Digital Currency Past Present Future - Bitcoin is on the RUN. Next Stop $8,500

"Juggernaut - a massive inexorable force, campaign, movement, or object that crushes whatever is in its path."

Huge stones have been hurled, walls erected, bridges destroyed but bitcoin just keeps coming. If you have a chance to read Satoshi Nakamoto's White Paper on bitcoin, its value proposition is eliminating the middlemen e.g. banks, thereby eliminating the associated costs.

Nakamoto's vision is slowly unfolding before our very eyes and China's ban of crypto exchanges is the latest victim. There is nothing more dramatic and convincing to prove that you're right than to bring down the 2nd largest economy in the world to its knees. Bitcoin's price being back to $4,000 and pushing upwards despite China's ban is a huge ego-boosting win for bitcoin and Nakamoto. What else can stand in bitcoin's path without getting annihilated?

The banks fear bitcoin so do the businessmen who stand in the middle. Lambasting bitcoin publicly is but a typical response especially when you realize that you're about to lose everything you've built your whole life (see previous blog Lessons from the Past - Car a road Hazard ).

What comes up must come down

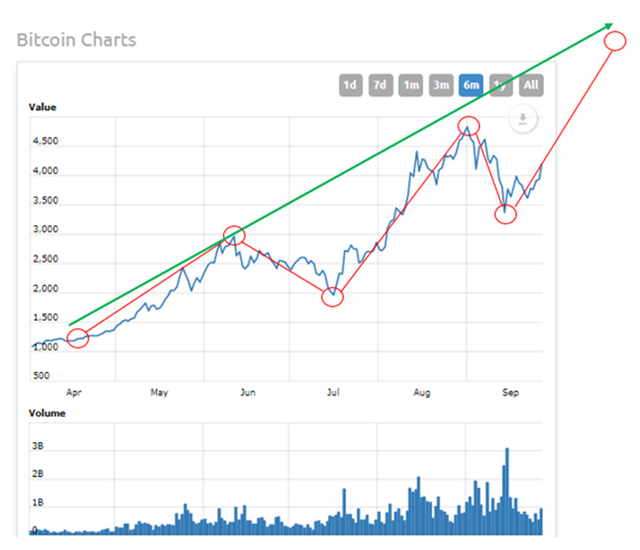

This week is bitcoin's third uptrend and its gunning for a new high of $8,500. Historically, bitcoin more than doubled its price from a dip. In July, it losts a third of its value to $2,000 (from a $3,00 high) and then rose to $5,000. In its mid-September drop, it losts a third of its value again to $3,500. Multiple this number by 2.5x and you'll get its next target price of $7,500 - 8,500 range before dipping again.

Every jump and drop in bitcoin's volatile history has been caused by a controversial event. Below are would be triggers.

Uptrend Biggest Triggers

Amazon and Bitcoin Partnership - rumors on the street this week is that Amazon will start accepting bitcoin as a form of payment. A very strategic move for Amazon and a milestone achievement for bitcoin.

SEC's Approval of first bitcoin ETF - this is the third attempt for the hedge fund to get this ETF approved. The number "3" is a lucky number and so luck seems to be on their side this time around.

China's Reversal on Crypto Exchanges - one of the crypto exchanges in China will be closing its doors end of September. The remaining 2 exchanges announced to stop operating end of October. A smart move since October is China's election and a change in leadership could bring forth a fresh new look at bitcoin's potentials.

Downtrend Biggest Triggers

Another charlatan like Jamie Simon calling Bitcoin a fraud and then Buy at the Dip - Mark Cuban and Jamie Simon are not the first nor the last to criticize bitcoin. There will be more but all will fail.

SEC's Rejection of first bitcoin ETF - Won't be surprised if the SEC rejects the ETF for the third time but it's just a matter of time for this ETF to be approved.

China's bitcoin mining ban - Not a far fetch move considering China is developing its own crypto-currency. See China's next Move - Ban Mining?.

Disclosure: I do not intend to provide investment advice through this article and does not represent that the securities or services discussed are suitable for any investor. Investors are advised not to rely on any information contained in the article in the process of making a fully informed investment decision.

HOPE YOU FIND THIS HELPFUL. PLEASE CONSIDER UPVOTING, RESTEEMING AND REPLYING BELOW.

Congratulations @sandalphon! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP