Indian Cryptocurrency Exchanges Must Fight Against RBI

Let be honest, cryptographic money costs in India have been shaken up severely over the most recent couple of weeks. We used to always stay on par if not 3-5% higher than worldwide costs until the point when sixth of April and now we're continually 3-10% underneath.

RBI's decision had an overwhelming impact in the initial couple of days of its decision before things settled down in the long run. Costs for buy and deal are bring down today than it was previously and volumes are down also. It doesn't help the market that one of the best Bitcoin trade 'Coinsecure' is as of now defective after their Bitcoin robbery occurrence.

Get the job done to state Indian digital money advertise is in a bad position. We have a challenging situation to deal with. Be that as it may, we'll traverse this over the long haul.

Hooligans of India

Save Bank of India on the sixth of April chose to force a harsh order keeping any of their directed substances from rendering administrations to these trades or organizations managing in digital currencies. Investors obliged.

Numerous investors have been fixing their noose around trades for at some point. Be that as it may, a couple of banks are as of now tearing administrations to the trades which has kept things moving. These draconian laws and orders should be ceased. Banks need to first anticipate tricks and fakes as opposed to pursuing simple targets like crypto-trades.

Investors overlook that 'our cash isn't bank's cash!' They are only caretakers of our cash. They simply hold it for us as a center man of trust. The cash completely is our own and our alone!

This imperative truth is totally overlooked and regularly overlooked by these hooligans in control. Keeping the natives to practice their entitlement to put resources into budgetary instruments of their decision is illegal.

RBI's Irrational Concerns

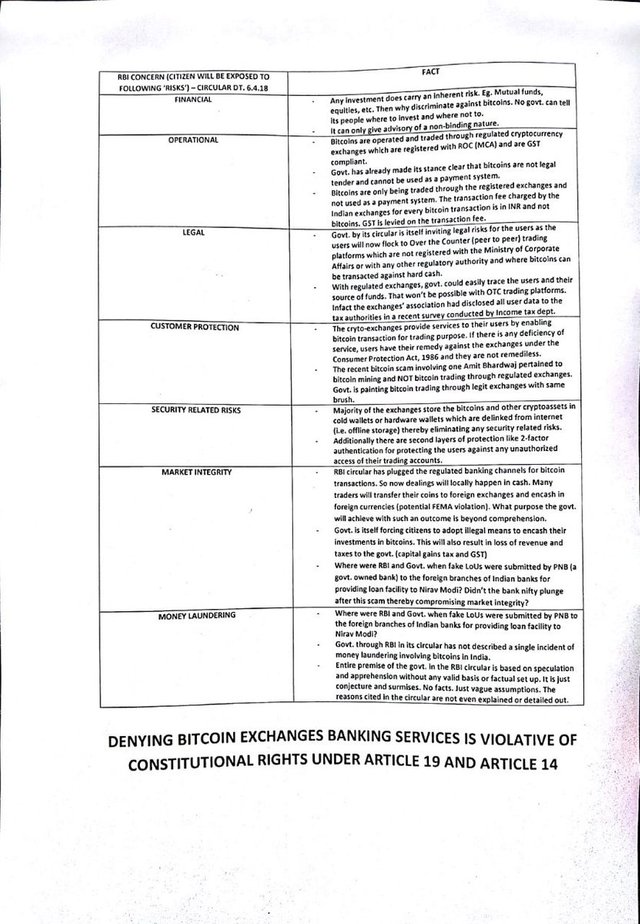

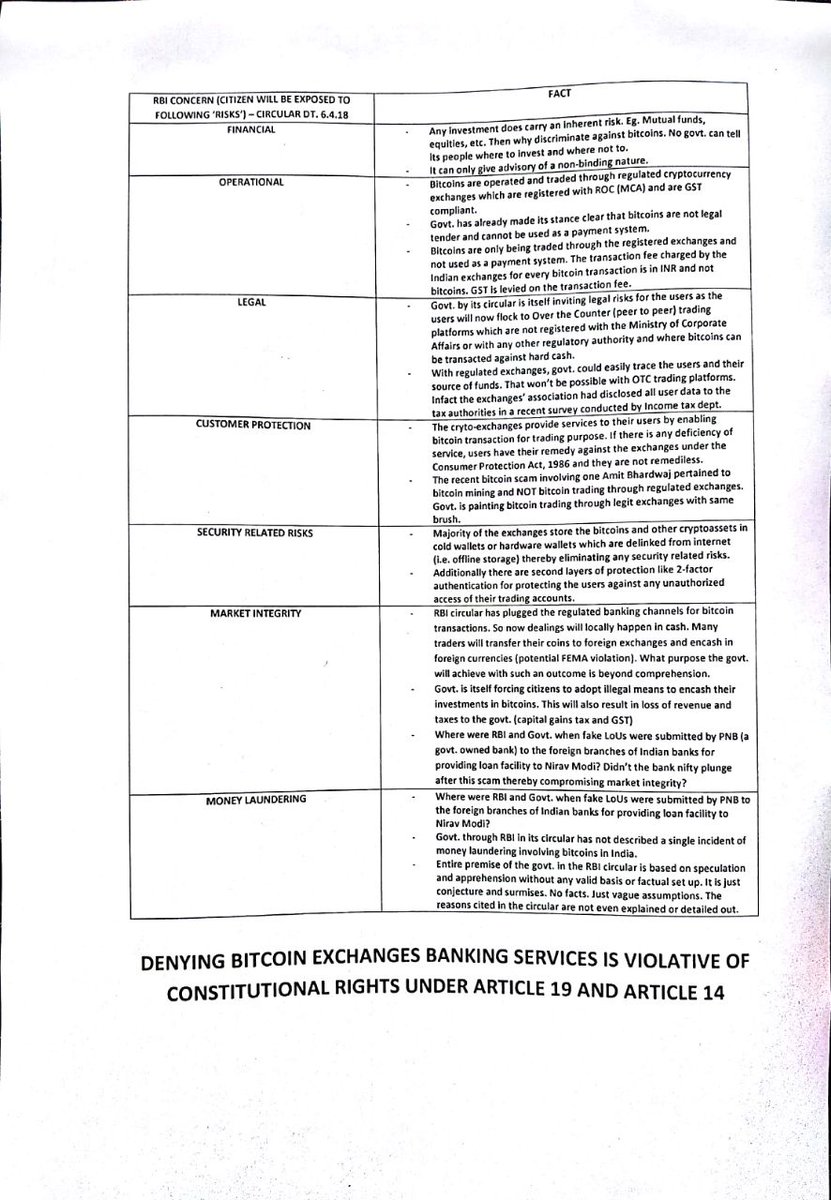

An attorney Yusuf drilled down the accompanying focuses and they should be considered by every one of us and the majority of the trades in our battle against the RBI. It

brings up a few actualities for the situation and discloses to you why in someways how our trades have a body of evidence against the RBI and they can battle it out.

Fortunately for us, pCoinRecoil is as of now doing that in the Delhi High Court and the following hearing is booked on the 24th of May. There's a great deal in question. P2P trade outlets have existed since perpetually now however the costs in p2p trade for the most part suck.

Scurry makes squander

There's no better method for putting it over. I've run over different Steemians who have left their situations in cryptos they held out of dread of RBI's choice and acquired huge misfortunes because of their flurry.

This fight will proceed as the administration hardware itself is in two personalities about restricting cryptographic money. One a player in the administration needs a restriction on exchanging however different needs to direct it. We'll simply need to sit back and watch which way the pendulum swings.

Trades meanwhile have choices to enlist themselves abroad and some have done it in Singapore and Estonia. This enables them to bear on specific tasks or render p2p administrations without being in the locale of the Indian government.

Presently it's a short time before we know how things go. Clutch your tokens and don't offer them at this time. The market is pivoting and in the event that you can prop these troublesome circumstances you are probably going to end up as the winner toward the finish of the battle.