Why Bitcoin’s $10,000 Price Doesn’t Reflect Its True Value

These are some of the financial news headlines from the last few days:

Bitcoin finally hits $10,000! — The Economist, Nov. 28th, 2017

Bitcoin surpasses the $10,000 milestone! — CNBC, Nov. 28th, 2017

BITCOIN SOARS ABOVE $11,000! — The Guardian, Nov. 29th, 2017

News outlets haven’t even had 24 hours to let the “10K” news simmer and it already went up to $11,500. By the time they published the “11K” piece, it already dropped to $9,000. As soon as they entered the last word on their “Bitcoin is crashing!” article, it’s back at $11,000 per BTC.

This is not unprecedented.

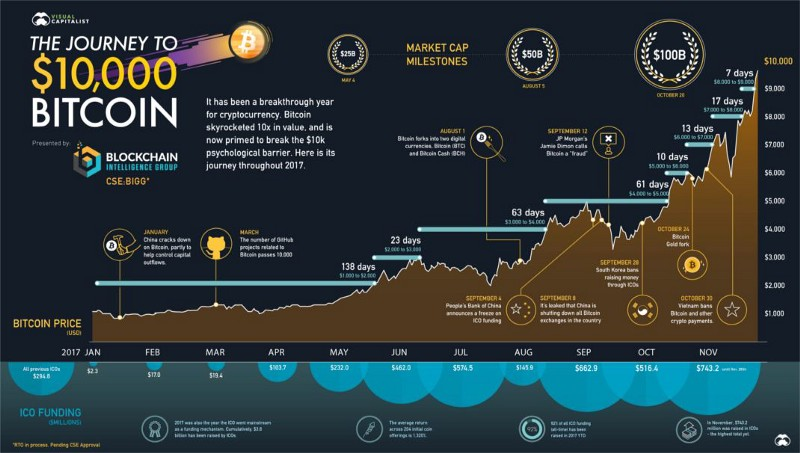

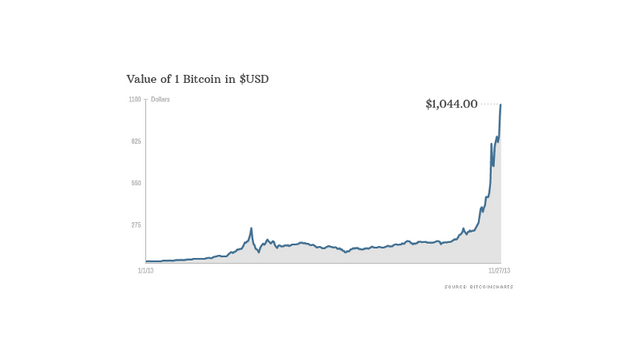

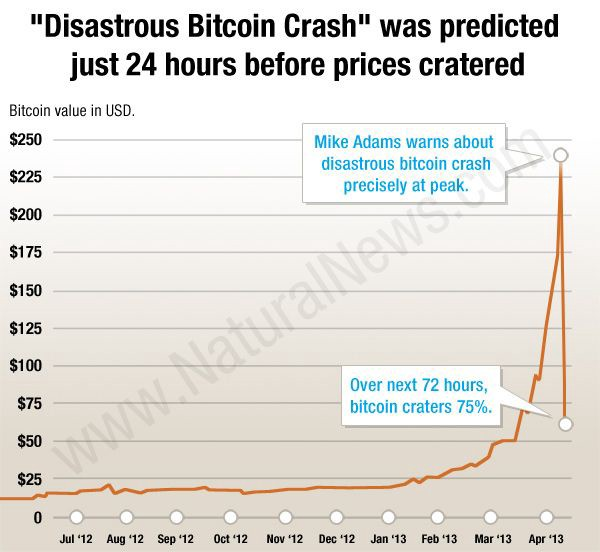

We’ve seen this before, back in 2013. A media frenzy when Bitcoin was approaching $1,000 that fueled that year’s bubble. In January of that year, one bitcoin was trading at around $15.00, hit $266 by April, crashed back to $50. By November, it had already broken $1,200, peaking at $1,242 on Mt.Gox. That’s an almost 100-fold increase. That’s an order of magnitude larger than this year’s (2017) 10-fold run up.

The charts are almost identical and news articles look exactly the same. Just add one zero.

Image from CNN Money

The media gobbles this up because people are fascinated by this stuff. Stories of people finding 5000 BTC in an old hard drive that they bought for $25 in 2009, a man throwing away 7500 BTC by accident and scouring a landfill to try and find it, a man buying pizzas for 10,000 BTC — It’s the sizzle to the steak and it sells.

The Other Side

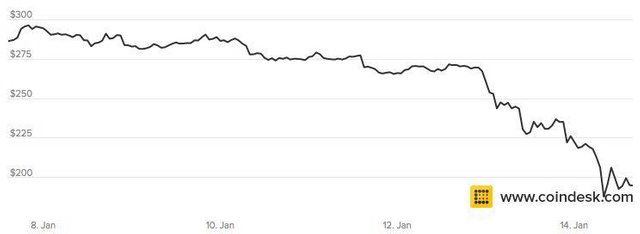

People love it when things go up, but what goes up must come down, and Bitcoin is not immune to this. History shows three major “Bitcoin Bubbles”, and a LOT of volatility in between. Swings of 20–30% in one day are not uncommon in the Bitcoin world, but to most people this can be quite terrifying. For example, in the same day when Bitcoin broke $11,500 a couple of days ago, Bitcoin crashed back to $9,600, and lost 20% of its value overnight.

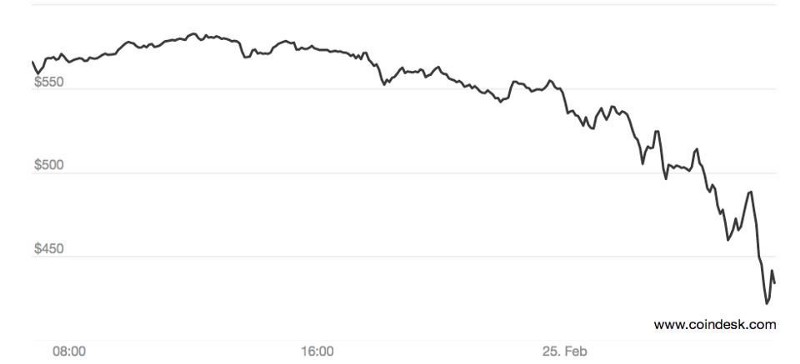

It isn’t just that, there are more. There’s that time it crashed from $260 to $50.

Then there was that time it crashed from $330 to $180.

Or that time it crashed from $600 to $250.

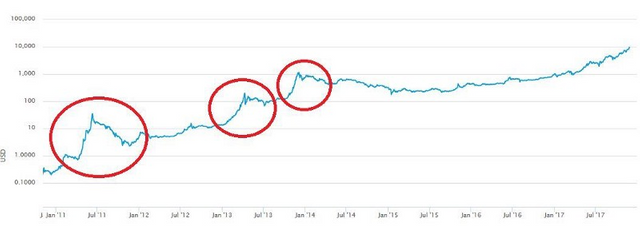

So Bitcoin doesn’t just keep going up, what a surprise. If you look at short term linear charts, yes, there are major downswings at any given point in time. It does not always go up for 12 months straight. Yet if you look at the logarithmic chart below:

Log charts are better than linear charts in measuring performance over long periods of time. A jump from 1 to 30 will look tiny compared to a jump from 100 to 200 in a linear chart, even though it is a 3000% increase versus a 100% increase. A log chart fixes this problem.

We can see on this all-time price chart that since Bitcoin was invented, it has been on a steady upward climb, with some major swings in between. You’ll notice that in the early days, the swings were actually bigger and more volatile.

Three times in the history of Bitcoin, the price went parabolic, meaning it went almost straight upwards on the chart. An almost vertical climb on a log chart is hard to achieve unless the price goes up very very fast. This was the case in 2011 and twice in 2013. In both years, Bitcoin increased by at least 100-fold. As you can see, in this 2017 climb from $1,000 to $11,000, we haven’t formed a parabolic uptrend just yet. It will need to track upward towards $100K really fast for that to happen. We are not there yet and in fact, we have a long way to go.

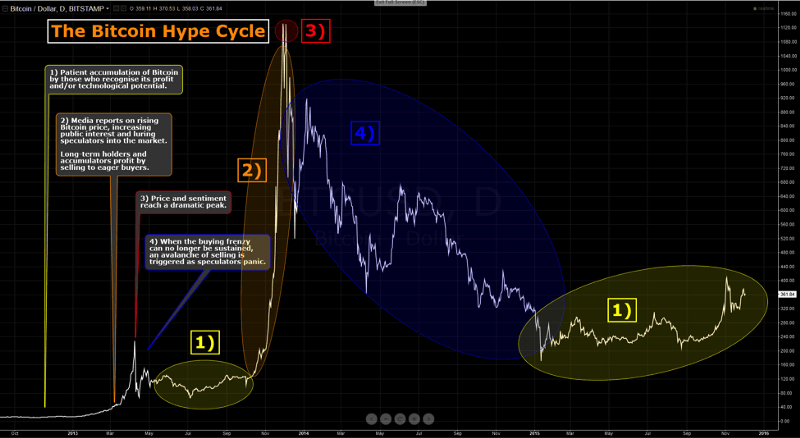

The Bitcoin Hype-Cycle

The peculiar thing about Bitcoin’s price is that it has these cycles. First, a slow and steady accumulation by people who understand the tech and buy it when it is ignored as worthless. This is usually after the price had just “crashed”. Then it starts to reach a point where the media picks up its growth. And then, a parabolic buying frenzy where even your grandma starts buying Bitcoins. Finally, after reaching a dramatic peak, it finally pops and drops, leaving only those who believe in the tech and support it even after a crash. Back to square one,with a bigger base price and a larger user base. Rinse, repeat.

The Obsession with the Price While Overlooking the Value

Price is not equal to value. Water is cheap, but it is pretty valuable. If water suddenly became scarce, its market price would skyrocket. In the same way, the value of Bitcoin has nothing to do with its exchange rate.

When Bitcoin was worth exactly zero dollars, it already essentially solved the previously unsolvable 30-year old computer science problem called the Byzantine General’s problem — how to reach agreement with other agents over an untrusted network of communication. That value proposition was there from day zero, even if the price of one Bitcoin was zero.

“A lot of people automatically dismiss e-currency as a lost cause because of all the companies that failed since the 1990s. I hope it’s obvious it was only the centrally controlled nature of those systems that doomed them. I think this is the first time we’re trying a decentralized, non-trust-based system.” Satoshi Nakamoto, 2009

Because of Bitcoin, we don’t need middlemen to transact — hell, we eliminated the need for trust. We can transfer value over the internet without asking permission from a gatekeeper. The internet did this for the transfer of information, whereas before, we had to go to the post office to send mail, through a telephone operator to call someone overseas, or a publisher to let the world read about our stories and ideas. Bitcoin is doing this today, letting us transfer value from one owner to another without permission, globally, and instantly.

Just like how the value of your paper money is not in the paper itself but in the government or authority that issues this paper, the value of Bitcoin is not in the tokens used to exchange with each other, but in the network that allows this exchange to happen.

The price of Bitcoin is the least interesting thing about it. The value of Bitcoin is in its ability to do what it set out to do, and do it best. When you truly understand the technology, you’ll realize it’s true value.

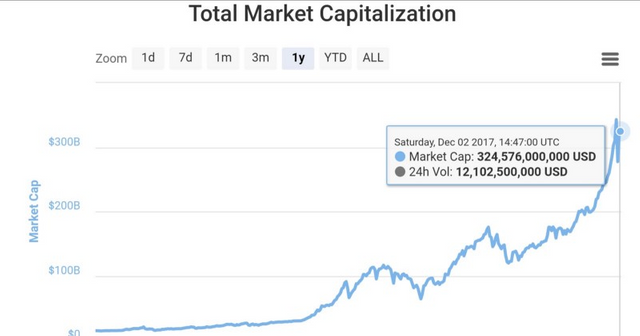

The Crypto-Renaissance, A Financial Revolution

Over one third of a trillion dollars. That’s the total amount of cryptocurrencies in the world. $165 Billion belongs to Bitcoin alone, which just shows how dominant network effects can be. Because of Bitcoin technology, the power to create and exchange money was granted to every person on earth and is no longer the monopoly of kings and oligarchs. The printing press did the exact same thing for the power to create and exchange information, which started the renaissance and led to the industrial revolution. It’s a return to the original spirit of why money was invented in the first place.

There is immense wealth being created right before our very eyes, but it is happening so fast that most people are ignoring it. I remember when I was a young boy, I loved reading the Guinness book of world records, and one of the most fascinating things for me there was the list of richest people in the world. In the late 80s to early 90s, it was consistently the Sultan of Brunei, with his golden throne, 200 Ferraris, and a gold plated Rolls Royce that made the top of the list.

Then in the late 90s to early 2000s, it suddenly became Bill Gates and a bunch of other geeks that made it to the top. Where the hell did they come from? How can a bunch of geeks writing software, wearing sneakers, and working from their garages become wealthier than a Sultan with solid gold chairs? Why did this happen?

Because there is much more value in a global network allowing people to store, exchange, and transfer information than in yellow shiny rocks and fossil fuels from under the ground.

The exact same thing is happening today in the cryptocurrency world. Suddenly, geeks who toiled over establishing the Bitcoin network voluntarily and thanklessly for years and years are being paid back by the very software they helped build. Traders who believed in projects and invested the small amount of money they had left along with time and effort in building these projects are seeing 1000% up to 30,000% increases in the value of their net worth in cryptocurrencies. Pioneers are paving the way for a new generation of financial applications that will usher billions of new users to the internet economy. There are some among them who are already approaching Billionaire status, and many more will follow.

Wealth creation is not a bad thing, and the concentration of this wealth is also not necessarily a bad thing. How the wealth was acquired is what is important — honest wealth. Bitcoin is honest money. No coercion, no unfair advantage, no abuse of power, and no abuse of labor was needed to establish the newfound wealth of the original Bitcoin and cryptocurrency trailblazers. This is why trust fund babies who have been “trading for decades” shit on Bitcoin — they cant accept the fact that a geek who took an early risk on an unknown technology is now much wealthier than them, in the same way I can imagine a guy sitting on a solid gold throne must have scoffed at the idea of a geek in a garage being richer than him.

Bitcoin and cryptocurrencies will make a lot of people financially independent, and that’s a great thing. Millions of people who never had access to capital will be able to pursue their goals and build things that could ultimately help humanity as a whole.

A Bitcoin Core developer was asked (and I paraphrase) “If you work voluntarily to help the Bitcoin network, who pays you? Why do you do it?” His response was “Bitcoin pays me, so I pay it back to Bitcoin with my time and effort.”

The Separation of Cash and State

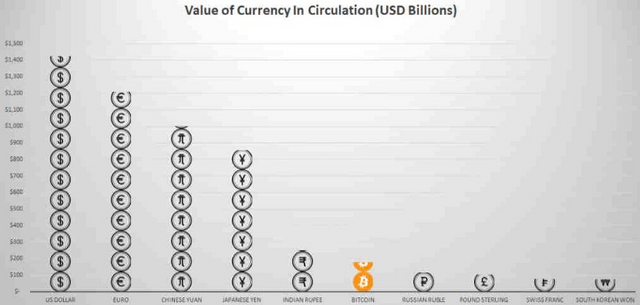

Bitcoin is now the 6th most valuable circulating currency in the whole world, and it did this in about eight years, with roughly only about 0.01% of the world’s population owning or using it.

So, we could be watching one of the biggest financial bubbles in history unfold with this cryptocurrency mania. Yet on the other side of the coin, there is also the non-trivial possibility that we are witnessing something remarkable happening before our very eyes — the return of the separation of cash and state.

People are hungry to be a part of the world of finance. What was once the private playground of the rich and powerful, the middlemen and brokers, institutions and corporations — the world of investing and financial exchange — have been eclipsed by thousands of common people empowered by the free and open nature of blockchain-based finance. The people that can’t afford the buy-in to the current system, ones who do not pass the vetting of its gatekeepers and are left with nowhere to go. They see Bitcoin and cryptocurrencies as a permissionless option to participate in the global financial economy and a way out of their own rat races. They invest hard earned money, a few bucks here and there, hoping to make honest gains on their own, even risking losses, instead of being at the mercy of consumerism and inflation.

And it works. Young men and women from all walks of life, from the Philippines to Kazakhstan, they’re learning about Blockchain tech and Crypto trading, putting in the time and effort, finding jobs in the industry, making money, and then teaching or inspiring others to do so too.

Children born from 2009 onward are going to live in a world where digital cryptocurrencies always existed and are the norm instead of a fad. They will never understand the need to wait “3 to 5 business days” for money to be transferred, to wait in line at a bank, to pay 10% to send money. It’s easy to think that this is wishful thinking, but remember, lot of people called the internet a fad too. Now we no longer go online, we live online.

Technologies of tomorrow like robotics, Artificial intelligence, autonomous machines, and the Internet of Things will not use credit cards, a technology never intended for an online network, but will use blockchains and cryptocurrencies, with Bitcoin as the global reserve. This is almost a certainty.

Will crypto markets crash in between? Most likely. In the same way the dotcom bubble burned over six trillion dollars back in 2000, Bitcoin and cryptocurrencies will probably go through the same cycles. Bubbles establish the true players in the market and eliminate all the ones who are there for a quick buck. What’s important is that the technology is real, and it is here to stay.

The Future of Money Itself

“True confidence lies not in being sure you are right, but in not being afraid to be wrong.”

So what’s going to happen? Bitcoin’s upward trend becomes logical once you understand the many layers of the technology behind it. Add to that the thousands and thousands of people who, for their own financial self-interest, will work day and night and fight tooth and nail to keep the fire going, building the network, protecting the network, being the network, and you’ve got an unstoppable force or innovation and value pushing us towards the next evolution of money.

But to answer the question, no one can predict what is going to happen.

These are merely possibilities that I and others have explored. To say we know where this growth trend will end up is folly. That’s why the work never stops, that’s why we drive the direction instead of letting it drive us. As I write this, the positive feedback loop and self-reinforcing trend that Bitcoin started keeps moving forward and upward, with no equilibrium in sight, and with the end-game being a global paradigm shift in the way we transfer value to one another.

The future of money will lie in the hands of its users, the people, the sovereign individual, and not in the powers that be. Money is , in fact, a form of speech. It is just a message about the transfer of value from one to another. Because of the Bitcoin protocol, we finally figured out how to use our most powerful communication channel, the internet, to exchange value with anyone, anywhere, anytime, without permission or friction, freely.

We will live in a future where Bitcoin set money free.

Thoughts and opinions are my own and in no way reflect any affiliations I have with any organization.

I do not give investment advice. This is not investment advice.

An interesting and thoughtful article. Unusual for R38.

Very well done

Thanks, I'll convey it to him when I get the chance...

I'm honored to have someone with such a reputation score reply to me

Congratulations @rkdupron! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP