Why Bitcoin's Value Might Spike In Time of Global Crisis?

Global crisis is an event marked by falling purchasing power of consumer making it difficult for thousands of business to reach its annual target. Global crisis also marks a rise in job losses and slash in property prices. During a global crisis the prices of goods and commodity dramatically changes. The last known global crisis occurred in year 2006-2008. So how this will effect Bitcoin since?

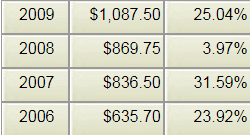

Bitcoin works as an asset same as gold, valuable rocks, etc. First we need to see what happens to such assets that tend to be a store of value in time of Global crisis. I have snapped a picture of gold prices during the global crisis happen in 2006-2008.

Bitcoin works as an asset same as gold, valuable rocks, etc. First we need to see what happens to such assets that tend to be a store of value in time of Global crisis. I have snapped a picture of gold prices during the global crisis happen in 2006-2008.

From the chart we conclude that assets that tend to be a store of value spikes in time of global crisis because people feel there money is safe and investors hordes them to increase their wealth. Now you might be thinking that why have I used gold as comparison? The answer is simple because gold and bitcoin has a lot of similarities except that Bitcoin has no physical existence. They both works as an store of value, is a safe long term investment, have intrinsic value and are limited in existence.

Coming back to topic, so why will Bitcoin price spike during such time?

A global crisis is a period of great uncertainty as most of the stocks and assets price are falling this creates a room for Bitcoin because Bitcoin is a mobile asset unlike any other. This put Bitcoin at a greater advantage. You can buy Bitcoin anywhere in the world. We have also seen examples where Bitcoin price has spiked in certain currency exchanges at times of uncertainty.

Proof?

There are dozens of more such proof where Bitcoin price has spiked during times of uncertainty. As we see, Bitcoin performed well during such times then there is a very high possibility that contrary to popular belief that its price will face a down trend, it would rather spike. The local country exchanges will see an increase in volumes as we have experience in some many country based exchanges.

This adds another reason for Bitcoin price hike, since Bitcoin can be brought, sold, transfer to any country without the use of bank or government this leave gold and other stocks far behind Bitcoin in mobility adding to consumer interest during global crisis. Imagine buying Bitcoin today in your local exchange for $4300 and selling in Zimbabwe based exchange at $7200. This diversity and high volatility in Bitcoin price is likely to push Bitcoin price during crucial times.

This is just an opinion.

Bitcoin may also crash in a case of deflationary crash if people will need fiat cash, as hard as it is to imagine now and I bet such a deflationary crash will not happen before 2019, and probably not later either.