BlackRock's Take on Bitcoin: A $2 Trillion Asset with a Magnificent 7 Vibe

In the wild, wild west of financial markets, where the digital cowboys ride in on their blockchain steeds, BlackRock has just tipped its hat to Bitcoin. According to the behemoth of asset management, Bitcoin, now strutting with a cool $2 trillion market cap, has a risk profile that's not so different from the tech titans known as the "Magnificent 7" - Apple, Amazon, Tesla, Nvidia, Meta, Google, and Microsoft. But wait, there's more - BlackRock suggests a modest 2% allocation to Bitcoin could be, wait for it, "reasonable".

The Magnificent 7 vs. The Digital Cowboy

The Magnificent 7:

- Apple - The shiny fruit of tech innovation

- Amazon - The everything store turned tech powerhouse.

- Tesla - Where electric dreams meet reality.

- Nvidia - The graphics card whisperer.

- Meta - The social network that thinks it's a metaverse.

- Google - The librarian of the internet.

- Microsoft - The old guard with new tricks.

These companies have been the darlings of the stock market, often seen as somewhat safer bets due to their established presence and market dominance. Yet, BlackRock sees Bitcoin, the digital upstart, not as a wild card from the saloon but as a potential partner in the investment corral.

Bitcoin: The New Ranch Hand?

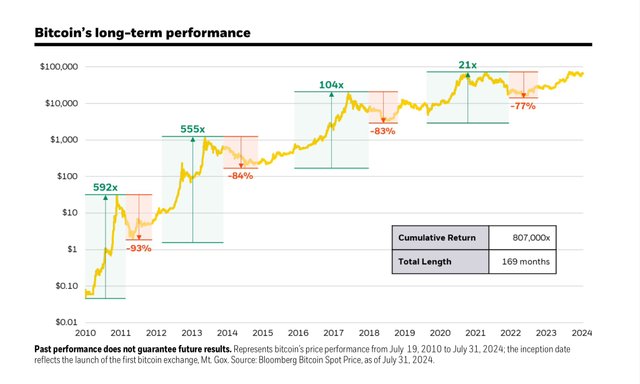

- Market Cap: Now at $2 trillion, Bitcoin's not just knocking on the door; it's sitting at the table with the big players.

- Risk Profile: According to BlackRock, Bitcoin's volatility might be taming down to play nice with the likes of tech's top dogs.

- Adoption: With institutions like BlackRock giving nods, Bitcoin's moving from the fringes to the financial mainstream.

Why BlackRock Suggests a 2% Allocation

BlackRock's recommendation of a 2% allocation to Bitcoin isn't just a whimsical suggestion from a company known for managing trillions. Here's the gist:

- Diversification: Adding Bitcoin to a portfolio could diversify risk, much like adding a new species to the ecosystem might balance out a food chain.

- Potential for Growth: Bitcoin's fixed supply contrasts sharply with the potentially unlimited stock issuance of companies, offering a unique value proposition.

- Hedge Against Inflation: In an era where money printers go brrr, Bitcoin's capped supply is seen as a digital gold.

The Caveats and Cautions

Of course, it's not all about riding into the sunset with sacks of Bitcoin. Here are some cautionary tales:

- Volatility: Bitcoin's price can still swing like a pendulum in a storm.

- Regulatory Uncertainty: Governments worldwide are still figuring out how to deal with this digital maverick.

- Technological Risks: Blockchain is innovative but not immune to hacks or significant network issues.

Conclusion

BlackRock's acknowledgment of Bitcoin as a viable asset class with a risk profile akin to the Magnificent 7 is a significant endorsement. It's like the old, wise sheriff of Wall Street giving a nod to the new gunslinger in town. A 2% allocation might seem small, but in the vast universe of investments, it could be the difference between a portfolio that's just surviving and one that's thriving in the digital age.

So, if you're thinking about hitching your wagon to Bitcoin's star, remember - the future's not set, but with BlackRock's blessing, perhaps it's time to saddle up for the crypto ride.

Note: Always do your own due diligence because, at the end of the day, investing in Bitcoin might feel like betting on which tumbleweed will roll past your window first.

References: