Why The Co-Opting Of Bitcoin Via Centralization Is Doomed To Fail

To date, there has been little discussion regarding the attempts to co-opt Bitcoin. The following team project paper was written to increase that discussion. Some of the formatting has been lost in this post. Please contact for original pdf file.

CENTRALIZATION:

WHY THE CO-OPTING OF BITCOIN VIA CENTRALIZATION IS DOOMED TO FAIL

DFIN 524

University of Nicosia

April 17, 2018

Dennis Lapchis

Mark Odermann

Per-Olof Vallin

Edward “Coach” Weinhaus

TEAM STRUCTURE 3

ABSTRACT 4

SECTION I: INTRODUCTION TO THE PHILOSOPHY OF DECENTRALIZATION 5

IDEOLOGICAL FOUNDATION OF BITCOIN 5

THE CYPHERPUNKS AND THEIR PRINCIPLES 5

MONETARY SOVEREIGNTY 5

SOUND MONEY 6

UNCENSORABLE MONEY 6

DECENTRALIZATION 7

SECTION II: CENTRALIZED INSTITUTIONS REACTIONS TO BITCOIN 8

BITCOIN GROWTH FORCES THE FINANCIAL WORLD TO TAKE NOTICE 8

TRADITIONAL FINANCIAL ELITES ARE OF SPLIT MIND 9

THE TRADITIONAL FINANCIAL ELITES REACT 10

STATUS QUO PRESERVATION 10

COMPETITION ELIMINATION 10

SECTION III: THE CO-OPTING OF BITCOIN 11

THE BIRTH OF CRYPTO COMPETITION 11

FINANCIAL INSTITUTION RESPONSE 12

NEW CENTRALIZERS 12

SECTION IV: CENTRALIZED BLOCKCHAIN CANNOT OVERTAKE BITCOIN 13

INTRODUCING THE END OF CO-OPTING PUBLIC DECENTRALIZATION 13

VULNERABILITIES OF CENTRALIZED BLOCKCHAINS 14

THEORETICAL EXAMPLES OF THE FAILURE OF CENTRALIZED BLOCKCHAINS 14

REAL WORLD EXAMPLES OF CENTRALIZATION 15

CONCLUSION 16

TEAM STRUCTURE

Dennis Lapchis

Dennis produced sections II and III and served as team leader.

Mark Odermann

Mark contributed with Per-Olof on Section I and edited the abstract.

Per-Olof Vallin

Per-Olof produced section I and provided final editing and vision signoff on the entire document.

Edward “Coach” Weinhaus

Coach was the final team member added. His work product includes:

- produced Section IV,

- laid out the initial section breakdown for team members,

- copy-edited each section,

- standardized the footnoting,

- added the table of contents, and

- wrote the original abstract draft.

ABSTRACT

Bitcoin was created as a reaction to the centralized nature of the world's financial systems and the consequences of centralization to those who understood its dangers. Bitcoin’s success is a result of both its ingenuity and its spirit, as encapsulated by the movement from which it spawned. Success has a price, both from imitators motivated to repeat bitcoin's success and from those most threatened by it. Their response has been attempts to co-opt parts of the technology and the network of users of bitcoin with other cryptocurrencies by actors who - either by nature, design or instinct - seek to centralize power and control of value transfer platforms. This centralization is precisely opposed to the spirit of bitcoin. While they may develop successful applications from their selective appropriation of Bitcoin innovations, any attempts to directly overtake Bitcoin’s principles and decentralized value proposition will be self-defeating.

SECTION I: INTRODUCTION TO THE PHILOSOPHY OF DECENTRALIZATION

This paper discusses Bitcoin as “decentralized money” that evolved from a set of principles and ideologies as an alternative to the mainstream centralized monetary structures of the world. The intended appropriation of this technology by centralized interests is worthy of concern and opposed fundamentally against “the spirit of bitcoin.”

