Bitcoin Has Swung 10% In Seven Days -- Is It Really More Stable?

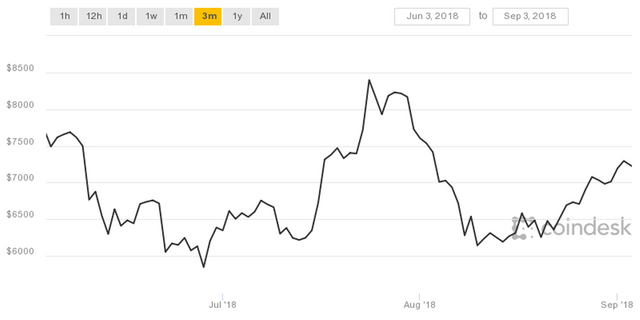

Bitcoin, as well as the wider cryptocurrency market, has been struggling with stability for years. Over the past 12 months, bitcoin has climbed from around $5,000 to an eye-watering near $20,000 before sharply falling back this year.

The bitcoin price is now hovering around the $7,000 mark.

Later this month the U.S. Security and Exchange Commission (SEC) is due to make a decision on whether to grant approval for a bitcoin exchange-traded fund — something the SEC has previously rejected due to fears around bitcoin's wild price swings and price manipulation.

A bitcoin exchange-traded fund would make it easier for investors to buy into bitcoin, potentially injecting a fresh wave of capital into bitcoin and other cryptocurrencies, many of which are almost pegged to bitcoin.

Ahead of the SEC decision, cryptocurrency trading technology firm SFOX has found there has been a drop-off in price variations on digital asset exchanges so far this year, suggesting the entrance of large Wall Street firms into the market is making bitcoin more stable.

Now bitcoin and cryptocurrency price differences are no more than one-tenth of 1%, according to SFOX.

"Before institutional firms were actively trading crypto or heavily involved (before 2018) bitcoin price differences between exchanges varied as high as 4.5%," Danny Kim, head of growth at SFOX, told Business Insider.

Wall Street giants such as Goldman Sachs and ICE, the parent company of the New York Stock Exchange, have signaled they are keen to begin offering cryptocurrency trading to clients, while money managers, hedge funds, and endowments have also been entering the market.

However, there has been a big new change in bitcoin trading this year: A significant rise in bitcoin shorting, where investors bet the price will fall.

Bitcoin short positions have been nudging their all-time highs during the past month, signaling that traders are giving up hope that bitcoin will maintain its current price of over $7,200.

On September 1, a 10,000 bitcoin short position was opened. Bitcoin shorts first reached their highest year-to-date position on April 9, while bitcoin was trading at around $7,000.

A lot of overly confident short positions mean the bitcoin price can be pushed quickly higher, due to so-called short squeezes — and this has already happened a few times in the last few months.

Despite these bets against the bitcoin price, Kim is confident more institutional money in bitcoin will mean long-term stability.

"As this trend continues, the stabilizing effects of institutional investment will extend beyond price spreads, and on to price fluctuations," Kim said.

"Eventually, it could even come to the point where bitcoin could come to resemble the stable coins people are looking to for payments and is used for Satoshi Nakamoto's original vision: a "Peer-to-Peer Electronic Cash System."

Last month SFOX announced the closure of a $22.7 million Series A funding round with participation from Airbnb co-founder Nathan Blecharczyk and is aiming to make it easier for institutions to "trade from a single account" and "buy and sell high volumes without impacting prices".

You can follow me on Twitter @billybambrough and read my other Forbes posts here

Disclosure: I occasionally hold some small amount of bitcoin and other cryptocurrencies

I am a journalist with significant experience covering technology, finance, economics, and business around the world. As the founding editor of Verdict.co.uk I reported on how technology is changing business, political trends, and the latest culture and lifestyle.

Source :https://www.forbes.com/sites/billybambrough/2018/09/03/bitcoin-has-swung-10-in-seven-days-is-it-really-more-stable/1