Are We in an ICO Bubble?

Initial Coin Offerings (ICOs) are a way for companies to raise funds by exchanging investors' contributions into digital currencies or tokens. This year, start-ups have raised a whopping $2.4 billion from ICOs outpacing Venture Capital.

There are so many ICOs coming out right now there is no way to keep tract of all of them. The model of direct investment is clearly the future, but there are many coins that have no true business model, are just an idea, and will never bring in any revenue. There will be many losers and many of these ICOs will soon be worthless.

You are already seeing money fleeing altcoins and moving into Bitcoin (BTC). I believe this trend will continue and you will want to be in solid coins that will stand the test of time.

It was the year 2000 and the NASDAQ had grown from $1,000 in 1995 to more than $5,000 in less than 5 years. Companies were IPOing on a daily basis and fetching huge valuations, with some offerings doubling on their first day. Anyone with an idea could IPO and bring in big money.

Sound familiar?

By May of that year, the NASDAQ lost over a Trillion dollars in value. Companies started folding including the infamous Pets.com, however the dotcom bust brought us companies like Amazon and eBay. There will be a handful of winners such as these in the crypto revolution and you will want to position yourself accordingly.

Anyone can make a token, so you will want to own coins with solid use cases, development teams, and most importantly network effects. Look at many of the largest tech companies today, they have network effects making it virtually impossible to compete. No one wants to be on a network, app, or site by themselves. Users go where other users are and can interact with the best content. Take YouTube for example, they virtually control the entire online video market.

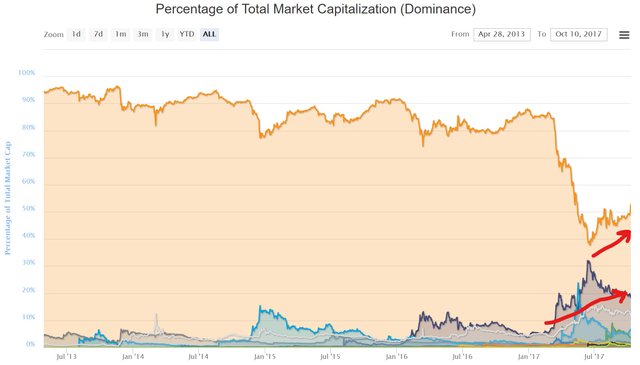

Bitcoin enjoyed 80-90% market share for quite sometime, however with the altcoin boom as well as network congestion due to its success, it hit an all time low of 37.8% in June of 2017. Since that time it has rallied and recaptured over half of the entire market at 52.5%. There is no need to have so many "currency" tokens. If bitcoin can scale which it will and keep up with the changes in technology, it will continue to command most of the market due to its first mover advantage, development teams, and network effects.

With all these ICOs, the top 2 coins of Bitcoin and Ethereum still control over 71.2% or nearly 3/4 of the market!

I predict bitcoin and a handful of the other top coins will continue to dominate the market in the years to come. I believe many of these ICOs are overvalued and will continue to decline. I think the ICO market is in a "bubble" and will "pop" with coming regulation, revelation of fraud in some coins, and when investors realize many of these coins are worth little to nothing. I think this happens in the next 6-12 months, but only time will tell. Don't get stuck with the next Pets.com.

My strategy of picking top coins has paid off, we highlighted a handful of coins in a post just 2 months ago and since then have seen returns of 43.6% in Bitcoin (BTC), 53.9% in NEO (NEO), 64.4% in PIVX (PIVX), and a whopping 72.9% in Monero (XMR). I still like all of these coins.

Bitcoin (BTC) price at time of writing $4,805.

Disclaimer: You should perform your own research and make your own investment decisions, this is not investment advice. I own or may plan to own cryptocurrencies mentioned above.