IDEOLOGICAL FOUNDATION OF BITCOIN

THE CYPHERPUNKS AND THEIR PRINCIPLES

The concepts behind bitcoin evolved out of the military-industrial complex going back to at least World War I. A small group of passionate activist computer science experts in San Francisco in the 1990’s known as the “Cypherpunks” most closely took these pre-modern concepts into the ideas underpinning bitcoin today. The Cypherpunks were more interested in principles of freedom from centralized control than anything else. Digital money became a key part of that over time. Freedom from central control pervaded the group itself; even this small group agreed on little amongst themselves, with more divergent view emerging over time. “Although there was never complete agreement on any one thing, this was an open forum where personal privacy and personal liberty were ultimately placed above all other considerations.”

MONETARY SOVEREIGNTY

The first look the world had of Bitcoin was the white paper released by Satoshi Nakamoto on the Cryptography Mailing List on the 1st of November 2008. The paper had the title “Bitcoin: A Peer-to-Peer Electronic Cash System”. Satoshi had set out to create digital money without the need for a third-party validating transactions. In the world of government issued fiat money, the only way you can “own” your money is by taking the money out of the bank and holding it as cash in your hand. Once the money is put into the bank and converted into bank deposits, the legal ownership of the money changes. The bank then can create even more money by lending out the money deposited. Because banks are agents for shareholders, they take risks with deposits, which can have systemic implications such as bank collapses, defaults, bank runs, depressions and recessions. The systemic principal/agency risk with banks as caretakers of deposits has necessitated reactionary government depository insurance, which is considered “normal.”

Money cannot be created by ‘fiat’ with Bitcoin. Only the holder of the private key can control bitcoin. It is not multiplied. Bitcoin gives people back the possibility to own its money, thus creating “monetary sovereignty” within the bitcoin protocol.

SOUND MONEY

In the first bitcoin block (“the genesis block”), the genesis block, Satoshi had encoded a message from the same day: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”. The timing of the release of the Bitcoin whitepaper and the first block being mined, merely months after the Lehman Brothers’ collapse and governments around the world bailing out too big to fail banks, together with this message, indicates that bitcoin was created in order give the world a better monetary system. Bitcoin’s design points to at least one reason why Satoshi thought it would be better - a limited supply, without government control, thereby limiting the ability for the government to inflate money to cover its expenses.

Traditionally, the concept of sound money has been associated with gold and the gold standard. Gold, as sound money, has a finite supply and cannot be inflated at will. As Ludwig von Mises opined, the return to sound money means abandonment of inflation. No matter the number of bitcoin outstanding, the amount that will ever be created has a hard cap of 21,000,000. Although bitcoin’s fixed inventory is value-neutral, it has been branded “deflationary.” As more dollars are created, or other currencies are inflated, assuming the “real value” of bitcoin does not change, each bitcoin will be more valuable per dollar, leading real world prices of “goods” to go down in terms of number of bitcoin required, relative to fiat currency. This smacks of deflation by simply “staying the same.” The deflationary design of Bitcoin is one of the keys to its valuation strength.

UNCENSORABLE MONEY

Bitcoin solved another problem with a centralized financial system, the censorability of money.

Censorship of money takes several forms:

- Government cracking down on a monetary system.

- One needs governmental permission to use the non-cash monetary system

- Governments can block particular transactions within the system.

Bitcoin solves the censorship of money by decentralizing.

DECENTRALIZATION

In order to create a new monetary system, with the desired characteristics, Satoshi had identified that it would have to be decentralized. There is no central authority needed in Bitcoin in order to verify if a transaction is valid or not. As an example, the scaling debate for the past 1-2 years has also shown that Bitcoin is politically decentralized. Many different groups tried to force through their scaling solutions, without succeeding. In addition, the development of bitcoin is open source and highly decentralized. There are several clients for running a node. The most widely used client, Bitcoin Core, had in 2017 alone more than 700 contributors. As stated on the Bitcoin Core webpage: “Everyone is free to propose code changes and to test, review and comment on open Pull Requests.”

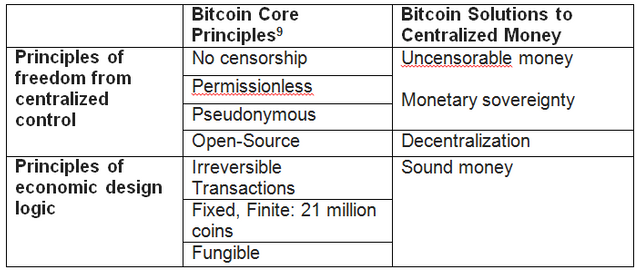

Personal privacy and personal liberty, as the essence of bitcoin, clash with a centralized financial system. Table 1 summarizes bitcoin’s principles as applied to centralized money.

