What's Bitcoin's Next Move? Check-Out Whale Alert on Twitter

We maybe in a bear-market, but the good news is lining-up. Check-out the Whale Alert Twitter account.

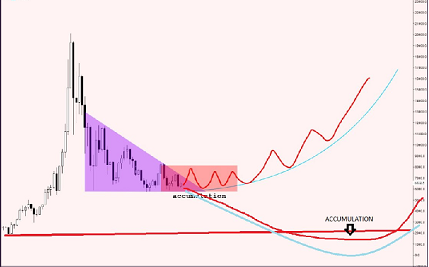

Opinion is divided on Bitcoin’s next move, with a descending triangle on the monthly charts, forming since last December, a bearish pattern that typically completes with a decisive lower move below the flat-line, but some see a period of accumulation to form a bottom before the next market cycle;

If we look back at the monthly’s, we also see a head and shoulders pattern that began forming in June;

This coincides with a probable ETF delay looming from the SEC and there’s a possibility we could be about to break the $6000 long-term support level, although the expectation of an SEC announcement to delay VanEck approval may already be largely priced into the market and we could trade sideways, as happened in 2014, the only other comparable data-point to which we can refer.

Of course, the SEC could be about to surprise us, or give us an indicator that they are warming to the idea of VanEck approval at a later date, but in the meantime, we have the NYSE’s Bakkt platform coming in November, which reportedly only needs approval from the CFTC, so this is very likely. Some commentators believe that this is bigger for the crypto space than an ETF approval and Bakkt’s stated aim is to make Bitcoin “more liquid and trusted”, apart from their other unstated, but rather obvious aim of making lots of money;

In an attempt to compete with this, Nasdaq is making preparations to launch its own cryptocurrency trading desk, scheduled for Q2 2019, targeting institutional money and offering them custody solutions, which is conditional on there being guidance in place from the regulatory bodies, but Nasdaq’s conversations with the SEC and CTFC appear to be moving towards a positive outcome with this timeframe in mind, according to Nasdaq insider sources;

More good market news that might also trigger the next Bitcoin parabolic is that Citigroup is in the early stages of a plan to launch a Bitcoin Digital Assets Receipt (DAR), a financial instrument so similar to an ETF, many are now wondering whether we need an ETF at all, as it gives investors the same opportunity to speculate on the future price of Bitcoin without owning Bitcoin itself, since Bitcoin would be owned by Citibank on behalf of the investors in the DAR. Ciitigroup is racing to be the first to do this, so others will no doubt follow suit.

Fidelity, the fund management firm with $2.5 trillion under management is planning to offer its investors exposure to Bitcoin with the introduction of cryptocurrency products by the end of Q4 2018, according to CEO Abigail Johnson. This follows news that Blackrock, which has over $6 trillion in funds under management and is also the world’s largest provider of ETFs is teaming-up with Coinbase for an ETF proposal.

So, whatever happens to the price of Bitcoin in the coming weeks, all of the above should have the positive impact on the market we’ve been waiting for in 2018.

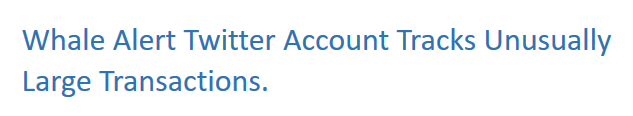

A new Twitter account called Whale Alert is aiming to provide more transparency to cryptocurrency traders, by detecting unusually large real-time transactions, whilst seeking to identify the sender, before tracking it to the deposit wallet of an exchange and monitor the activity of the wallet for any possible market changes.

Whale Alert will focus primarily on transactions involving BTC, Ethereum, ERC20 tokens and USDT, which has been the subject of many rumours regarding manipulation and speculation. Whale Alert will only tweet transactions it is monitoring, if they are over $8,000 USD for Bitcoin and $2,000 USD for Ethereum, such as the two movements of 15,000 BTC last week;

https://twitter.com/whale_alert

https://www.cryptoglobe.com/latest/2018/09/nasdaq-rumoured-to-be-listing-cryptocurrencies-by-next-year/

https://bitcoinexchangeguide.com/which-is-better-for-bitcoin-etf-approval-or-bakkt-by-ice-and-starbucks/

https://www.ccn.com/citigroup-is-the-latest-bank-to-offer-crypto-custody-heres-how-it-will-affect-the-market/

https://www.newsbtc.com/2018/09/19/fidelity-ceo-teases-crypto-product-announcement-by-end-of-the-year/

https://bravenewcoin.com/news/why-a-coinbase-and-blackrock-crypto-etf-might-be-approved/

tnx, and tell me your opinion in my analysis

https://steemit.com/analysis/@garraboy/my-analysis-for-nzd-jpy-4h

I don't use shark patterns, or Gartley's, but yes it's a bearish pattern. Good stuff.

Bitcoin is one, and opportunities only increase in number, everyone wants to earn. @automation @banjo @cleverbot,

Heeeeey, Caitlin!

With all the good news we've had we should be right up there by now

Yes, but the shorts are stacking-up and the market makers are manipulating the market, but retail investors are getting wise to this and the developments I mention in my post will surely lift the market, sooner or later.

Let's hope so. I'm big into holo right now

Yeah, I’ve got some Holo, but not in a big way.

I don’t know whether you’ve heard of Trybe, @wales, by you’d be a welcome addition there.

It’s a new social media platform built on the EOS blockchain, similar to Steemit.

You’d receive 100 Tokens just for signing-up and a further 10 tokens every day you sign in and I’d give you plenty of upvotes.

If you’re interested, click on the referral link below;

http://trybe.one/ref/9865/

I always consider these different sites, but I really wonder what the point is of cross-posting content everywhere. EOS hasn't even proven itself as a currency and seems pretty overvalued.

That being said, I'll check out Trybe with your link. Pretty skeptical of referral programs because they tend to attract a lot of scammers (like Weku, someone impersonated me there and plagiarized my poetry) but it never hurts to try, I suppose.

A year from now there will probably be a hundred crypto social media programs, but likely only one or two will prevail.

Well, Trybe seems to be fine in my experience and a few of the guys with high Steemit ratings are over there.

Hmmm, guess I have some research to do. Just wonder how it'd be possible to manage stuff on all these different platforms when it takes most of my time to keep up replying on Steemit already :-)

Well yes, I know what you mean.

I've been thinking of joining another writing site, but will have to come back to this tomorrow, got a bit of a hangover right now

What other writing ✍️ website were you thinking of joining, out of interest?

I've just joined trybe...I was thinking of weku which seems the same as steemit...I used to be in wikinut but they stopped paying..and other sites over the years that went out of business. The best was bubblews but they folded too

Do I have to be on an Eos platform to get the air drops, if so then which one

Well, you’ll need an EOS wallet and the easiest is EOSlynx. The next airdrop is December 11th and any tokens you earn on Trybe before then can be withdrawn to the wallet and then the airdrop pays out according to your balance.

now that bitcoin is 6,531.73 USD as of today, i think this is the right time to invest on it because in the next three months to come Bitcoin will surly increase by 5 time the current prize.

Good content

Thanks 🙏

seeing to the present situation.I can say that bitcoin give its investors a positive result in future...Yesterday one of my friends said that I have purchased 300 Buxcoin on the price of 1 Buxcoin/1euro...but now its rate is more than 3 euro per coin....it means that upto December the price of many coins will go high up

Interesting, I’d never heard of it.