Bitcoin Volatility and Speculation

Volatility as a bug

Due to its relatively small market capitalization and immature infrastructure, price discovery in the Bitcoin network is inefficient and volatile. From an end-user perspective, volatility is an impediment to use. Although it is possible for merchants who accept bitcoin to use a third-party payment processor (such as BitPay or Coinbase) in order to convert their bitcoin into a local currency, this is an imperfect solution. It seems likely that the bearish price performance of bitcoin in 2014 can be at least partially attributed to selling pressure from merchants. It would be much better for the ecosystem if merchants began to use bitcoin as a unit of account and a store of value. This behavior would be price-supportive and would go a long way in furthering the monetization of bitcoin. However, for bitcoin to become a unit of account it must exhibit price stability. We cannot blame businesses for converting to fiat currency when the price of bitcoin regularly varies by more than 1% per day. So, at first glance this might appear to be a chicken-and-egg problem.

Volatility as a feature

This is where currency traders (i.e. speculators) enter the equation. Price volatility is a problem for most people when they think about bitcoin but to those interested in trading, it is a beacon. This volatility presents a tremendous opportunity for profit. As with any significant market need, the return on investment is commensurate to the degree to which a market participant meets a specific market demand. Bitcoin needs more trading volume and the reward for providing this liquidity is substantial for those who know how to navigate volatile markets. Trading will tame bitcoin volatility by acting as the catalyst of a virtuous circle: increased trading volume means lower bid/ask spreads and increasing price stability, which leads to further adoption, which means a larger Bitcoin market cap, which brings more traders into the market. Rinse and repeat.

The linear trend line

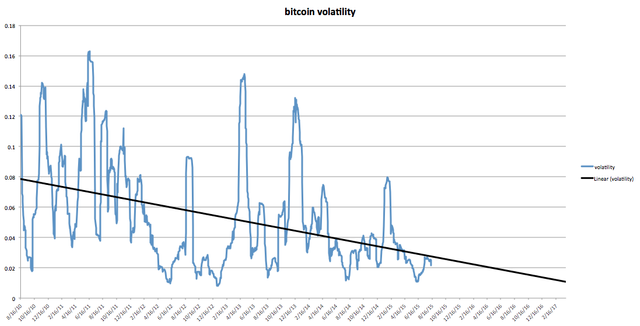

This virtuous circle of monetization has already begun. According to data gathered from btcvol.info, price volatility is decreasing over time. Drawing a linear trend line, we can extrapolate the volatility into the next few years as shown in the chart below:

Price volatility has lessened considerably as the Bitcoin network has grown and this trend will continue as the market capitalization of the network expands. Based on the current volatility trend, it is likely that we will see volatility halved in the next two years. If this trend continues, by 2017–2018 bitcoin volatility should be on par with volatility seen in the gold market at about 1–1.5%. Of course, if the network expands more quickly, following an exponential curve, these numbers could look very different. In the meantime, there is an opportunity to add value to the network and to increase price stability by trading bitcoin.

Profiting from volatility

For the reasons mentioned above, to many people, price volatility is a “bug” in the current Bitcoin ecosystem but for those interested in trading, volatility is an attractive feature. In effect, the market is offering traders the chance to help “regulate” the bitcoin price and to receive some bitcoin in return for offering this liquidity. However, this is not as easy as it seems. In order to trade effectively, one must buy when the market is “oversold” and sell when the market is “overbought.” Most new traders struggle because smart trading is often counter to instinct. To trade profitably it is essential to have an effective trading plan that is scrupulously followed. This requires expertise, discipline, and time. This is where my company, COINCUBE, presents real value. By taking a tested trading plan and putting it into code, COINCUBE offers users an expert trading strategy that is automated. This means users can stop with obsessive bitcoin price checking and get back to more productive things. COINCUBE’s ‘WAVE’ trading algorithm buys during price corrections and sells during price spikes, helping to regulate the bitcoin price and earning our users a profit at the same time.

Written by: Robert William Allen, Founder & CEO of COINCUBE

Kudos!

Excellent write!