Bitcoin was created in order to compete with and provide an alternative to the government fiat monetary system due to its vulnerabilities all which revolve around centralization. Therefore, decentralization is at the heart of Bitcoin.

SECTION II: CENTRALIZED INSTITUTIONS REACTIONS TO BITCOIN

BITCOIN GROWTH FORCES THE FINANCIAL WORLD TO TAKE NOTICE

Bitcoin grew beyond the borders of any country, and was liberated and independent from the state and financial institutions. In February, 2011, one Bitcoin could be purchased for $1 dollar and it lacked any attention from mainstream financial institutions. By July, 2011 the price had soared to $31 per bitcoin. In November, 2011, with the price of Bitcoin at $2, Wired Magazine wrote an article “The Rise and Fall of Bitcoin”, as if the ride was over. As far as the banking power players were concerned, Bitcoin could be ignored.

Over the next two years, the price of one bitcoin would spike to over $1,000 in November, 2013. This inspired group of crypto-pioneers, who believed there were significant cracks in the centrally managed financial system, were willing to risk their fiat currency for the promising potential of cryptocurrency. The elite financial institutions began to take notice of this “nerd money.” Via the power of decentralization and global distribution, increasing numbers of people joined Bitcoin’s open-sourced development movement, and the Bitcoin nodes and cryptocurrency mining industry expanded. A worldwide interest was taking hold, and discussions of radical disruption to the banking industry were blossoming.

From bitcoin’s high of $1,094 in 2013, financial elites did their best to persuade the public that it was all merely a fad, and nothing to seriously consider. Alan Greenspan stated that Bitcoin was a “bubble” and that it lacked intrinsic value, while the former president of the Dutch Central Banker mocked that at least when tulip-mania was over one still had a tulip. Regardless, the cryptocurrency-cat had been let out of the rebel-financial-bag, and the banking industry would slowly have the data to see that bitcoin could pose a serious threat to their industry.

TRADITIONAL FINANCIAL ELITES ARE OF SPLIT MIND

The traditional financial entities have much to lose should a borderless, peer-to-peer, digital currency continue to grow and become accepted by the citizens of the world. The success of bitcoin has led to both an acknowledgment of its strength and a visceral reaction to the threat it poses.

Currently, the majority of the world’s Central Banks do not support decentralized cryptocurrencies, such as bitcoin, and understand the possible disruption to their industry. Bank of England Governor, Mark Carney stated cryptocurrencies have the potential to create a “revolution” in finance. Bitcoin’s relative success, Francois Villeroy de Galhau, Bank of France Governor, posited that “Bitcoin is in no way a currency, or even a cryptocurrency.” Adding to the critique, Elvira Nabiullina, Russia Central Bank Governor, stated in regards to Bitcoin, “We don’t legalize pyramid schemes” and “we are totally opposed to private money, no matter if it is in physical form or virtual form.”

Both Carney and detractors views have merged among central banks. Wanting to both harness the power of Carney’s “revolution” and mitigating the risk of Nabiullina’s “private money” are natural reactions for governments.

But governments are not the only financial elites with a stake in the current system. The banks too see both a revolution and a threat. Private banks, such as JPMorgan Chase, have publicly mocked Bitcoin by producing a report calling Bitcoin vastly inferior to fiat currency. In 2017, CEO Jamie Dimon blasted Bitcoin, stating it was a “fraud”, and that “the currency is not going to work”. He added that Bitcoin’s use cases were limited to “if you were a drug dealer, a murderer”, or someone living in North Korea. And, like Carney seeing a revolution, Dimon recently recanted his statements.

Sensing both existential threat and opportunity, the established players in the financial system have begun to understand the significant impact that peer-to-peer cryptocurrencies could unleash on their industry.

THE TRADITIONAL FINANCIAL ELITES REACT

The world’s banking institutions and governments currently control the management of global currencies since the full-scale loss of a gold standard. This power over the financial markets has allowed central and private banks the ability to significantly influence governments and political policies. A new form of currency or any threat to the existing system promises a loss of power, control and ultimately wealth for the established players. Bitcoin threatens just that and the elites have reacted commensurately, attempting to both ‘centralize’ and ‘de-decentralize’ for Status Quo Preservation and Competition Elimination.

STATUS QUO PRESERVATION

The potential for Bitcoin to greatly undermine the existing financial and political powers of the State are significant enough that centralized actors have every reason to be concerned about Bitcoin and do whatever it takes to maintain financial control. Bitcoin’s thrust into the financial limelight has exposed it as a competitor and potential threat to the status quo and current fiat system.

In 2014, Fortune’s Trond Undheim stated the obvious: “some banks are afraid of Bitcoin because it would force them to innovate.” Bitcoin’s success did scare the banks into addressing its presence. The banks created new innovative blockchain technology applications; centrally managed blockchain cryptocurrencies. By co-opting bitcoin’s technology, the banks hoped to mimic bitcoin’s success and preserve their status quo position as key power players in a centralized system.

COMPETITION ELIMINATION

The established financial system is generally not content with preserving the status quo when a threat is on the horizon. In 1996, the initial software for E-gold was launched with the intention of providing a currency that was backed by a physical commodity. E-gold was designed to be a private currency that would allow international circulation independent of the controls of government and central banks. It grew in popularity with libertarians and privacy advocates, and after experiencing great success for a digital currency, the E-gold offices were raided in 2005, and the operation was shut down on charges of money laundering.

Another short-lived currency, shut down by the centralized financial authorities was the Liberty Dollar. Bernard von NotHaus had a similar goal of creating sound money, backed by precious metals. In 2007, the Liberty Dollar offices were raided and von NotHaus faced criminal charges for making a competing currency to US coins. Satoshi’s anonymity is no surprise given the authorities’ response to E-Gold and the Liberty Dollar.

Satoshi Nakamoto had solved the double-spend issue that had plagued development of digital currencies, and it appealed to crypto-anarchist techno geeks and freedom-loving libertarians. Additionally, it could not be controlled or shutdown by suing a corporation, jailing a CEO, or seizing data files and servers. This decentralized nature has confounded the traditional financial elites. Before bitcoin, the attempts to create privacy and liberty-enabled currencies rested on known people and entities who could be co-opted. Bitcoin’s decentralization has made similar tactics impossible to stop bitcoin.

Although the centralizers attempts to eliminate competition may be real, a direct attack on Satoshi, or the protocol itself is impossible or too expensive relative to the threat .

SECTION III: THE CO-OPTING OF BITCOIN

THE BIRTH OF CRYPTO COMPETITION

Bitcoin was released to the world unburdened by E-gold’s and the Liberty Dollars’ vulnerability of centralization. It was embraced by a passionate group of supporters and developers who quietly built the Bitcoin infrastructure, inspired a passionate community, and nurtured its evolution. These pioneering Bitcoiners shared the communal spirit of creating an open-source project that could greatly impact the world and compete against the existing fiat financial system.

FINANCIAL INSTITUTION RESPONSE

In recent years, the bitcoin community has continued to spread across the globe, incentivizing bankers to begin to develop action plans. The reasons for co-opting and taking countermeasures against Bitcoin’s growth continued to increase, and as the banks were warned of the coming disruption to their business sector, they started developing cryptocurrency projects of their own.

While observing the decentralized bitcoin community become stronger, banks invested millions of dollars in developing and exploring blockchain technologies. As Nathaniel Popper shared in the 2015 interview Bitcoin: Great Libertarian Hope or Co-opted By Wall Street?, the “amazing irony that the very institutions that Bitcoin was designed to circumvent are the institutions showing the most interest in it now.” The plan to co-opt the Bitcoin bubble was in full effect and by 2016, 60 commercial banks were publicly supporting and investing in blockchain startups and initiatives. Banks of course are part of the centralized financial system.

The most extreme examples of financial institution response is that of the central banks. The number of central banks exploring their own digital currency is non-trivial.

