Bitcoin can be a bubble?

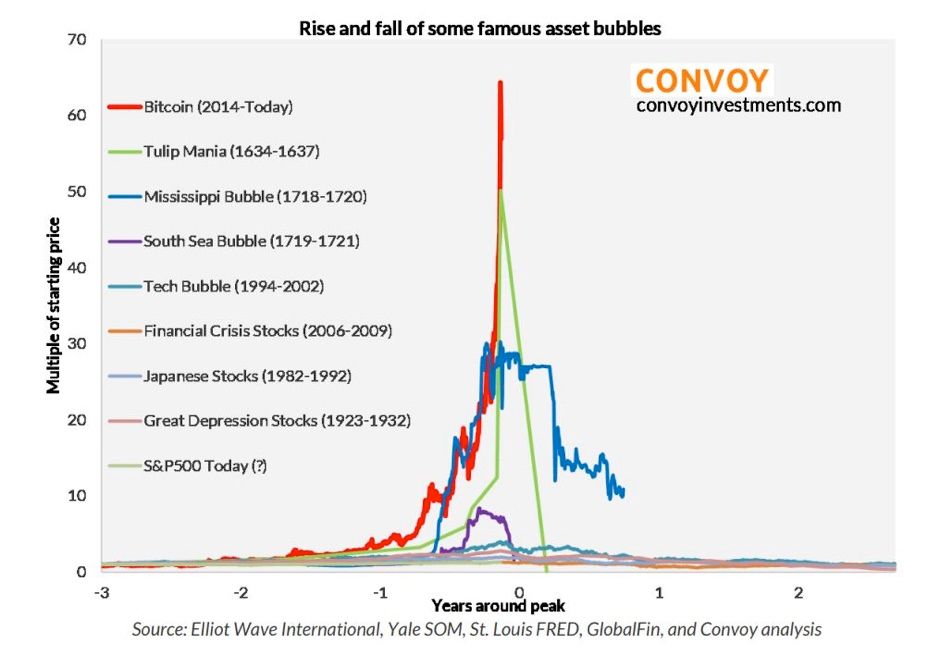

Today I will try to explain why, according to my humble opinion, the phenomenon of bitcoin and in general of cryptocurrency can not be minimally compared to a bubble and in particular to the most fomosa and known (being also the first bubble phenomenon) of tulips . Meanwhile, let's start with a few historical notes and try to understand better what a bubble is and how it looks. In economics with the term speculative bubble, we mean a market phase that is strictly characterized by a constant and unjustified increase in the value of a given asset in a well-defined period of time and usually this increase occurs in a very short time range. When does a bubble burst? Essentially the outbreak occurs when there is a change in trend, which leads to the paradoxical devaluation or in many cases total of the asset in question. Anyway the phase of exponential growth of the value of the asset corresponds to a negative explosion that leads to devaluation and therefore to the total loss of the value of the good. We are sadly known some of the main bubbles, we see some: dot-com bubble, railway companies bubble, economic crisis 2008, Irish real estate bubble, the south sea company bubble and finally the oldest bubble of tulips. In fact, my attention just wants to fall right on this bubble and we try to analyze it together.

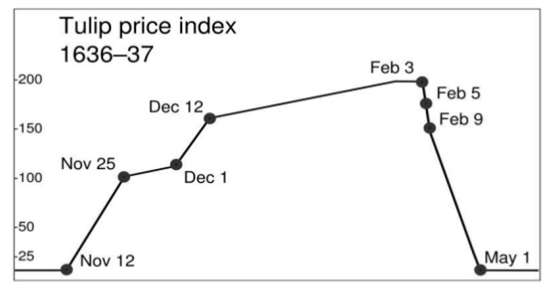

The bubble of tulips was a speculative bubble on the prices of the single bulb, as it was present around 1600, during this period the demand for tulips took peaks so high that the bulbs reached a disproportionate price. Each tulip was given the name of various Dutch admirals, around 1623 some species of tulips reached absurd figures, we also speak of thousands of florins, just think that the annual salary at the time was on average 150 florins. But there was an event that determined this burst of the bubble, in fact the record price was paid for a bulb so called "semper augustus" that was sold for the stellar figure of 6000 florins. Now I will try to explain to you why the bubble of tulips can not be compared to the phenome of bitcoin. But there are signs that instead indicate that we are in a new era from a financial and monetary point of view. What counts is persistence: Bitcoin has in the past reached several peaks in valuations and then collapsed. It happened in 2011 and 2014. But it always came back to grow exceeding the previous record. It is therefore not a bubble, because the bubbles once exploded generally do not return. It's a virtual asset and it looks a lot more like gold. Few use it to buy other things, many choose it as an investment. More generally, Bitcoin could be the sign of a completely new decentralized and blockchain-based Internet. For me it is unthinkable to compare a simple and obvious flower to a process of revolution and technology as innovative as the blockchain can be, regardless of everything, I am very confident and I think that all this has now been discovered and is destined to continue to exist and to revolutionize once and for all the way we live and change it forever. See you next time, my dear friends!