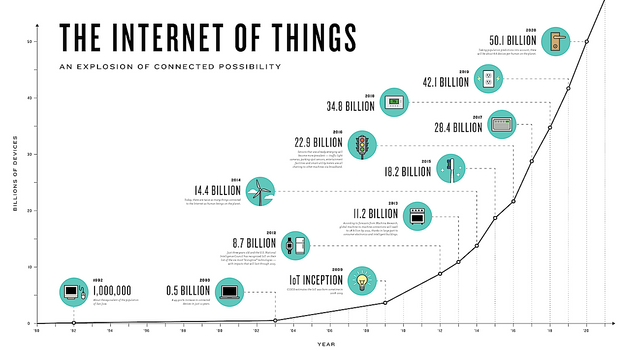

The team behind IOTA hopes that their currency will be used as the backbone infrastructure for transaction value in the internet of things era. We will see micro payments, or even Nano payments i.e. a fraction of a cent used to access many of these things.

Taking a look at the stats, it has up to over 1 billion in market cap at the moment, and ranked 9th cryptocurrency on coinmarketcap. This is quite a great leap forward given that only recently it became available for purchase on exchanges.

ZERO TRANSACTION FEE

An essential part of blockchain technologies are transaction fees which help prevent spam attacks. However, with IOTA and the tangle technology, there are no fees, miners, and blocks. This is especially useful for offering micro payment solutions. Implementing this on blockchain solutions will be far too expensive. Third world country adoption of cryptocurrencies in the future will require very cheap transaction fees. This might finally solve issues with the people, who don’t have their own bank accounts. Moreover, buying things like our morning coffee will also be more practical with micro payments.

So IOTA transaction is free, it escapes the transaction fee with conventional blockchain cryptocurrencies.

ISSUES AROUND CENTRALIZATION

Blockchain cryptocurrencies rely heavily on miners which can lead to issues around centralization. In order to get your transactions speedily validated, you will have to pay some extra charges in transaction fee. There are even slight frictions between miners and the developers.

SCALABILITY

When it comes to most blockchain technologies right now, scalability is a big issue especially with bitcoin. Since IOTA transactions do not work off a block, you don’t get the issue of it becoming slow with more and more people that are on the network. This is an area where IOTA can perform extremely well. There should be no issues with scalability when you get more and more transactions being performed on the network. It becomes quicker and faster the more people and transactions that are performed on it.

To attain mass adoption and become main stream currencies in the next few years, cryptos will have to be capable of successfully scaling on a global level. So far in theory, IOTA will be capable of meeting these demands more easily.

QUANTUM RESISTANT

IOTA is said to be quantum resistant. Quantum computers, pose an enormous risk to all the cryptocurrencies out there in their current form. This risk of quantum computer attacks does not only affect cryptocurrencies. All computers in the whole world, including those owned by large banks, corporation and government. IOTA has an integrated quantum resistant algorithm. This algorithm has post quantum signatures to protect the security of hashes in the event of a quantum attack.

In conclusion, IOTA is free, solves a lot of blockchain technology scalability issues, and supposedly quantum resistant as well.

Downsides using IOTA

First is the issues related to scalability. The network is said to be more secure, the larger and busier it gets. Does this mean that the network is slow and not secure at the beginning where the network has fewer people on it?

IOTA Requires a COORDINATOR

IOTA has a current requirement on something called a “COORDINATOR“. This helps arrange transactions and actually stabilizes it before the network is large enough to secure itself from being attacked. By the time that day comes, the IOTA team has promised that they’ll switch those coordinators off permanently. Some people see the introduction of this coordinator as a sign that IOTA isn’t truly a completely decentralized network.

Uncertainty of Implementation Of IOTA

Another major problem is the underlying uncertainty with implementation of IOTA into the hardware of IOTs in the near future. Getting this network incorporated into hardware manufactured by third party companies can be a future challenge. Setting aside those who doubt this internet of things will ever take off in the first place. IOTA’s tech like the standard hash function will have to be incorporated in the CPUs of all of these smart devices. IOTAs team response to this is that as this industry grows and demand for this tech increases, it’ll just become another component in the tech stack. Also, how the manufacturers will adapt if they want to keep up with the pace of this market. Critics will doubt an entire industry adapting to IOTAs technology as a standard in this space. Chances are there are even going to be better competitors even coming out.

Conclusion

Bitcoin still is the most tried and tested cryptocurrency despite its issues with scalability. It has so far been hack proof. A major challenge with IOTA compared to Bitcoin is that it’s yet to be tested in the remotely similar way.

I personally feel IOTA can stand the test of time given that it is backed by very big companies like Bosch, Innogy, Microsoft, Cisco, Ubuntu etc.

SatoshiPay Phases out Bitcoin, partners with IOTA

SatoshiPay, a blockchain-based nanopayments company that enables digital transactions on a micro-scale, today announced its partnership with the IOTA Foundation to explore replacing Bitcoin with IOTA as the company’s settlement network.

SatoshiPay CEO Meinhard Benn said: “We love Bitcoin for its pioneering role in the creation of our industry, but some blockchain networks it inspired have evolved faster than Bitcoin itself, so we decided to move on to superior technology.”

While corporates such as Bosch, Innogy, Microsoft, Cisco, Ubuntu etc. are building IOTA prototypes focused on the Internet of things, SatoshiPay is the IOTA Foundation’s first partner to build a purely web-based application.

I know that IOTA will really go up and I have already bought them. Hopefully it will give us a good profit.

I learned a lot from your post.Thanks a lot.