Digital Currency Past Present Future - Recent Developments

Below is a compilation of key developments in bitcoin and cryptocurrencies for this week. Key statistics are included at the bottom of this post as well.

IMF Chief Lagarde Tells Central Bankers: “Not Wise to Dismiss Virtual Currencies"

Christine Lagarde, head of the IMF, warns central bankers that bitcoin is rising. She has told them not to discount digital currencies, because they are gaining more adoption and traction. Lagarde addressed this issue in a conference Friday in London. She said digital currencies might give existing currencies “a run for their money.”

An ABC News article quoted her: “In many ways, virtual currencies might just give existing currencies and monetary policy a run for their money. The best response by central bankers is to continue running effective monetary policy, while being open to fresh ideas and new demands, as economies evolve. For the full story ”IMF Chief Lagarde Tells Central Bankers: “Not Wise to Dismiss Virtual Currencies"

Bitcoin Blow as Fund Drops ETF Plan

Grayscale Investments, dropped its exchange application for the first bitcoin ETF. This is a huge slap on bitcoin as many investors look at bitcoin ETF as a white knight that will catapult its price to 20,000 range. Grayscale if you may recall is the same company that lauched the first trust fund "GBTC" which is being traded in the OTC markets. See blog Is GBTC a Good Investment?. Click here for ETF Plan Dropped Video.

The Bitcoin ETF Holy Grail — Another Firm Attempts the Odds Against SEC

According to public records, another company has filed with the U.S. Securities Exchange Commission to create two bitcoin exchange-traded funds (ETF) based on Bitcoin derivatives. ETF firm Proshares Capital Management aims to get its bitcoin-futures products listed on the New York Stock Exchange (NYSE) with a proposed maximum aggregate offering price of $1M per ETF.

Proshares is an ETF management firm that launched in 2006 and offers over 140 alternative funds that cover a broad spectrum of investments. The company has products listed on the NYSE, Chicago Board of Options Exchange (CBOE), Nasdaq, and other mainstream trading platforms. Now the Maryland-based business is creating its “Proshares Trust II” a bitcoin ETF that derives its Net Asset Value (NAV) from derivatives rather than holding the currency in reserves. For the full story: U.S. Firm Proshares Files for Two Bitcoin ETFs

Japan’s Government Back Leap Into Digital Currency

As digital currencies continue to experience soaring interest worldwide, growing numbers of banks and central governments are strategically positioning themselves to capitalize on its advantages.

One recent example is in Japan, where Japanese banks announced plans to introduce a digital currency in time for the 2020 Tokyo Olympics. A consortium of banks, led by Mizuho Financial Group and Japan Post Bank, has garnered the blessings of the country’s central bank and financial regulator to launch J-Coin, an electronic currency used to purchase goods and transfer money using smartphones.

Transactions of J-Coin which can be converted to Japan’s fiat currency yen on a one-to-one basis will occur via a smartphone app with an accompanying QR code that can be scanned in stores.

J-Coin is seen by many of its advocates as a potential means of weaning the Japanese off their heavy reliance on cash, which currently accounts for 70 percent of all transactions. This is higher than any developed country, where on average cash usage rates are only 30 percent. Full story: Japan going Full Digital

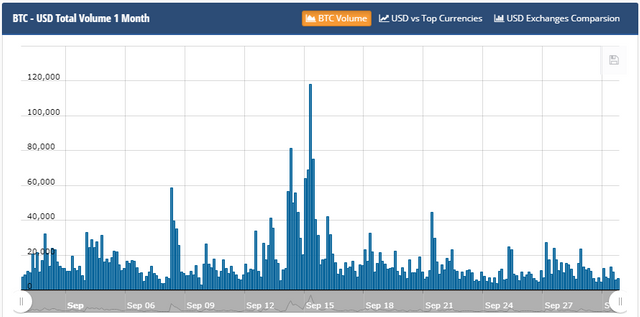

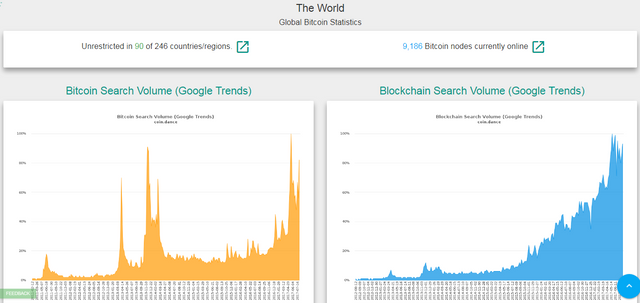

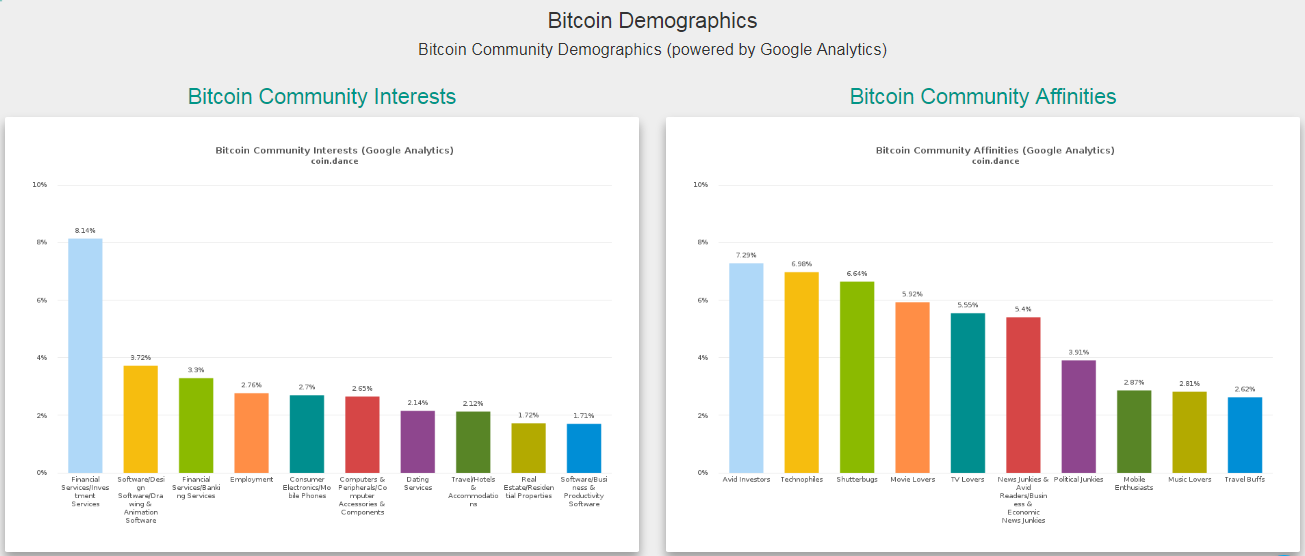

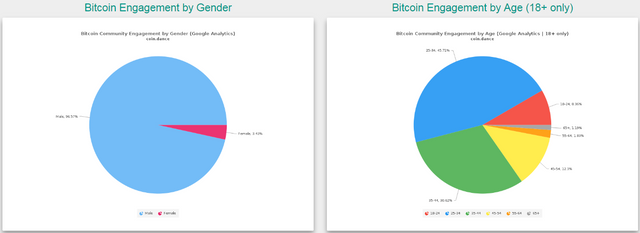

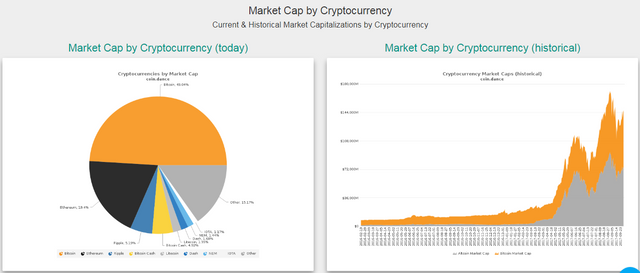

Meanwhile, here are key stats:

See Also Previous Posts:

Bitcoin is on the RUN. Next Stop $8,500

Bitcoin Mainstream Adoption - Lessons from the Past

Bitcoin's Adoption Stage

Authors get paid when people like you upvote their post. If you enjoyed what you read here, create your account today and start earning FREE STEEM!

This is fantastic.