NEW CENTRALIZERS

Central Banks and financial services companies are not the only responders to the financial success of bitcoin and decentralized cryptocurrencies. A new form of competitor had formed - new cryptocurrencies promising the benefits of decentralization and bitcoin without its decentralizing properties. Some of these attempts were innocent and well-meaning attempts at a better version of bitcoin which became susceptible to ‘centralization by design,’ while others were merely the result of promising financial success and were ‘centralized with intent.’ By 2017, centrally managed cryptocurrencies like Ripple were dominating headlines and a plethora of cryptocurrency options flooded the market. Venture capital saturated the ecosystem and practically anyone with a napkin-based business plan was encouraged to go public with an ICO. The froth and greed was at peak levels. This environment created hundreds of bogus investment proposals, saturated the market with too many options, confused the investment community, and ultimately weakened the sector by detracting from Satoshi’s original premise.

Bitcoin detractors, bad actors, and unknowing opportunists found themselves mutating the Satoshi blockchain into a centrally managed cryptocurrency and morphing it back into the existing financial paradigm. In other words, co-opting Bitcoin was as easy as tweaking the new blockchain technology and transforming it to function in the old system.

With the general public confused and uneducated about cryptocurrencies and blockchain technologies, it has been easy to disrupt the continued advancement of bitcoin’s growth. This co-opting of Satoshi is less about Satoshi’s ideas, which are open-source and to be shared by nature. The attack on bitcoin is about co-opting potential bitcoin users. As bitcoin is peer-to-peer, it has a significant network effect. Each new user brings more than the value of “one new customer” to the network but instead all of the new possible transfers of values between each of the bitcoin network and the new user. Losing a user, or potential user, to the newly introduced centralized cryptocurrencies hurts the entire network more than the loss of a customer.

The co-opting plan, born both by design and accident, will fail because they lack the decentralized spirit of Satoshi.

SECTION IV: CENTRALIZED BLOCKCHAIN CANNOT OVERTAKE BITCOIN

INTRODUCING THE END OF CO-OPTING PUBLIC DECENTRALIZATION

Bitcoin’s purported crypto-competitors have mostly chosen centralization or become centralized nonetheless, creating a different form of blockchain than Satoshi’s vision. These new forms have substantive consequences for its users. Centralization’s key features promise benefits. A centralized authority creates strength to the network simply in that the users have an entity to trust. With trust, a network can be faster, less expensive and create a much leaner smoother system of governance. A centralized system also has gains in accountability; with a known centralized actor, or groups of actors, responsibility is easily seen and measured. Accountability creates opportunities for redress when problems arise. In other words, if something bad happens, we know to whom to go to fix it. However, each of these benefits create a vulnerability to Satoshi’s vision and the promises of bitcoin, and will likely be their undoing.

VULNERABILITIES OF CENTRALIZED BLOCKCHAINS

The main vulnerabilities to centralizated blockchains create existential problems for their blockchain’s value.

Strength in trust comes with a commensurate loss of the benefits of a distributed system. For example, economic incentive design (“cryptoeconomics”) based on rational acting cannot hold value in a system where a breach of trust can be highly compensated. Because a centralized system is based on a single (or limited) point of responsibility, the problems of centralization are systemic. Whereas bitcoin plans for bad actors, centralizers cannot survive them. Further, centralizers are incentivized through their control to act in their own interests above the interests of the rest of the blockchain users. Even systems not designed to be centralized, may create incentives for actors to collude, conspire and collaborate to gain control of the blockchain.

The fact that in a centralized system, the actors are known creates the largest obstacle to their success. The central actors can now be easy targets for redress, not just from the user community, but to the jurisdictional governments. Their bank accounts can be shut down, they can be subject to litigation, they can be compelled by force or other means of control. Governments are expert at extracting rents through taxation and regulatory control. The more centralized, the more government will co-opt centralized blockchains.

THEORETICAL EXAMPLES OF THE FAILURE OF CENTRALIZED BLOCKCHAINS

Examples of hypothetical centralized abuse of a blockchain abound. The most obvious is the most centralized of actors, governments centralized digital currencies. It was government control of currencies that led to the creation of bitcoin as an alternative. Blockchain technology controlled by the government is anathema to the spirit of Satoshi. To see why, let’s look at a hypothetical centralized actor and what they could to do a blockchain.

A controlling, trusted, centralized actor in charge of a blockchain may solve the “double-spending” problem, assuming the trust is warranted. However, the immutability of the blockchain would be in question. Without decentralization, nobody would be guaranteed able to maintain the old records but the centralized actor nor stop the centralized actor from changing history. In short, without immutability, there is no auditability. Therefore, trust in a central actors leads to distrust of the system’s truth. Once auditability, truth, and control are not moderated by the distribution of the network’s consensus, then, inflation or other means of “spending away value” are possible, just like in a traditional banking system.

Even a beneficent, moral, centralized actor (or group) effectively controlling a blockchain is an existential risk. An identifiable actor can be litigated against and forced to comply, or regulated. For those who appreciate bitcoin’s privacy, a simple application of the “third party doctrine” could mean privacy is lost through the government subpoena power. Whether moral and beneficent makes no matter in the central actor - the incentives lead to the same hypothetical issues as with the trusted actor above.

REAL WORLD EXAMPLES OF CENTRALIZATION

To paraphrase Father Niemoller , “First they came for the cash, then they came for the crypto, and now they centralize.” That is the playbook of the Reserve Bank of India , which announced on April 5, 2018, it “[has] directed banks and regulated entities not to deal with or provide services to individuals or businesses dealing in virtual currencies” while at the same time exploring creating a “central bank digital currency.” Central authorities directly attack bitcoin then try to replace it. But without Satoshi’s protections, they will fail to find adherents.

Governments are not alone. Ripple, a for-profit centralized ledger company, has seen more than 32,000 blocks go missing, making its balances unauditable and proving its mutability. The much-described DAO hack’s solution effectively created incredible value, comparing the Ethereum market capitalization ($39.2 billion ) to that of the “unsolved” Ethereum Classic ($1.3 billion ). This showed that human intervention, collaboration and centralized decision-making created value, much as predicted. But, it has a flip-side as well, as seen with the “fund recovery protocols” proposed in EIP-867. As Ethereum now has a sense of “recovery” and “fairness” as embodied in the DAO hack solution, the community expects some way to resolve the continuing “lost funds” problems. However, centralizing is scaring away the developers, who now, also as predicted, would face legal liability:

“Hirai later stepped down from his position as EIP editor, citing legal concerns that may result from permitting the draft to continue...Citing a Japanese law, Hirai argued that the movement of funds, especially in the case of unclear ownership, was beyond the capacity of developers and could make them liable to corruption, coercion and bribery. ‘I want to be a software developer, not a lawyer,’ Alexey Akhunov posted on the thread.”

Although Ethereum remains strong, it faces an existential crossroads as to whether it stays ‘centralized in fact’ or faces an unhappy community seeking other options.

Zcash has become centralized in fact as well, with a reported 60% of its hash rate in the hands of one actor. It is unclear how such a concentration of power can give Zcash community security, even if it has not been abused yet.

Even non-financial institutions, such as Microsoft who seek to participate in the cryptocurrency community at large, are susceptible to be pressured or find advantage in attacking bitcoin. Because Microsoft is a known and large entity, it has a lot to lose in crossing the largest central authority, the United States government. Bill Gates, still active with Microsoft , verbally attacked bitcoin’s societal value while awaiting a decision in a key privacy case (United States v. Microsoft ). In this instance, Microsoft saw itself as defending privacy, while failing to provide email records (stored elsewhere), whereas Gates described bitcoin’s privacy protections as little more than hiding illegal activities. Even if bitcoin is not attacked directly by a government, it can be attacked nonetheless based on government pressure.

CONCLUSION

The spirit of Satoshi ultimately haunts the centralized actors who seek to co-opt bitcoin users and attack the bitcoin network via competition. Ultimately, it is human nature that will make competitors to bitcoin seek to destroy the tenets of Satoshi. Particularly, the power of greed and the desire to control. Whereas bitcoin’s cryptoeconomics are designed to address dishonest (and greedy) actors, centralized systems reward them for undermining their own networks. Governments and those in power will attack that which is vulnerable for advantage. Each time the dust settles, the distributive properties of bitcoin and those blockchains that embrace the decentralizing spirit of Satoshi will remain to earn back their lost network users.

Coins mentioned in post:

Congratulations @seattleredpill! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard: