Will Bitcoin Be a Safe-Haven During Recessions?

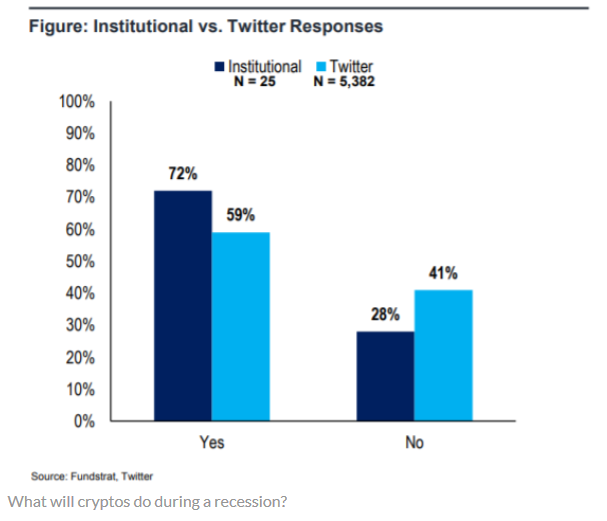

A survey, conducted by Fundstrat, found that Bitcoin investors believed that it would function as a safe-haven asset during the next recession, with 72% of institutional investors agreeing with this, as compared to 59% of retail investors surveyed on Twitter.

This comes amid reports that Coinbase in planning to recruit an extra 150 staff due to institutional interest in the cryptocurrency space;

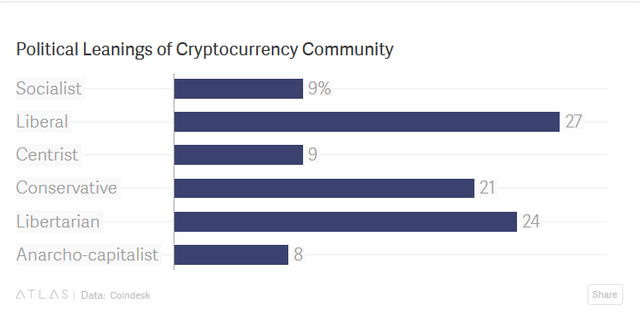

The notion that Bitcoin will be a safe haven during a future recession owes much to its anti-establishment, libertarian beginnings: Bitcoin’s foundations were built in reaction to the financial crisis of 2008, as libertarians believed that the public needed an alternative monetary system that would be superior to the conventional fiat system of government’s and central bank’s and its structural wealth inequality. The principle of Bitcoin gradually became more popular following the banking bailout and austerity politics with the idea that it offered individuals radical freedom in their lives and financial affairs from the oversight of those controlling the old fiat system via a decentralized network of distributed trust, in which people become their own bank, have control of their assets and the ability to trade with a certain amount of anonymity.

Although, a recent sentiment survey by Coindesk showed that the political leanings of Bitcoin hodlers has changed somewhat from its early days;

Nevertheless, will Bitcoin function as a viable safe-haven asset during geopolitical and economic uncertainty? There is contrasting evidence for this.

The most obvious example is Bitcoin’s 80% price spike of early 2013, in response to the financial plight of Cyprus, this was followed by another push higher during the debt-crises of 2015 in Greece.

Numerous other economic crises can be correlated to a surge in popularity and trading activity for Bitcoin and other cryptocurrencies such as Dash. The populous of countries facing a currency crises and hyperinflation have been given a reason to buy Bitcoin; Venezuela, Zimbabwe, Argentina, Iran and Turkey, whilst there is also an increased demand for Bitcoin in African countries facing a GDP growth slump such as South Africa, Sudan and Kenya.

Bitcoin also increased its value by 7% in response to the US government shutdown of January 2018, falling back again when a new budget was agreed by congress, but it has so far failed to benefit in any clear way from the worsening trade war between the US and China, as some expected, although gold, the traditional safe-haven asset, has so far remained in a downtrend during this trade-war, so perhaps Bitcoin has captured a portion of the gold market, despite it lacking the liquidity gateways to bonds, stocks and an ETF.

Going forward, Bitcoin will need a more liquidity gateways and simpler way for the general public to invest in it, better UIs and wallets.

https://coingape.com/cryptocurrency-will-rise-recession/

https://www.coindesk.com/no-crypto-isnt-just-for-libertarians-anymore/

https://www.bitguru.co.uk/crypto-news/coinbase-looking-to-recruit-150-more-staff-recruiting-wall-streets-finest/

My concern is that the next major "recession" will be more of a collapse due to deficit spending. If this were to occur, people will need to sell their assets across stocks, bonds, and cryptos in order to sustain their livelihood. Unfortunately, I believe many individuals will lose their homes. While I believe crypto could be the safest security as it is not government backed, I believe the next big collapse will also subtract market cap from cryptos holistically thus posing opportunities for those with savings and limited or no debt to buy in at discounted prices. It's hard to say that bitcoin and other cryptos will be safe in a recession, but perhaps they are the safest on the time horizon continuing through and after the recession as a means to store value before inflation that could become hyperinflation, or in other words; excessive creation of fiat government backed currencies as their means to sustain the current dollar pegged monetary system.

Good comment. You make a good case there, thanks.

Bitcoin is shaking us like an earthquake :p

In time, it won't just be us, but them.

Congratulations @sandwichbill! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Think of it this way, markets go down 50% in a recession, sometimes more in the real serious ones, but Bitcoin can go up and down 70% losses all throughout a normal nothing is happening year for no reason whatsoever, so why would it be any different in a recession?

The volatility of Bitcoin has reduced this year. This post is about what Bitcoin may do during a recession, not a normal market and Bitcoin doesn't go up, or down by 70% for no reason whatsoever.

I agree @sandwichbill - I would love to see what would happen when there is no BTC market manipulation.