What Really Caused the Bitcoin Decline?

What happened? Why did we see a sudden $1000 decline in the spot price of Bitcoin from around 7.4k?

Many commentators are pointing the finger at the inaccurate reporting of Goldman Sachs ditching plans to open a cryptocurrency trading platform, whilst in reality Goldman is just prioritizing cryptocurrency custody solutions above the trading platform, as a result of regulatory uncertainty.

Why would Goldman abandon plans for a cryptocurrency trading desk, if Binance expects to make profits of over $1 billion this year alone, despite their low fees? Wouldn’t Goldman and its shareholders want a slice of the action?

.png)

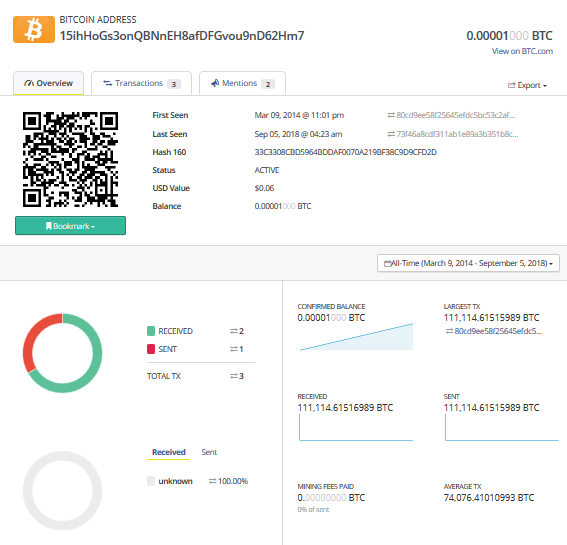

There are also reports of a 10,000 BTC short position (approx. $74 million) being taken by an unknown trader 2 days prior to the Goldman Sachs fake news, as confirmed by the BTC/USD shorting charts on Trading View and that this could be insider trading from somebody who knew the Goldman FUD was coming.

This large short position came after somebody had moved 111,114 Bitcoins from a ‘Silk Road’ wallet that had been dormant since 2014, by using a Bitcoin mixer in a largely unsuccessful attempt to avoid the tracking of this large transaction. 11,114 Bitcoins were tracked to Bitfinex, 4,421 to Binance and 210 to Bitmex;

Whether or not this transfer is connected to the Goldman FUD and the large-short position is unclear. It may be, as some are speculating, that the owner of this wallet is exchanging Bitcoins for a mix of privacy coins such as Monero etc, the transfer of which would avoid the need for the use of a mixer. After all, owning a privacy coin like Monero is akin to having a Swiss bank account and I can imagine a lot more individuals with money to hide will start using Monero, Zcash, etc. I wouldn’t be surprised if Bono has got some. (By the way, why doesn’t Komodo ever get mentioned as a privacy coin? And why is it so often left-out of a list of PoS coins?)

Anyway, it seems that the decline could be in part due to a large sell-off Ethereum, by Digix, after DGD holders gave them the green-light to liquidate their Ethereum holdings. On September 5th, between 10:30AM and 11AM GMT, about 60,000 Ethereum were exchanged on Bitfinex, sending the price down from $280 to $265, followed by another 70,000 between 11 and 11:30AM GMT, causing a further decline to $260 and the market saw a correlating 4% decline in the spot price of Bitcoin from 7,3k to just under 7k.

It may simply be that Bitcoin hit a key resistance level at 7.4k, which also happens to be near to the 61.8 Fib retracement level and Bitcoin was unable to break through, causing a sell-off. The Goldman FUD no doubt helped precipitate this.

To maintain anonymity, Bitcoin tumbling is used to avoid tracking of transactions across Bitcoin’s public transactions log and any person’s ID connected to that address.

In order for someone to put their Bitcoins through the rinse cycle, the sender must connect to a Tor network and use a third-party Bitcoin mixing service. Some of the leading third-party providers of Bitcoin mixing are Helix, Bitcoin Blender, BitMixer, Bestmixer, Bitcoin Fog and Pay Shield. Bitcoin mixers have varying degrees of trust and reliability. There have been many instances of people losing all their Bitcoins by sending them to a service run by a scammer.

It can take a few hours to ‘clean’ the ‘dirty Bitcoins’ and fees typically range between 0.5% and 3%.

In Conclusion

What we really need is for the SEC to introduce a regulatory framework, then Goldman can open a trading desk and institutional money will really start to flow-in. What the hell’s taking them so long?

Why not sign up to Trybe, a new social media platform built on the EOS blockchain, similar to Steemit?

Receive 100 Tokens just for signing-up and a further 10 tokens every day you sign in.

Click on the referral link below;

https://www.reddit.com/r/Bitcoin/comments/9ceb5v/1b_bitcoins_on_the_move_owner_transfers_100m_to/

https://www.blocktrail.com/BTC/address/15ihHoGs3onQBNnEH8afDFGvou9nD62Hm7

https://cryptalker.com/bitcoin-mixer/

https://www.trustnodes.com/2018/09/05/flash-sell-off-200000-eth-sends-price-20-250

manipulation all the way just like everyday in crypto and stocks..

when moon ? ?

ask @lanniebrockstein , he'll be able to tell you.

My long term bull case is based on the inevitable entry of institutional money. Last year's bull run was a surprise fueled by mostly retail money, but it's not the big move that I see on the horizon.

Posted using Partiko Android

After a lot of thinking I believe that we don't necessarily need the likes of Goldman. After all the space has grown tremendously without them. Make no mistakes, Goldman doesn't pay games unless the game is in their favour. Any regulations will do exactly that. BTC was designed to escape this kind of power, not embrace it.

Of course institutional will boost the market short term, but what are the implications long term? Probably a situation the mirrors the stock market which is heavily manipulated and controlled by institutions.

i am bitcoin favorite so that i have resteemit and i am following you so please give a up-vote

thanks and best regards

Why not sign up to Trybe, a new social media platform built on the EOS blockchain, similar to Steemit?

Receive 100 Tokens just for signing-up and a further 10 tokens every day you sign in.

Click on the referral link below;

http://trybe.one/ref/9865/

i will do it

thanks for information...

"What the heck is taking them so long?" Truer words were never spoken. Getting a bit frustrated myself, if this trend doesn't turn around within 6 months I'll probably take my losses and leave crypto. I can't hodl forever and my patience is limited. What do you think? When is this bear market going to die.... if ever?

In our opinion Goldman Sachs is not to blame but we would like to add this thinking, please see our post explaining what happened: https://steemit.com/bitcoin/@bitcoin-city/is-goldman-sachs-the-reason-bitcoin-has-fallen-this-week

We've got the Bakkt platform coming in November, which is backed by physical Bitcoins and they have confirmed that no fractional banking will be applied. We need SEC regulation and when it eventually arrives it is likely to be good for crypto, an enlightened approach in much the same way that the Clinton administration regulated the internet, in order to avoid innovation and capital flight from the US in the global Fintech race. A Bitcoin ETF will be upon us, probably in 2019, although it may come from Canada before it comes from the US. Crypto is viewed by institutions as a new asset class with the opportunity for exceptional revenue and alpha. I hesitate to offer financial advice, so let me put it another way. I'm hodling, because my nous tells me that in the long-run it will all be worthwhile, but it's going to be a bumpy ride. The good, low-hanging fruit will become more difficult to reach as time goes on and there will be many wealthy people created from digital assets, more so than the stock-market. (opinion)

The SEC has rejected 7 etfs in a row, what makes you think this Bakkt Etf will be any different?

No, Bakkt is a cryptocurrency trading platform and it only needs approval from the CFTC, which is very likely.

https://medium.com/bakkt-blog/https-medium-com-kellyloeffler-price-discovery-f9c77885383

you can trade crypto on coinbase, gemeni, bittrex, what the big deal with Bakkt?

It targets institutions and offers them cold wallet storage. It's a big deal for the cryptosphere.

Wallsteet isn’t coming. Private funds bought above $10,000 plus and will be out if we dip below 5K

Bear market lives

It was the Clinton administration that caused the markets to be in the mess they are today. Not strictly Clinton himself per se but Larry Summers, Robert Rubin and Sandy Weill and their involvement in dismantling Glass Steagall in order to allow the merger of Citibank and Travellers. It was this that led to the securities fraud that caused the 08 crash to happen. None of the administrations that have followed has dealt with this problem adequately either. it's been bye bye capitalism and hello plutocracy and neoFeudalism.

I think it will be necessary for the crypto world to sort its own problems out so that it can offer an alternative to the current pseudo-capitalist situation in the fiat world rather than the other way round.

It could be that you need to do a full Adam Smith invisible hand and let everything sort itself out through mutual self interest. That will allow big crashes to occur and markets sort themselves out but it will also allow bad actors with lots of "cash" to wield a lot of power when the sector is small. Mass uptake in the real world will eliminate that as their power is diluted. Another alternative would be self-regulation - that would annoy purists though - who decides who the power brokers are and how is that regulation enforced.

Ok enough of my rant..... I'll be making more enemies than friends :P

Very interesting

Bitcoin has dumped from $6400 to $6100. Very depressing

Why not sign up to Trybe, a new social media platform built on the EOS blockchain, similar to Steemit?

Receive 100 Tokens just for signing-up and a further 10 tokens every day you sign in.

Click on the referral link below;

http://trybe.one/ref/9865/

Well, Uranus, Neptune, Pluto, the North Node of the Moon, and Chiron, which is to say all of the outer planets and celestial objects, are each currently in their retrograde motion.

That means five of the twelve major layers of Time in th'Earth's solar system are moving backwards. Also, it was only a few days ago when Saturn was retrograde, and only a few weeks ago when Mars was too. Neither of them have reached the "full steam ahead" part of their direct motion.

In terms of astrology that basically means that anybody trying to move forwards in regards to long-term endeavors must be like the salmon that doth swimmeth upstream. Most people and institutions do not have the stamina to do so. It is a time to retrace one's steps.

You must be on that "good good" kush brother.

Why not sign up to Trybe, 'tis a new social media platform built on the EOS blockchain, similar to Steemit?

Receive 100 Tokens just for signing-up and a further 10 tokens every day you sign in.

Click on the referral link below;

http://trybe.one/ref/9865/

In our opinion Goldman Sachs is not to blame but we would like to add this thinking, please see our post explaining what happened: https://steemit.com/bitcoin/@bitcoin-city/is-goldman-sachs-the-reason-bitcoin-has-fallen-this-week

Good article, thanks.

You’re welcome

Re-Steemed, to help with your promotion efforts!

-exp

Thanks again, old bean, very good of you.

I'm staying in for the long term so rumors don't matter

Long term won't matter if the same happens here as what happened in the late 90s in the internet world.....ie crash and consolidation. If we see a repeat it will only be projects with large war chests that survive.