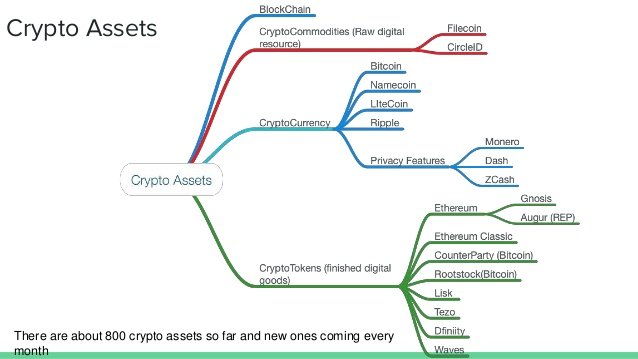

CRYPTO ASSETS- a brief introduction

(pic. credit- slideshare)

A Brief Look at the Rising Cryptoeconomy-

This piece will show up in the upcoming issue of Distributed magazine, a ebook I started out with BTC Media to serve as a primer on blockchain and allotted ledger technology.

Preface: I first wrote the “Intro to Cryptoassets” the night time before the inaugural problem of Distributed went to press in late 2016. My tardiness was once less the consequence of procrastination, alternatively than a surprising consciousness that we had a gaping gap in a textual content that was once supposed to introduce novices to this rapidly emerging innovation. The time period “cryptoassets” had no longer yet been popularized, and texts such as Chris Burniske and Jack Tatar’s (who helped with this updated version) Cryptoassets hadn’t been published. Yet I sensed the tidal wave of new asset issuance that used to be coming. That wave got here crashing down upon this nascent industry in 2017 with the onslaught of ICOs, and this 12 months with the upward push of tokenized securities and non-fungible tokens. With the newest trouble of Distributed ready to hit the press, I realized I had to replace my unique introduction to account for the emergence of crypto-tokens as a bonafide asset class, with a broader vary of extra described characteristics. I hope this brief piece can be used to assist entrants to this innovative technology greater without problems recognize the scale of its ramifications. —JG

It is not going that Satoshi Nakamoto, Bitcoin’s pseudonymous creator(s) at the beginning realized they had invented more than just the world’s first current cryptocurrency, a cryptographically secure, internet-based cash with a provable supply, which incentivizes the protection of a decentralized monetary network. However, almost a decade later, it’s clear Nakamato brought an entirely new paradigm for price advent and exchange thru his innovation — what we now name cryptoassets, or “tokens.”

The following iteration of cryptoassets after Bitcoin were other protocol tokens, which are the native cryptoassets of any blockchain or distributed ledger — database networks with no central server, often used as a reward to incentivize validation of transactions in the network. The introduction of the 2nd cryptoasset at the encouragement of Nakamoto, Namecoin, a decentralized domain naming carrier (DNS) the usage of Bitcoin’s source codel was released in 2011. The subsequent cryptoassets to be delivered were much less novel than Namecoin — typically attempts to create new cryptocurrencies, a subset of protocol tokens that attempt sovereign, digital money (like bitcoin.) Litecoin, Darkcoin, and endless others, copied Bitcoin’s open-source code, delivered new facets such as velocity or privacy, or tweaked the cryptography, earning this kind of protocol token the disparaging term “alt-coins.” Between 2011 and 2014 thousands of these cryptoassets emerged, and many received market capitalizations that prolonged to the heaps of hundreds of thousands of dollars.

Most of the attempts at cryptocurrency disappeared in the “cryptowinter” of 2014 and 2016, when the market capitalization of all cryptoassets collapsed. The small handful that survived, however, have on account that exploded in value. That being said, it ought to be cited that not even bitcoin has yet been adopted so widely that it can be honestly regarded a “currency.” This partly explains the adoption of the time period “protocol” or “network token,” which is also used to describe the native cryptoassets of blockchain and disbursed ledger protocols that do not attempt to create digital money, per se (such as Ethereum’s ether, defined below.)

The third generation of cryptoassets had been Mastercoin and coloured coins, first introduced in 2012 and 2013, respectively. Mastercoin’s mission was to end up a standardized protocol and token built as a 2d layer of the Bitcoin community for secure, decentralized “smart properties” and “virtual currencies.” Colored coins are methods for associating physical world assets with addresses on the Bitcoin network. These can be considered as the preliminary attempts to improve tokenized actual world assets — cryptoassets issued atop a pre-existing blockchain however tied to the cost of offline property such as currencies or property.

While neither of the aforementioned applied sciences failed to get hold of meaningful traction, Mastercoin did lead to the launch of Tether, an early stablecoin — a tokenized actual world asset backed via fiat, or government-issued money, deposited in a financial institution account. This was once designed to reduce the charge volatility that is characteristic of most other, floating, cryptoassets. Other tries at stablecoins have in view that been brought to create similar cryptoassets but pegged to fiat in a greater disbursed manner. Using external economic incentives, each MakerDAI, which uses collateralized debt positions (CDPs,) and Basis, which is designed like a decentralized central bank, are prime examples.

It would be Ethereum, a new blockchain and protocol token (ether), first proposed in 2013 and released in 2015, which realized the possible outlined via preceding technologies, and grew to become crypto-tokens into a bonafide, new, asset class. The primary innovation that Ethereum delivered ahead was the notion of a programming language for clever contracts — effectively self-executing contracts with the phrases of an settlement between events without delay written into strains of code. Not dissimilar to Mastercoin, this allowed the issuance of new cryptoassets without a new blockchain. But not like Mastercoin, which used to be a slow, second-layer protocol and token, the faster Ethereum blockchain and its native clever contracts allows developers to create new cryptoassets with ease and, in theory, to construct decentralized applications, or dapps — software with zero server downtime and censorship resistance.

One of the first dapps to be built atop of Ethereum was once Augur, a decentralized prediction (betting) market platform. In 2014, Augur created one of the first utility tokens, which is a cryptoasset, similar to a tokenized real world asset in that it is issued atop a pre-existing blockchain with its very own protocol token, however that permits an application to operate in a decentralized manner. Augur’s REP token allows its holders to stake their tokens in order to document on the effect of bets, which earns them part of the application’s transaction fees, and creates a decentralized tournament decision system. Utility tokens have due to the fact been created to facilitate computing strength (Golem), advertising and marketing (Basic Attention Token), and a decentralized asset alternate protocol (0x.)

Utility tokens, and their growing recognition amongst startups as a fundraising mechanism, led to a surge of Initial Coin Offerings (ICOs) in 2017 — a structure of crowdfunding first pioneered by Mastercoin, Ethereum, and Augur, which offers humans the possibility receive a portion of a new cryptoasset’s issuance and to bootstrap its community results in return for investment.

Concerns about cryptoasset issuance and achievable securities laws violations, buttressed via this technology’s potential for more frictionless, liquid, and obvious varieties of value exchange, led to a new subset of tokenized real world assets: the tokenized safety or “security token.” These cryptoassets derive their fee from an external, tradable funding asset, and are hence problem to securities regulations.The first tokenized safety was once created with the aid of a mission firm, Blockchain Capital, who created the BCAP token in early 2017. This token represented a limited partner interest in a undertaking fund, with each BCAP being a single share ($1 USD at the time of issuance.) Tokenized securities have due to the fact been issued for fairness via businesses like Documo, which offers document workflow solutions, cashflow by using Spin, a scooter sharing startup, bonds through Neighborly, and picture rights management through KODAKcoin. They’ve also been proposed for assets such real property and intellectual property. Ethereum also spawned new tokenized real world property that are not securities, such as DigixDAO, a gold-backed cryptoasset, and the more moderen stablecoins (above.)

The most recent cryptoasset to arise is the non-fungible token (or NFT.) An NFT is comparable to security and utility tokens in its issuance, but is special in that each token is unique and can't be used interchangeably (non-fungible.) The essential example of NFTs is Cryptokitties, a dynamic, digital collectible game, comparable to baseball buying and selling playing cards or Neopets in many years past. Non-fungible tokens draw on the provable digital shortage and furnish that Satoshi Nakamoto first invented with Bitcoin, and have been proposed for in-game items in video games, digital memorabilia, and creating verifiably scarce digital art, in addition to tracking rare items in the bodily world.

Bitcoin on my own used to be a innovative concept — a math-based money and shop of value, controlled by neither banks nor governments. But if the previous decade of innovation in crypassets is any indication, Satoshi Nakamoto’s invention will be remembered as the spark that ignited a reinvention of finance and beyond, giving new that means to our theory of “value” in the digital age.

I think if you use many images nad not right as lenghty you will be get in hot Posts