Bitcoin / Blockchain Regulations News Roundup

Several bearish scenarios on Bitcoin (crypto market) for the couple of weeks past brought the prices of cryptocurrencies down, sending investors scrambling to confirm whether circulating news of Bitcoin regulations are true. Here are some latest news on regulations from around the world:

China:

China's ban on initial coin offerings (ICO) is a necessary move to stop illegal fundraising and pyramid schemes but should not stop firms from studying blockchain technology, a senior central bank official told the Financial News newspaper on Tuesday.

Sun Guofeng, director general of the People's Bank of China's research institute, said in an interview with the newspaper that the central bank's move to ban the practice of creating and selling digital currencies or tokens to finance start-up projects on Sept. 4 was "necessary and timely".

"But this should not prevent relevant financial technology companies, industry bodies and other technology firms from continuing their research into blockchain technology," he said.

"Blockchain itself is a good technology, and an ICO is not the only way through which one can carry out research into it."

While there was already a sound regulatory framework for banks, it was relatively weak for technology firms which were now handling large streams of money flows, creating the risk of "regulatory arbitrage", Sun said.

For example, companies were potentially violating privacy protections by using data from online retailers and social networks to analyse consumers' personal credit conditions without their knowledge.

"In general, financial technology still holds strong risk characteristics and we must strengthen supervision," he said.

Regulators now planned to continue undertaking independent research into the financial technology system, and would seek third-party research and also assess companies' own research in order to formulate a framework

But the technology industry would be expected to foot part of the costs for creating such a framework, he added without providing details.

United Kingdom:

The United Kingdom’s Financial Conduct Authority (FCA) has issued an official statement seeking to further clarify its position with regards to ICOs.

image source: CoinIdol

The FCA has again emphasized the investor risks associated with ICOs, and warned that the authority seeks to curb ICOs providing services under the regulatory jurisdiction of existing authorities. “Many ICOs will fall outside the regulated space. However, depending on how they are structured, some ICOs may involve regulated investments and firms involved in an ICO may be conducting regulated activities. Some ICOs feature parallels with Initial Public Offerings (IPOs), private placement of securities, crowdfunding or even collective investment schemes. Some tokens may also constitute transferable securities and therefore may fall within the prospectus regime. Businesses involved in an ICO should carefully consider if their activities could mean they are arranging, dealing or advising on regulated financial investments. Each promoter needs to consider whether their activities amount to regulated activities under the relevant law. In addition, digital currency exchanges that facilitate the exchange of certain tokens should consider if they need to be authorised by the FCA to be able to deliver their services.”

Finland:

The Finnish Central Bank Has Praised Bitcoin’s Decentralized Governance Model

A new research paper released by Bank of Finland has lauded the self-governing capacity of the bitcoin ecosystem. The paper states that “bitcoin cannot be regulated. There is no need to regulate it because as a system it is committed to the protocol as is and the transaction fees it charges the users are determined by the users independently of the miners’ efforts.” The paper analyzes the fundamental underpinnings to bitcoin, and explore an array of potential use-cases for the technology. The researchers conclude that “bitcoin’s design as an economic system is revolutionary… Its apparent functionality and usefulness should further encourage economists to study this marvelous structure.”

The current regulatory climate regarding cryptocurrencies has significantly evolved in recent weeks. There appears to be a growing consensus among developing nations that ICOs distributing unlicensed securities should be subject to existing financial regulations and fall under the legal jurisdiction of existing financial authorities. The regulatory focus on the distribution of unlicensed financial instruments through ICOs has in instances latently implied the legitimacy of bitcoin, and in some cases initial coin offerings issuing so-called ‘utility tokens’ – signifying growing nuance in the regulatory sentiment among many western governments. Despite such, China’s recently initiated ICO crackdown may provide an example for other governments seeking to prohibit all initial coin offerings to draw upon.

Sources:

Bitcoin.com

CNBC.com

bit-finance.com

CoinIdol

btcnews.jp

The Verge

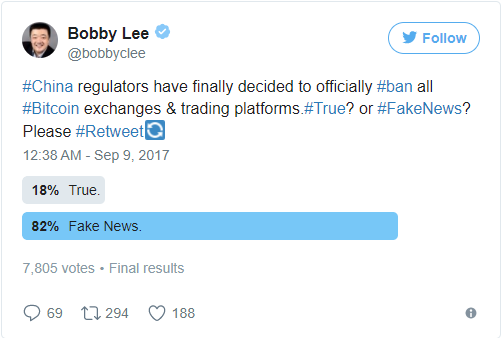

Is China banning domestic Bitcoin exchanges?

Congratulations @roido-san! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @roido-san! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP