Lightening Network, Banks monopolize transfer fees

Yes you read the title correct, lightening network is nothing more than the banking system finally hitting the Cryptoworld. I will try to write this article as simple as possible, so just bare with me, it's worth the while

Cryptocoins, the new money that will cause central banks to despair, the small man can finally beat the system and there is no way for the big guys to control and influence this amazing tech !!!

My god bitcoin, the tech where transactions are instantaneous and so fees are so low its nearly free!!

No sorry thats now how this works, most of you probably know this by now. The influence has been here since the beginning, you just have to understand it and ride the right waves to not get knocked down. The article is meant to make you think twice about which coins to hold from your own perspective.

Blockchain is most likely the greatest tech governments and banks could have stumbled upon. Now that it has gotten general user acceptance, with new people entering and learning about the tech every day, its time to start regulating the industry. But you see, regulation is only the last step governments have to take now, banks and financial institutions had to implement their systems first (Bitcoin futures and Lightening Network)

Right away, i recommend you to read this article before reading on:

Mathematical proof that the lightning network cannot be a decentralized bitcoin scaling solution

I want to throw some words at you that you will find when listening or reading about lightening network. These are the keywords you will find popping up over and over again.

3rd party

IOU (I Owe you)

Transaction

Fee

Duration

Summarizing the words above:

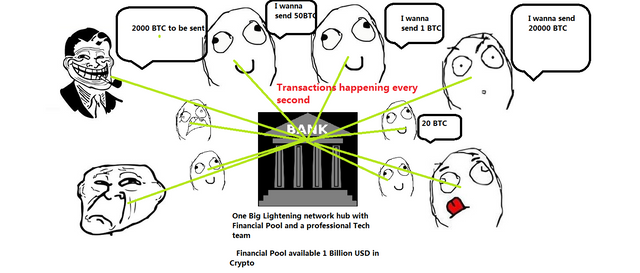

Lightening network works because it implements 3rd parties writing out IOU to 1 party, taking care that the transaction takes place for the other 2 parties involved ensuring the money arrives quickly, and the the 3rd party does this for a fee. Sounds familiar, right sounds like a banking system. And only banks are able to carry such a system, because you need financial pool in order to write out IOU's. Imagine how much money you need to lend if in every second millions and millions USD worth of crypto are transferred every second. (I use amazing graphics further down below to show you what I mean)

You may find all my related research material on the bottom of this article, to ensure you im not bullsh... you, including negative and positive sentiments to this topic. Please make your own mind about this topic in the end.

This topic is very important to understand if you have some money invested in the cryptomarkets, because I truly believe (so just my personal opinion here), only protocol tech that adopts lightening network in the future will be officially accepted by authorities for official payment systems, which would put great valuable projects such as EOS or Cardano at risk in the future, because they are designed to solve the crypto-flaws by themselves, without an additional networking layer.

Nearly all new projects and ICO's are using the Ethereum protococl, if lightening network is used to improve the ETH scaling system, they will monopolize the transfer fee market in the crypto world, as automatically nearly every existing token and coin today would be using the lightening network, generating transaction fees for the banks to be earned. (I will get to the point why banks will monopolize it)

IOU's (The foundation of how banks and central banks operate, implemented into lightening network)

The industry has managed to throw in their webs into bitcoin, and once again you slowly accept the situation as standard because you are constantly confronted with terms such as IOU's.

Anyone who has a Business Degree surely knows what an IOU is, for those that never really had an interest in finance stuff, an IOU is a mere paper signed in between the central bank and banks that money is being owed in between each other. IOU's are the main tools used for central banks to loan out money to other banking institutions "An IOU is an informal document that acknowledges a debt owed, and this debt does not necessarily involve a monetary value as it can also involve physical products"1. IOU's in fact can be signed in between any party, acknowledging a debt must be repaid, no matter if its in physical or monetary form. Some reading material for you.

The truth is out: money is just an IOU, and the banks are rolling in it

https://www.theguardian.com/commentisfree/2014/mar/18/truth-money-iou-bank-of-england-austerity

How Central Banks Enable the Money-Creation Process - https://mises.org/blog/how-central-banks-enable-money-creation-process

If we look at bitcoin and Ethererum too, the tech has following issues

1st: Transaction in between 2 parties without involving a third party ( this is still the same without lightening network)

2nd: Transaction times were meant to take only a few seconds (we all know now, transactions can take up to 6 hours or more)

3rd: Transaction fees were meant to be low (transaction fees have skyrocketed with the increase of value of cryptos)

4th: A decentralized system

5th: Mining, minors were able to generate money just setting up great mining kits in the early days, its still possible

ITS LIKE ALL THESE PROBLEMS ARRIVED WAITING FOR A NEW SOLUTION !!!

Lightening Network solves the customer pain that ETH and Bitcoin were meant to solve:

1st Now involves a third party

2nd Transaction times are nearly instant

3rd Transaction fees are low

4th Its a centralized system

5th Hubs are created that require

•Software

•Maintenance

•System admins

•Configuration

•Upgrades (You need a professional solution to make this happen

I added the youtube link of Andreas explaining lightening network, key things he mentions about running lightening network,

"you throw in funds to run lightening network hubs" -- "minors dont jump around going yay lets create lightening network hubs, like they did when they could create mining set ups, because it takes too many professional resources to do so"

Its so so obvious, the more funds you have and funnel into the lighting network to create a hub, the more Market share you will generate, additionally it will be extremely difficult to just generate and keep the hub running over long times of period, the system is no longer friendly towards people with low net income or small availability of professional resources

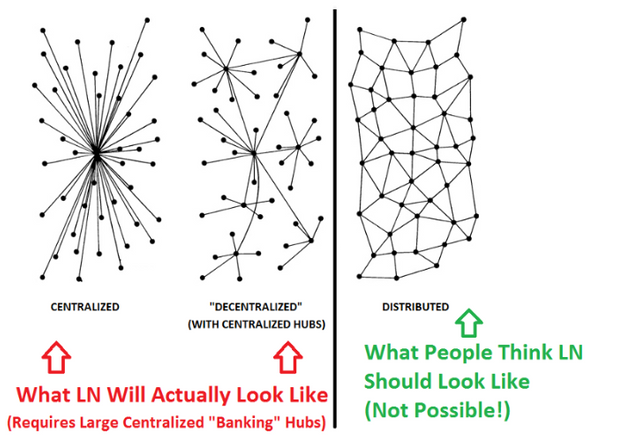

What networks look like graphically

(Source https://medium.com/@jonaldfyookball/mathematical-proof-that-the-lightning-network-cannot-be-a-decentralized-bitcoin-scaling-solution-1b8147650800)

The original customer pain Bitcoin served is now solved by a new tech called lightening network, a technology that can be implemented on to all block chains. To run lightening network on your protocol you need 3 basic primitives, checking hashes, multi signature contracts and lock time, time based controls. If a protocol runs on these 3 ideologies, lightening network can be implemented. Keep this in mind you have a coin that you want to invest in ( I hate having to repeat the word lightening network so often...)

- How can Banks get their share in crypto - on a regular basis

Let us take Bitcoin as an example, coming back to transaction fees and transaction times. Bitcoin has become so expensive to transfer, that it has no good purpose for the in the day to day business activities. The small investor pays fees of around 15 Dollars just to put it in their wallet. Blockchain sizes are at 1MB, only allowing for few transactions per second to take place, higher fees get processed first, your transaction will probably take around 5 hours. Bugger.

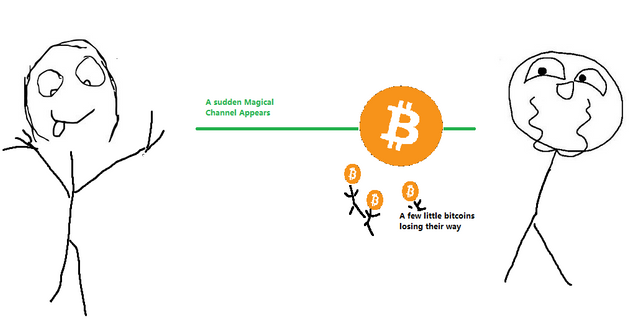

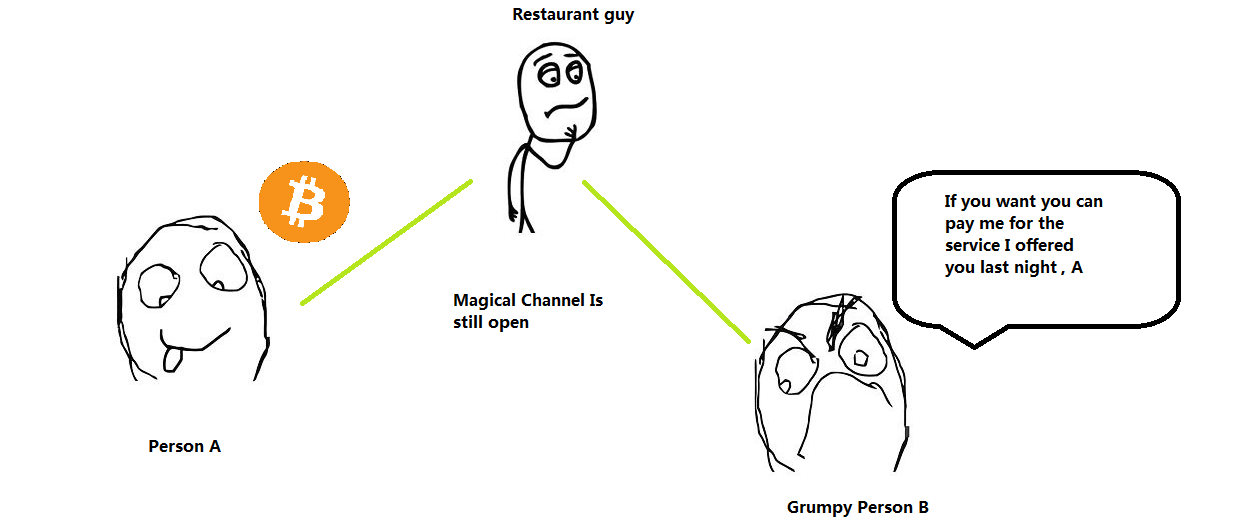

Explanation of channels with and without Lightening Network

Regular Bitcoin transaction, 2 people want to make a transaction in between each other, a channel needs to be opened so the transaction can take place, this needs to happen all the time for all the user. Clear? OK clear good. Pretty Simple 2 users, open channel -- close channel, finished (it just costs time and some small fees in the mean run each time this is repeated)

Traditional Sending of Bitcoin

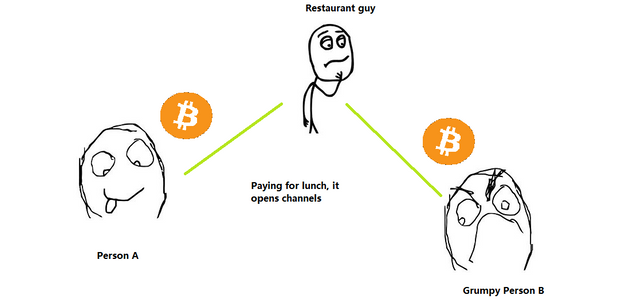

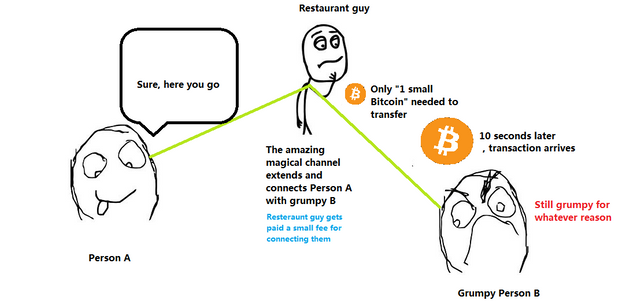

But what if you and your transaction partner already have an open channel with someone else, could you not use this channel to make the transaction instead of opening a new one. Just extend the channel over that guy. As an example, you and your friend turn out to have lunch every day at the same place, since years. The diner knows you so well you can sometimes pay a day later if you forgot your cash. Anyway, because you and your friend go to the same restaurant everyday, you share common 3rd party which you use to make payments everyday already, why not combine you (person A) the Diner (3rd Party) and your friend (person B) into one big channel, and while you guys pay for lunch, you also use the channel to pay for open bills in between each other, and the restaurant gets a little transaction fee for helping you out.

Using Lightening Network

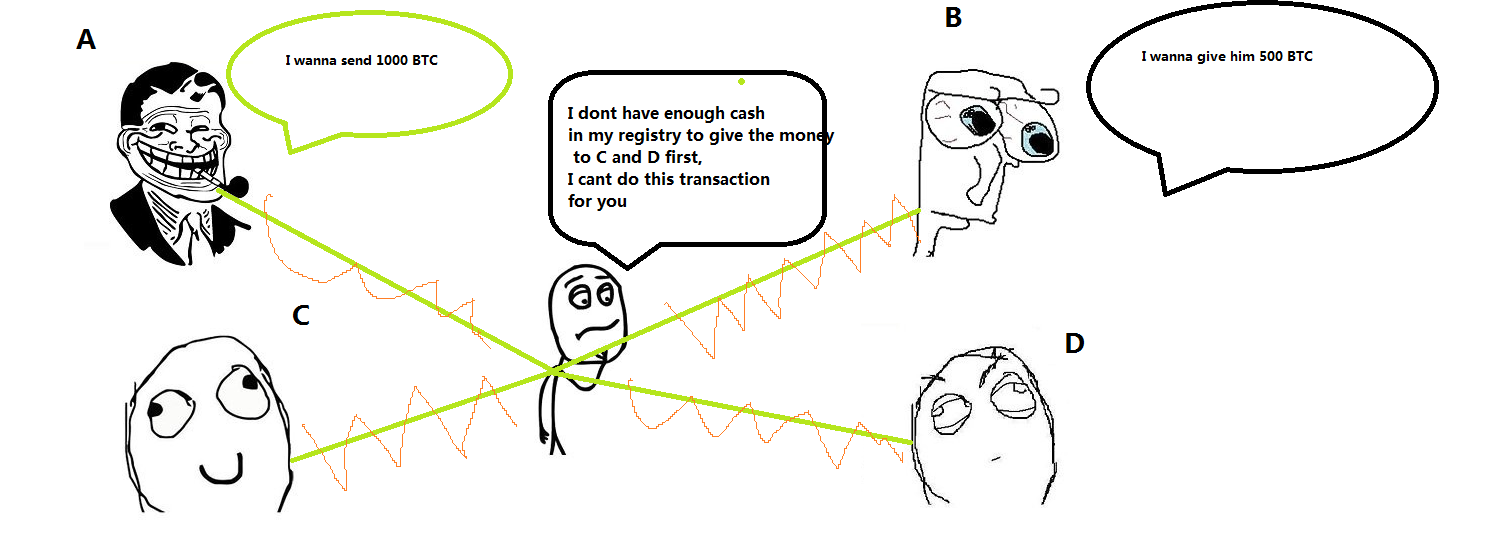

In order for the channel to stay open, the available bitcoin has to exceed the funds you are trying to transfer. So if you want to transfer 2 Bitcoins, but the 3rd Channel only has 1, you cant use their channel, you gotta open your own channel now, dam that sucks. So the restaurant in the example, would reach its limits for bigger transactions.

But if the 3rd party does have more bitcoin than the amount that you want to transfer, you can use the channel and it wont close down. The 3rd party will even get a small thank you present ( transaction fee) for holding the line for you. Thanks :D

So if a restaurant doesn't have enough funds to create a node with enough bitcoin, in order to make a bigger transaction happen and keep the channel up and running, then who can, ah thats right, banks and financial institutions could.

Not a lot of hubs will be able to take of care of big transactions, they would break down if their financial pool is exceeded by the transaction that is trying to be made.

Once you have such big hubs controlling the transactions, the environment will look as follow

•Regulation - You need regulation to overlook such big transactions

• Liquidity- this was not needed until lightening network was invented

• Fraud Department - is needed to ensure AML is in place

• Transaction fees are centralized

THERE WAS A SOLUTION, 1MB Blocksize restriction, implemented by Satoshi, if Blocksize reached limits, developers had the option to increase the Blocksize, to keep transaction fees low and short in time, this never happened. This could have been increased several times until a real solution to this problem could be found. Though I must admit there are some problems if Blocksize is increased, people would need to upgrade their software and there is a chance to get disconnected from the network, that would be a problem for exchanges, coinbase etc.

Instead Lighting Network appeared in times of ever growing transaction fees and duration, with Blocksizes never to be enlarged again.

Final Words.

Lightening Network is designed to be monoplized by banking institutions.

The barrier of entry is high to become a lightning network hub, higher than creating a bitcoin mining kit.

The hubs will fall under regulation and will be overlooked by anti fraud departments, as finally all transaction are more easily traced if they run over a few hubs.

Protocols that can implement lightening network have a high chance of becoming accepted as payment options in governed system and real world applications.

Hubs will enable governments to finally regulate the crypto market.

Investment into crypto currency industry will increase because of it.

Blockchain is here to stay dont worry, just be careful with which Altcoin you will choose to invest in, as they suddenly could become worthless if they cant support lightening network.

Satoshis best kept secret why is there a 1 mb limit to bitcoin block-size

https://cointelegraph.com/news/satoshis-best-kept-secret-why-is-there-a-1-mb-limit-to-bitcoin-block-size

Bitcoin developers block size increase

https://blockchaind.net/bitcoin-developers-block-size-increase/

Other Sources:

1:IOU https://www.investopedia.com/terms/i/iou.asp#ixzz551MrDa2r

2: The truth is out: money is just an IOU, and the banks are rolling in it

https://www.theguardian.com/commentisfree/2014/mar/18/truth-money-iou-bank-of-england-austerity

3: How Central Banks Enable the Money-Creation Process https://mises.org/blog/how-central-banks-enable-money-creation-process

4: Mathematical proof that the lightning network cannot be a decentralized bitcoin scaling solution https://medium.com/@jonaldfyookball/mathematical-proof-that-the-lightning-network-cannot-be-a-decentralized-bitcoin-scaling-solution-1b8147650800

5: The Bitcoin Lightning Network Questions - Andreas M. Antonopoulos

6: Bitcoin lightning network 7 things you should know

https://medium.com/@argongroup/bitcoin-lightning-network-7-things-you-should-know-604ef687af5a

7: https://lightning.network/