A Concise History of Accounting Ledgers Through to Bitcoin

In this article we will look at the ways that the formulation of ledgers throughout history has had a dramatic impact on the advancement of economies and societies and consider how the distributed ledger will achieve the same impact, a new industrial revolution.

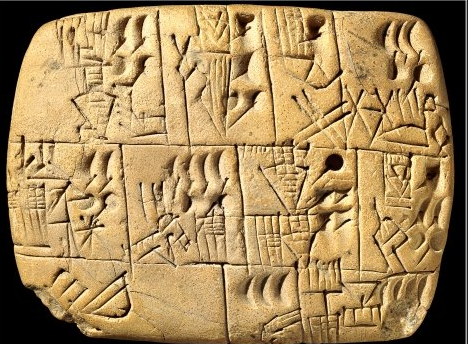

The accounting ledgers, developed by the ancient Sumerians of Mesopotamia c.3500-3000 BCE, are known as “Proto-cuneiform” and they are records of trade, consisting of impressions, or holes, denoting a quantity laid-out in rows and columns next to a standardized pictographic representation of goods and items, these pictographs only evolving into a complete written language towards the end of the Uruk period in approximately 3200 BCE, called cuneiform (from the Latin cuneus (“wedge”) + fōrma) due to the wedge like appearance of the writing produced by a stylus on soft clay and later fired, or baked in the sun.

The Sumerians, it would appear, developed the spreadsheet before they developed the word-processor and the tablets detail the flow of commodities such as grain, textiles, fish, pots, tools and cattle (described according to age and sex) by the date of the transaction, the signature of the authorizing party, a seal of authentication and a base 60 sexagesimal form of quantification.

(Pictured, Proto Cuneiform tablet recording beer rations for slave labourers)

Proto-cuneiform allowed civilization to progress from agrarian life to an urbanized division of labour, with a stable system of records beyond memory that were less prone to error and made the management of large communities fairer and more efficient.

Next came the development of the double-entry bookkeeping system, pioneered by Jewish bankers in the early-medieval Middle East and adopted by Italian merchants and money-lenders by way of trade interactions, the oldest record of its use in Northern Italy being the accounts of the Republic of Genoa, in 1340. Luca Pacioli was the first to document double-entry bookkeeping in a book Everything About Arithmetic, Geometry and Proportion, published in 1494.

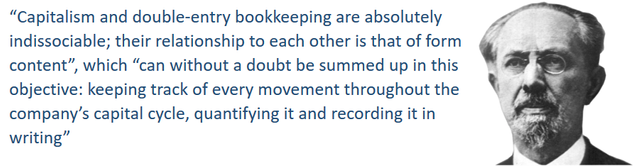

Werner Sombart (1863–1941) declared that the spread of double-entry-bookkeeping lead to development of capitalism, the term capital not having been previously categorized;

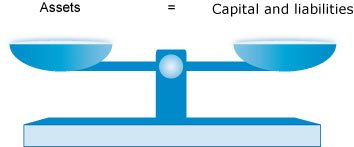

Double-entry bookkeeping is a simple form of algorithm that minimizes errors by balancing the book through a combination of debts and liabilities according to the equation;

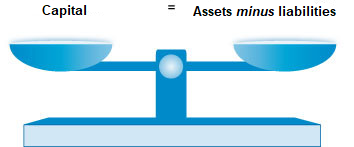

To measure the Capital within a business, we rearrange the algorithm accordingly;

Double-entry bookkeeping became ubiquitous, provided a standardized ledger for businesses and investors that accounted for assets, liabilities, capital, income and expenses year-end closing entries, still used today to record entries in both the Profit and Loss register and the Balance Sheet.

This, combined with private property, capital, large-scale commerce and credit, set the scene for huge advances in the expansion of business and trade that shifted capitalism towards a systematic and rational profit pursuit, leading to the creation of central bank ledgers, limited liability companies and the stock markets.

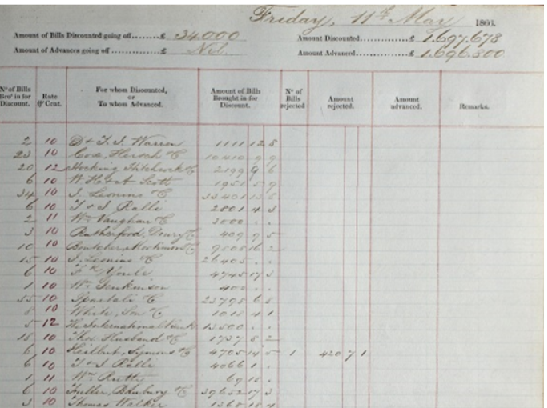

(Pictured, Bank of England ledger from 1866)

Demand for qualified and competent accountants surged in conjunction with increasingly complex global transactions and ever larger scales of manufacturing and logistics, prompting the establishment by Royal Charter of the Institute of Chartered Accountants in England and Wales, in 1880.

However, handwritten accounting ledgers are obviously not error free and are very time consuming, which had hampered the growth of business and trade since the industrial revolution, but the process gradually became digitized by computer spreadsheets and software and in 1978 the introduction of Visiclac saved businesses 20 hours of manual work a week, whilst ACT, Sage and QuickBooks took the process a step further by including new features, such as audit trails.

In 2009, Bitcoin offered up a new ledger technology, an open, P2P distributed ledger, allowing participants to verify, audit and record sophisticated and complex transactions inexpensively and in a permanent way, that does not have to be maintained by a centralized authority. This was followed by Ethereum smart contracts and dApps.

Banks and financial services are adopting distributed ledger technology in response to the threats/opportunities it offers, in order to reduce transaction times and costs, whilst increasing efficiencies. The distributed ledger will stimulate economic growth, innovation and jobs growth. The Bank of England estimates that DLT has the potential to increase GDP at a steady-level of 3%.

In short, the distributed ledger will be used in trade, commercial and investment banking, mortgages and derivatives, insurance, asset management, market infrastructure (FX exchanges, international payments, futures, options etc) IoT, healthcare, verification of identity, legal contracts etc.

https://www.thoughtco.com/proto-cuneiform-earliest-form-of-writing-171675

http://famous-mathematicians.org/luca-pacioli/

https://en.wikipedia.org/wiki/VisiCalc

https://en.wikipedia.org/wiki/QuickBooks

http://www.dadarivista.com/Singoli-articoli/Dada-Speciale-2015/13.pdf

I upvoted your post.

Keep steeming for a better tomorrow.

@Acknowledgement - God Bless

Posted using https://Steeming.com condenser site.

Thank you. Keep Steeming on and Steeming in.

Прикольно)

Спасибо

Congratulations @sandwichbill! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: