The Wolf in Sheep's Clothing - BTC compromised by banks while Chinese miners prepare to crash the markets

This is an overview of what has happened to Bitcoin in the last few years with some conspiratorial insight into what the near future might hold for this King of Coins.

Yesterday I had a long chat with a man I refer to as Angel of Crypto. He has dedicated his life to understanding this arena and focused his attention exclusively on Bitcoin recently. I cannot reveal his identity so you're just going to have to trust me when I tell you he is an extremely intelligent & intuitive human being and I feel it to be my duty now to share with you what he told me.

To cut a long story short, the future of Bitcoin looks bleak. Worst than that, it appears to be fast turning into a ponzi scheme controlled by the banking system and will ultimately be replaced... potentially sooner & not in the way you might imagine.

Old technology struggling to keep up

Many of you will understand this already but for the benefit of those who are learning about the scalability issue for the first time I will expand on this a little.

Blockchains are built using 'blocks' of information. A permanent record of all transactions facilitated by the miners whose computational power provides the calculations required to run the network. Bitcoin's blocks are just 1MB and this size can only allow for a few transactions per second. With the growing number of Bitcoin users the network is slowing down and transaction fees are rising. Transactions which should only be a few cents are now as high as $20. Please note that a transaction fee in this situation is not based on the amount of money you are sending but the amount of data you are using on the block.

Sidechains

Sidechains are extensions to existing blockchains designed to enhance their functionality.

The Lightning Network represents a potential sidechain. A soft fork of the Bitcoin blockchain was implemented to allow for segregated witness, a change which permits sidechains to be implemented more easily. This sidechain is presented to us as the solution to the scalability issue. Please note however that we appear to be a few years away from any kind of implementation.

Hardforks & softforks

I mentioned above that the Lightning Network is a softfork which means it is still connected to original the Bitcoin blockchain as a sidechain and 2nd layer.

A hardfork is the creation of a whole new blockchain whilst retaining the principles of the original coin.

Bitcoin Cash

In August Bitcoin Cash was born when the Bitcoin blockchain hardforked. The fork came about because two schools of thought created a divide in the Bitcoin camp. There were those who supported the Lightning Network and those who supported the creation of a new blockchain with the ability to increase the size of its blocks over time, permitting an increase in users without affecting transaction times or fees.

The wolf in sheep's clothing

Bitcoin was born in 2009 and has been putting banks under an increasing amount of pressure since then. With more money than the rest of us put together the answer was obvious. Find a way to 'own' Bitcoin. But do it in such a way that the mainstream population have no idea what has happened.

The Lightning Network is not decentralised

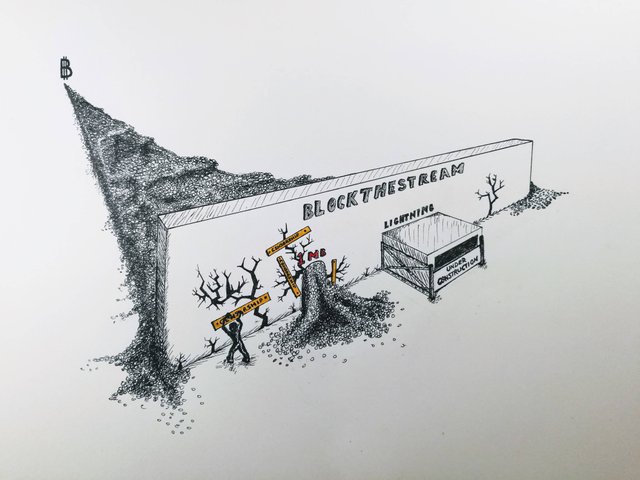

It has been slowly taken over by Blockstream, founded in 2014.

The too-big-to-fail insurance giant AXA is one of the main owners of Blockstream - and they're throwing around millions of dollars to any dev / troll / censor who opposes Satoshi's simple and safe roadmap for on-chain scaling

source

Henri de Castries, CEO of Blockstream's parent company is also chairman of the Bilderberg group. He has part ownership of American Express, Chase, Goldman Sachs, JP Morgan and other banks.

A conflict of interest perhaps? We all know the ultimate goal of the banks can be summed up in one word: CONTROL

And don't you think Blockstream is a curious choice of name given that what it is ultimately doing is blocking the stream of transactions?

The replacement of Bitcoin

The Lightning Network is in fact designed to become Bitcoin's replacement and will not work as the sidechain it is promised to be.

To put it in simple terms, your Bitcoins will be held by them while some kind of token which can only be exchanged on the Lightning Network will be issued in their place. Sound familiar? That's right. Just like the Federal Reserve Bank issuing little green pieces of paper.

However, with the rising price of transfer fees it will slowly become more and more expensive to withdraw your Bitcoin and with the growing realisation that Bitcoin is permanently flawed as a viable method of exchange for all, fewer and fewer people will be interested in accepting it, giving the lower quantity Bitcoin holders no choice but to return their coins to the Lightning Network where they will at least have some kind of perceived value.

It will become an investment for the rich only and not the fast, low transaction fee 'bank killing' system it was born to be.

Bitcoin Cash is the ORIGINAL Bitcoin

We have been led to believe that our Bitcoin holdings are in line with the original thinking of the group behind the creation of Bitcoin. But this is not the case. In fact, Bitcoin Cash is the currency which has stayed true to this system of thinking by building a new blockchain which permits the block size to increase naturally whilst remaining decentralised.

It is only a question of time before the world wakes up to this and Bitcoin Cash will eventually replace Bitcoin as the leading method of crypto exchange.

Media Manipulation

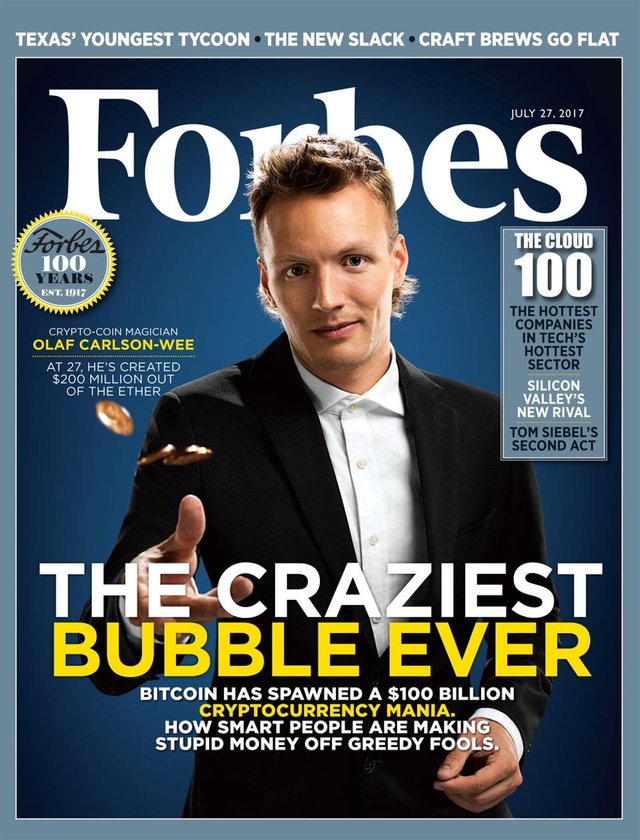

Have you noticed how the media have gone from telling us Bitcoin is for criminals to reporting on the massive amounts of money being made by respectable people?

The $10,000 price was widely anticipated early this year by the mainstream media and there are now many articles predicting the price to hit $1M by 2020.

This would explain why we are seeing an unprecedented rise in Bitcoin value at this time. It is currently sitting around the $11,000 mark.

But these first time crypto investors understand little of the story I am telling you and some might argue they are playing a very dangerous game right now.

The experienced traders amongst you will know this line does not represent a good investment. A bull market is not a bull market forever and Bitcoin is due for a massive adjustment.

Angel of Crypto believes this will be happening very soon but not for the expected reason.

Operation Dragonslayer

The Bitcoin network is run by miners and over 70% of them are Chinese. They have spent years investing huge sums to position themselves firmly at the top of this system, reaping the rewards of Bitcoin mining from massive warehouses full of computers buzzing away constantly, processing our transactions.

The problem for them is that due to the restricted block size there is a gradual increase in difficulty rate. Crudely put, as the difficulty rate increases their ability to make money decreases. And without the scaling solution fixed there is very little incentive for them to continue mining Bitcoin on such a huge scale. The original Bitcoin, now called Bitcoin Cash is what Angel of Crypto believes they have their sights set on as the alternative.

But in order to ensure the success of Bitcoin Cash against Bitcoin they have to play the game carefully. Don't forget Bitcoin is now propped up by the US banks and timing here is key.

Operation Dragonslayer is a said to be a plan by the Chinese miners to crash Bitcoin and milk the situation to the max, increasing their overall holdings and position of control.

How will this be done?

Various insider documents have been circulating on Twitter & Reddit suggesting that the Chinese group controlling Operation Dragonslayer now own 1 million Bitcoins. At the current price that's worth around $11 billion.

If this is true they are in a very good position to strategically sell huge sums, causing people to panic and creating a crash like never before which will affect the entire crypto market.

Where will they move their Bitcoin when they pull out of BTC?

If only I knew the answer to this question! There are those who do claim to know but are charging lots of money for the information. What Angel of Crypto believes is that once they are done pumping & dumping the coins of their choice, they are intending to bring down Tether.

For those of you who don't know, Tether is a cryptocurrency designed to be perfectly pegged to the dollar. Despite rumours of US gov involvement reaching all the way to the popular exchange Bitfinex, for the most part it has worked very well in its functionality. Traders use it as a place to hide in bear markets. It is easy to make money on a downward market by selling to Tether at the start of a crash and buying back in when it hits the floor.

If they are somehow able to crash Bitcoin, the alt coins and Tether simultaneously there will be nowhere to hide. The whole market will be crashing and unable to sell, Bitcoin holders will simply have to wait and see what happens.

What does experience tell us?

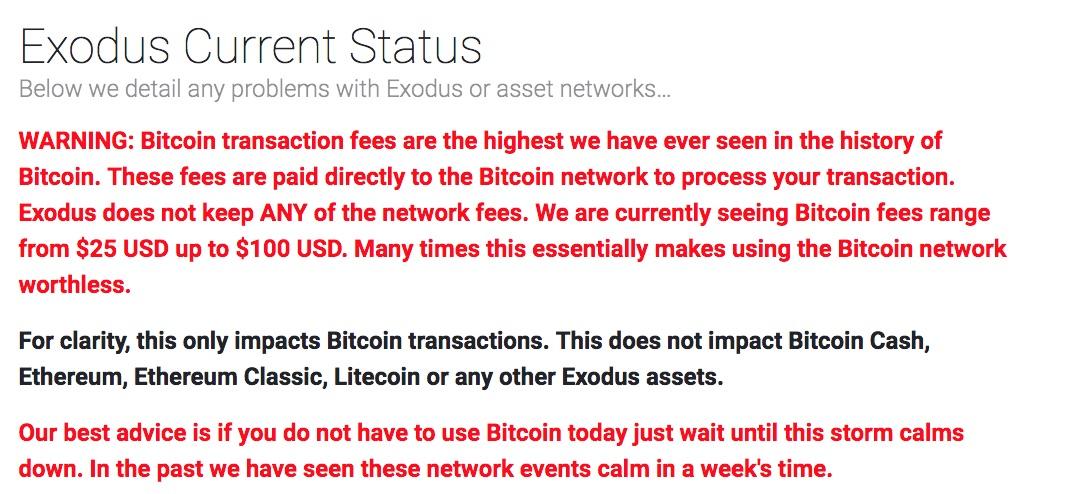

When the price of Bitcoin is dropping fast and everyone is trying to pull out at the same time, the price of your transaction will sky-rocket. If indeed you are able to make the transaction at all. Many have noted that in the main exchanges it is simply not possible to sell your Bitcoin when it is crashing.

Check out this Exodus wallet notification captured during the last mini-crash of Bitcoin

This time Bitcoin will be more than just dumped

The best time to crash Bitcoin, assuming you want to badly damage it's value and public perception, is just after the difficulty rate adjusts. The hash rate would not have time to recover before the next difficulty adjustment meaning that Bitcoin would most likely be rendered unusable for a prolonged period of time. Potentially months.

Naturally this would shatter public perception and when Bitcoin Cash grows from the ashes as the new fast mover, with all the familiarity of Bitcoin and scaling issues resolved, it will be accepted as the replacement, leaving the Chinese miners in a formidable position of power over this new & improved network.

When will this happen?

The next difficulty rate adjustment is currently set to be approximately 5 days from now. The estimated time of adjustment can be seen in a countdown clock underneath this chart.

Angel of Crypto did acknowledge that he believed Operation Dragonslayer to be set for the previous difficulty rate adjustment, but turned out to be wrong.

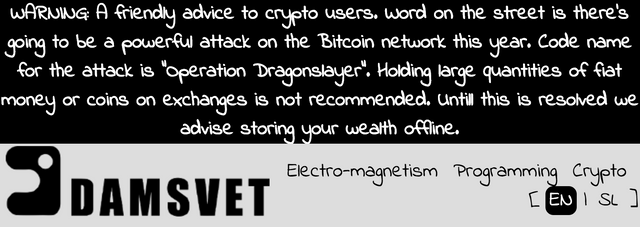

I scoured the internet this morning looking for anything which might validate his story and discovered many such confirmations amongst which was a Slovakian group whose warning on their website could not have been clearer.

Upon further research I found this site to be connected to a user on Steemit. You may be interested to read what is proposed to be a segment of his personal conversation with a Hong Kong Investment Banker, published here two days ago.

It relates specifically to Operation Dragonslayer but leaves certain words out as not to give too much away. Angel of Crypto was able to fill in some of these blanks (stated in this article) but what struck me as particularly odd was the 1,343 eyeballs on this post with only 4 votes. One of them being mine.

Those who have access to this kind of knowledge don't tend share it willingly with others. Not for free anyway! So, it would seem to me that this post was intentionally kept off the Steemit radar by those who read it.

In Conclusion

I am not a financial adviser, I've only been trading for six months and my personal knowledge of this subject is sketchy. So I'm not suggesting you listen to one word I have said. I cannot list too many sources in this article because it mostly came directly from the mouth of a man who prefers to remain anonymous. I felt instinctively drawn to repeat his words for my fellow Steemians here on the off-chance that he is right.

If he is, you have four days to prepare yourself for this event in order to make the most of it.

Personally I will not be holding any crypto at the moment the difficulty rate is adjusted. I will be holding it in my hands as paper money, ready to buy back into Bitcoin Cash at the moment I believe the floor has been reached.

Perhaps I will be laughing at my actions a few years from now? Though I prefer to focus on the other possibility. And I will be laughing for a different reason, from the deck of my luxury yacht.

Who is @samstonehill?

Currently based in Bali he travels with his partner & two children. With no bank account he has been living on STEEM & crypto for over six months.

All content created for this account is 100% original (unless otherwise stated), produced by @samstonehill who invites you to use & share freely as you wish.

@samstonehill is the creator of:

@steemshop account where you can buy or sell anything you like using your steemit wallet SEE MORE

@steemmasters which provides FREE TUTORIALS, personal training & resteeming services. Website HERE

Contact me directly on steemit.chat if you want to know more about this

@steemholidays which encourages resort owners to offer holiday packages in Steem or SBD

@steemtv which aims to provide the best in decentralised films, exclusive to Steemit & DTube

The dailyquotes tag initiative designed to encourage steemians to share their most life changing quotes with the community on a daily basis.

The Aspiring Steemit Whales & Dolphins group on Facebook which seeks to help newcomers make the transition from Facebook to Steemit, providing them with detailed notes and personal assistance with their posts... resteeming them when he can.

I receive the equivalent of $3 a day using Genesis Mining

This was after investing around $500 (from STEEM payouts) into 2 year contracts, mining Dash, Ether & Litecoin

Use my referral code to get a 3% discount: wzrAS4

Some say it is a scam but I have found no reason to believe this.

@teamsteem @timcliff @jesta @good-karma @someguy123 @blocktrades @pfunk @klye @krnel @blueorgy @ausbitbank @thecryptodrive @ura-soul @pharesim

Without them our beloved Steemship would not fly.

Learn what this means HERE and place your vote HERE

The Bali Volcano Crisis

If you have a moment please check out the @charitysteemit account where you will find up-to-date films, photos and information on the erupting volcano & evacuee status.

Mount Agung erupted a 2nd time with force on the 25th November, sending an ash cloud 1,500m into the sky and we will be watching it closely over the next few weeks.

This is what it currently looks like.

.jpg)

Those of us in Bali are working hard to raise money to buy the evacuees solar power & water filters LEARN MORE HERE and we deeply appreciate any help we can get.

Thank you for your support 🙏🏻

I've noted the activity of Freemasons and Knights of Malta (catholic masons) around Bitcoin for some time. The Core team is filled with Knights of Malta. These are fronts for the banking aristocracy of Europe/US.

On the other side we have the chinese Dragon Societies.

The World is a stage and the Bitcoin World is no exception.

Check one of my older comments to see how many of the events surrounding Bitcoin are staged (I will expose the conspiracy even further in an upcoming post):

https://steemit.com/conspiracy/@bitconspiracies/100-the-mt-gox-conspiracy#@lavater/re-bitconspiracies-100-the-mt-gox-conspiracy-20170821t172809642z

regarding the upcoming crash....

holding Tether during the crash will be just as bad as holding BTC as it will likely implode. There are clear signs that Tether's peg to USD may be just an illusion:

https://twitter.com/Bitfinexed

call me old fashioned but during the crash I will switch mostly to Gold .

Not so concerned about Steem as it hasn't even pumped yet and it has constant demand coming the site itself, and not from some dodgy fake dollar printing. It might fall to around 50 cent but can't see it falling much further than that.

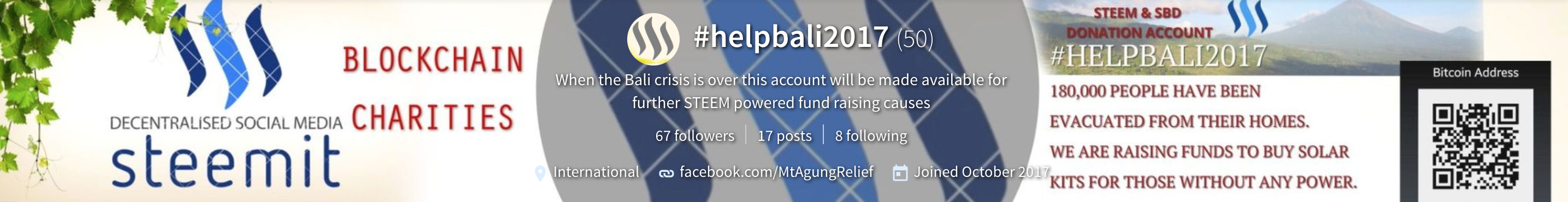

I'll keep holding some Steem, Monero, Ethereum, IOTA, BTS and EOS . Monero in particular I believe it is one of those coins which is not compromised and might be a safe haven from the IRS, though inevitably its price will be bleeding too during the crash.

See you all on the other side, hopefully sailing in the Sun in luxury Yachts lol .

Many thanks for your input here. Holding in Gold is for sure the best thing to do. If only I knew how to make that switch here in central Bali!

Steem had a good pump over the last few days. Always nice to see.

Fingers crossed for tonight... Let's see what happens...

102K Unconfirmed Transactions

Every once in a while I stumble upon some information that really hits home.

I've made very good returns on Bitcoin but I don't trust it an inch and have been thinking for a while it's a big con. So essentially I'm still heavily invested in something I'm pretty sure is a scam.

The tricky part is picking when to bail out - I've recently been gradually selling it and switching to Bitcoin Cash and Monero.

Riding Bitcoin on it's exponential climb is like standing on the edge of your volcano - but if we time this right it could be awesome.

Many thanks for explaining this stuff so I finally feel like I have a clue what the zionists are trying to do, and who it is who might defeat them.

This is getting exciting!

https://steemit.com/news/@corbettreport/bitcoin-usd10-000-what-does-it-mean

The crypto market dropped by 70bil in 24 hours (the majority of that drop being from btc) a few days ago and since then has more then recovered. Because of this I think if someone did dump $11bil worth of btc it might not have the outcome they expect since btc has already shruged off larger dumps then that without much damage at all. Also in my opinion btc will not be a vehicle of exchange in the long run and will be more seen as a long term store of value so its high fees and slower transaction times may not really matter much in the long run. I guess only time will tell.

It doesn't take $1 of Bitcoin to crash the market by $1… There's a multiplier effect when done strategically and automatic sell orders and trading bots will do a lot of the heavy lifting for you.

I agreed but again the crypto market cap dropped by $40bil in 10 mins a few days ago from that type of chain reaction, and overall it didn't do much damage at all. I agree that if they time a 11bil dump at the same time as a difficulty adjustment in a coordinated effort accross multiple major exchanges it can cause a lot of havoc, but it may not be as long term a drop as the dumpers might expect. There are a HUGE amount of $ waiting on the sidelines to buy into BTC if it did drop down to 2-5k, so I think they may/will have a hard time knocking BTC out of competition. I could be wrong but I tend to think beyond the US banning BTC outright, it prob isn't going anywhere, at least in the short/med term.

Really interesting to read this exchange. Thanks to you both! Have learned so much in the last few days...

to bring down a price in a liquid market it generally takes $10 to move $1 everyday is harder and harder to effect bitcoin like this expect any volatility to be skyward

All block chain technologies have scale-ability and fee problems. IOTA uses a new "tangle" data structure - not block chain. It is fee-less and has no scale-ability issues. The more users that use the IOTA network - the faster it runs. IOTA really is a brilliant solution. In my opinion IOTA could replace all block chain coins.

If only I had some wonga to invest. IOTA would be in my portfolio for sure.

I'm also interested in IOTA , it really sounds like the future of crypto

I stayed out of crypto until I joined steemit, because I have said all along I think it is the banksters playing us. They could NEVER have coaxed all the rebellious types into digital currency, so they pretended it was a rebellious thing to do... Hope I am wrong!

We're all in the same boat. Prepare for the worst, but hope for the best!

This very thought has nagged at me also. It's no secret the powers that be want a one world government and a one world cashless, trackable currency.

The best way to avoid "a one world government and a one world cashless, trackable currency" is to avoid having all your crypto in "one network"... I'll probably get bashed for saying this, but - in my opinion - there are better crypto networks than Bitcoin out there. Better technology, better privacy features and faster speeds. Here is a link to my current crypto portfolio:

https://steemit.com/crypto/@nateinsav/6uuagb-current-crypto-portfolio

Hope it gives others some alternative ideas. Please do your own due diligence. This is NOT investment advice.

thanks for the wonderful insight. I am quite new to all this but am slowly picking up. Have a great day, stay blessed.

Great article and love what you're doing!

Great avatar! Appreciate the comment. Only time will tell what happens to Bitcoin Cash...

This is an incredible article... it's definitely the best laid out and formatted article I've seen on this platform.

I actually turned all my money into tether during the last difficulty adjustment just in case, which didn't work out... but ultimately didn't really cost me anything either.

I've been really curious about the rise of Bitcoin, and have 30% of my portfolio in the coin, but have been disappointed to learn about the huge environmental impact, it's slowness and it's fees.

I've been keeping a close eye on Bitcoin Cash but it hasn't really done anything interesting in the last week or so.

So, I guess I'll ask the question that I'm sure everyone will ask... if Operation Dragonslayer were to happen this time, how do you think it would effect Ethereum and Litecoin?

It depends if they select them as they coins they want to pump, but it seems to me that the whole market will crash if 11 billion is strategically withdrawn. Like I said, I am no expert... will pose this question to Angel of Crypto tomorrow ;)

True... it could be the pebble that starts the avalanche. The total market cap is over $330B now... so it wouldn't devastate it by itself... but it only takes a small action to create fear.

I've followed you now after this incredible article... if you could ask your anonymous friend for us we'd all be very appreciative.

Thanks for the follow... still waiting on my man to drift out of the jungle back into cyber world. He comes here to take time off from all this madness so don't like to push him too much!

That's completely fair... you can't rush these things (even if billions of dollars might be on the line.

If you hear anything back, I might not make any drastic changes to my portfolio, but I might put in some stop loss orders for a couple of days. I've been bitten once before with those (lost about 10% from prices see-sawing around) so I'll only put them in for emergencies.

A double sided attack where they sell the 11 billion first and THEN reduce the Chinese controlled bitcoin mining hash rate would be very concerning. Imagine the cascade effects. The 11 billion sale would cause the market to drop and then if the hashrate was reduced after their sales cleared - the bitcoin market would drop and people looking to get out of bitcoin would be trapped because block times could potential increase to very long times. This would be like trying to clear a stadium with 1/2 of the doors locked during a fire. The results would not be pretty. This is exactly why I think IOTA has it right.

My opinion - the IOTA crypto architecture can and will prevent "attacks" such as the one mentioned here. IOTA is fee less - proof of work is done by each user in a distributed computing model. IOTA is inherently scale-able - the more users making transactions, the higher the network throughput. This is due to the fact that for every transaction a users posts they have to do proof of work on two transactions. This makes IOTA's network transaction rate exponentially scale-able. This also makes it improbable that any single entity or group could control network hash throughput.

There have always been and always will be groups of people looking to manipulate others. Bitcoin is ripe for this sort of manipulation (due to popularity, high price and old technology). Thanks for sounding the alarm so that everyone is not caught off guard to this possibility.

Yup, my first thought was Ethereum and Litecoin, and Monero :) Thanks Sammo, I'll stay tuned!!

Amazing journalism Sam!

Of course elitists want to control BTC, they want to control bloody everything these days!

I have taken your finacial advice, hope we are right 😱