Why We Should HODL and Ignore the FUD Designed to Scare Us into Handing Over Our Cryptos to Institutions

The financial news media scared people away from internet stocks after the dot.com crash, whilst institutions quietly bought them up and history is repeating itself with Bitcoin and other cryptocurrencies.

Ever since Bitcoin reached mainstream consciousness in 2017, the crypto-space has been assailed by a constant narrative of FUD pressuring down on the market that Bitcoin is "a bubble", “tulip mania”, "a fraud", "a Ponzi scheme", it will be regulated against, even banned. This has come from the financial news networks, such as Bloomberg, CCN etcetera and the banks, both central and private.

We will recall a like for like lesson from financial history, after the dot-com crash of 2003, when the financial news media were scaring the public away from investing in internet and technology stocks, whilst institutional investors outwardly scorned the "dumb money" of the public, although at the same time they were loading up on those same stocks from the individuals who were panicked into selling.

History is repeating itself and now the patronising FED Chair, Jerome Powell, says that cryptocurrencies are too risky for 'unsophisticated investors.' I guess he means us!

In all fairness, I have seen these same news networks say Bitcoin is a "screaming buy", only for the price to dip soon afterwards, but when they churn-out the FUD we must consider the other side.

Money talks and the learned, astute observers in the Steemit community will have noticed the change of stance by many of the same detractors. Institutions are smart enough to recognize cryptocurrencies as a new global asset class with the potential to provide much better revenue and alpha as compared to the traditional asset classes of equities, bonds, real estate, commodities and cash, whilst providing a safe haven during economic and political uncertainty. Cryptocurrency is extraordinary, in that it is the best of both worlds and many analysts say that the stock-market may be due a significant correction in the next couple of years.

Thanks to the Bitcoin correction from the 20k December 2017 highs and the ongoing FUD campaign orchestrated between the media, banks and institutional investors, institutions are now able to enjoy the best prices on Bitcoin and other cryptocurrencies with a utility case since mid-2017. In April, research by Fundstrat revealed that 82% of institutional investors believe the crypto market had bottomed, but then they were just waiting for custody solutions to be introduced, which are now in place.

The bull run of 2017 privately altered institutional sentiment towards cryptocurrencies, as their potential as a new global asset class came to be recognized. The vast difference that would be made to the overall market cap of the cryptocurrency market from the likely massive influx of institutional capital is just basic maths: the growth that led to the 2017 bull-run came largely from retail investors, just a tiny fraction of capital from institutions such as pension funds, sovereign wealth funds, endowments and foundations, mutual funds and insurance funds that collectively control $131 trillion of global wealth would make a massive difference to the overall market cap.

Billionaire, Steven Cohen, the owner of VC firm, Cohen Private Ventures, has backed institutional money to provide the cryptocurrency market with a much-needed shot in the arm and financial experts claim that institutions are already quietly accumulating Bitcoin in expectation of the likely approval of a Bitcoin ETF, either in the coming weeks, or later this year. But the media FUD keeps coming.

Financial analyst Hjortur Justinussen states that;

The snowball effect of institutional investment is gathering pace with total investments so far this year recently reported to be $637.7m, although it is now likely to be more than a billion, or in the billions, as compared to $496.7m for the whole of 2017 and institutions are currently providing 56% of the capital flowing into the cryptocurrency market. A recently conducted survey of institutional investors by Triad Securities found that 62% were considering buying Bitcoin.

George Soros and the Rockefeller VC firm, Venrock, have entered the crypto trading space.

Coinbase Custody for institutional investors was launched on 2nd July, 2018 and has already attracted over $20 billion. Coinbase CTO, Balaji S. Srinivasan, stated that the mass adoption of cryptocurrency is just beginning and he foresees that over 60% of the world's population will own and use crypto.

Goldman Sachs backed Circle reported that, in May, they had experienced a 30% increase in institutional clients, despite the plunging price of Bitcoin.

Investment group, Wellington Capital, with over $1 trillion of assets under management, has declared its intention to enter cryptocurrency trading and their systems already include various Bitcoin derivatives.

The world's second largest custody bank, State Street, is preparing to expand its financial offerings to include cryptocurrencies.

The world's 12th largest trading firm, Susquehanna, is about to open-up its trading desk to include cryptocurrencies. As one of the largest providers in the ETF market, no doubt they will also look to provide a Bitcoin ETF at some point.

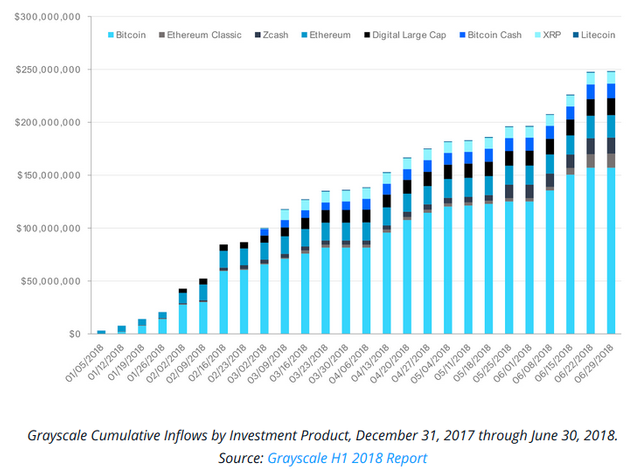

Grayscale Investments is onboarding institutional investors at the rate of $10 million per week to its Bitcoin Investment Trust. Greyscale's recently released Annual Report stated that that there has been a surge in interest from institutional investors and retirement funds.

The Andreessen Horowitz hedge-fund say the crypto boom feels like the ‘early days of the internet, web 2.0, or smartphones all over again' and recently announced a long-term "all weather" $300m crypto fund called a16z, focused on crypto investments with a non-speculative use case.

As stated in one of my previous posts, one of the largest fund managers in the world, Blackrock, were exploring the cryptocurrency market and this has been confirmed this week. Blackrock also happen to be the world's largest provider of ETFs, so maybe Blackrock will be another future Bitcoin ETF provider.

Fidelity have trillions of dollars under management and they are in the process of employing cryptocurrency traders.

Nasdaq, the owner of the NYSE, Intercontinental Exchange (ICE), are actively exploring ways to profit from the burgeoning digital asset class.

Also, an interesting development is that Mastercard has been granted a patent for “managing fractional reserves of blockchain currency", giving them the rights for a method using cryptocurrency on credit cards to purchase goods, so we should recognize the writing on the wall and ignore the market psychology when prices head south.

Conclusion: we shouldn't be panicked into handing over our crypto to institutions, when the FUD campaign shakes the tree to scare off the ordinary investor.

The future of cryptocurrency is going to be super exciting, but there won't be a sudden avalanche of capital into the cryptocurrency market from institutions, which they have ready and waiting on the sidelines. In practical terms, this process will be more gradual due to the current lack of liquidity needed to buy large quantities: in order for institutions to buy Bitcoin in the thousands, there must be enough sellers and therefore sufficient liquidity for the institutions to buy into. This fact makes sense of the ongoing FUD campaign, which, as said, resembles the dot.com FUD campaign of 2003.

We may still see dips in the price around futures expiration times and I'm half expecting one to coincide with the futures expiration on Friday 27th July, but in the long-term, a bit of nous tells the ordinary investors like me and you, dear reader, that things are looking very positive for the future.

Why? Why are these institutions and the banks so eager to invest in the cryptocurrency space? That is the question!

https://www.cryptoglobe.com/latest/2018/07/crypto-is-the-fastest-growing-segment-of-the-hedge-fund-industry/https://www.fnlondon.com/articles/blackrock-begins-exploration-of-bitcoin-20180716

https://www.chepicap.com/en/news/2076/coinbase-cto-believes-that-cryptocurrency-adoption-is-just-beginning.html

https://www.cryptoruin.com/billionaire-investor-says-crypto-will-revive-hedge-funds/

https://www.ccn.com/bitcoin-unicorn-circle-records-a-30-spike-in-new-institutional-clients-in-may/

https://www.ccn.com/bitcoin-investment-trust-creator-adding-10-million-in-new-investments-every-week/

https://www.ccn.com/mastercard-wins-a-patent-to-link-cryptocurrency-with-fiat-accounts/

https://blokt.com/news/institutional-investors-quietly-accumulating-bitcoin

All the circumstantial evidence points that crypto has hit its bottom and the big boys are getting in. Don't let the buyers take your loss. You can never lose if you never sell! If only 1% of global wealth of $131 trillion enters the space, bitcoin will go up 10x. HODL for the next year or so!

Continuous fall in price is also a factor

That’s about it, in my opinion, although I didn’t say x10, or in a year or so, it’s just my opinion based on the direct evidence of institutional money coming into the market, not circumstantial and it’s not investment advice. 👍

All serious observers of crypto news know that institutional money is coming into the market and that a Bitcoin ETF is not too far away.

By the way, I’ve just read your intermittent fasting post. Good stuff.

Yes I hear what your saying... but you still have to have a stop loss, especially for those smaller Alt coins. Don't wan to be hodling to zero. Personally I haven't sold any yet but if Bitcoin drops to $3000 I'm out. My stock brokerage account has been generating profits but my crpyto account has been in limbo since January. Thinking I could invest my money someone else....

You might just miss the best ride you could have without taking your clothes off.

You might just miss the

Best ride you could have without

Taking your clothes off.

- sandwichbill

I'm a bot. I detect haiku.

I've been waitng for the price to take off... but I can't wait forever. Dead money is dead money.

On the charts, I see an inverse head and shoulders pattern and the high volume impulsive move of the last week or so has broken the neckline at about 6,8k and tested the long-term 7,7k upper trendline once, before retracing. In the short-term, It may be that we will see a continuation of the impulsive move, now that the overbought conditions are easing off, or the price may fall back to the neckline at about 6,8k, which is now support, before retesting 7,7k. If we break through 7,7k, then we should see a price break-out. If not, then we may stay be stuck with sideways movement for a while. (that's my opinion in the short-term, based on the probabilities of technical analysis)

However, in the long-term I'm very bullish (opinion), because of the institutional money coming into the market (fact, not opinion as somebody suggested in this comments section) and the likely approval of a Bitcoin ETF sooner, or later. You won't have to wait forever. Happy trading.

Easy for you to say. Do you have thousands and thousands invested? I certainly didn't buy at the top of the market but I'm even down. It's easy to be optimistic when you're just a bystander but when you've got an arm and a leg on the chopping block you tend to be a bit more cynical.

Well, I’m by no means a bystander, but I’m very optimistic about the long-term future of Bitcoin and a few others with a utility case for the reasons mentioned in my blog and this post. I have realised that I should ignore the FUD, because, when I read between the lines, I see things very differently. We also seem to be on the brink of a positive regulatory framework. HODL rather than sell because of the FUD is what I’m saying in this post, but I have a policy of not offering financial advice, so I can’t tell you what the best course of action would be for you. That depends on your own financial considerations. Good luck, I’d love to see you make a ton of money out of all this.

https://coinnewstelegraph.com/u-s-congress-strikes-positive-tone-on-cryptocurrency-in-latest-hearing/

Since end of 2017 I've put all my money in and even sold everything I have and am continuing to invest in crypto and holding because it's all or nothing for me and I believe it will go up huge sooner or later.

The aspect of a pro trader.

...is to have a stop loss

:D hehehe, nice. Good one!

I hope it drops more, even below $1,000 so I can buy more. This space is exciting

your evil

Dude if it drops more you can buy more before ETFs take it to the moon.

But not that low!!! Common man, not even you would want to stomach that big of a price loss. We've had a bear market that's lasted over half a year, plenty of time to get in at a good discount. Now I want the payoff, no more waiting.

Bitcoin have a great

Crypto is here to stay just stay strong and hodl.

Nice bro. visit also my profile @fariskhan

Yes, yes, yes - ReSteemed!

-exp

Thanks, old bean👍

CRYPTO IS NOT SOMETHING PONZI SCHEME WHICH CAN BE VANISHED .ITS SOMETHING BIGGER WHICH WILL SOLVE REAL LIFE PROBLEMS .

AS FIRM BELIEVER OF BLOCKCHAIN AND CRYPTO REVOLUTION I CAN CLEARLY SAY WE ARE HERE TO STAY. CORRECTION IN CRYPTO WORLD IS NORMAL.

WE ARE THE BULL AND MARKET WILL RISE AND SHINE AND GO COMPLETELY BULLISH .

CRYPTO WE TRUST <3

Yes, quite right, Sir.

Really enjoyed reading that, I am interested to see if there is a dip around the 27th as well. If there is I'm scooping up a bonus pile more of bitcoin haha

Thanks for your comments. I think the ability of the whales 🐋 to manipulate the market around futures expiration times will become more limited as the institutions pile in, but we are not there just yet👍

I enjoyed the hell out of it!

Thank you.

Fantastic work with this one, kudos