Decentralized Exchange Vs Centralized Exchange - Are They Future Of Exchanges ?

Hi Friends,

This blog is about correlation between decentralized trades and concentrated trades with the goal that you can comprehend the fundamental distinction between them two .

So we should Understand first About Centralized Exchange and its advantages and disadvantages

What Is Centralized Exchanges

Unified trades are those where one trade fills in as an intermediator which enable us to exchange BTC or crypto against fiat money, for example, binance , kucoin , bittrex , poliniex and numerous others .

Professionals Of Centralized Exchange :

1-Easy To Use notwithstanding for amatures and learners .

2-Advance highlights accessible like ( Margin Trading and Stop misfortune)

3-High Volume So no problelm with liqudity

4-Trades are substantially speedier as high number of exchanges every second (Binance has 1.4 Million exchanges for every second)

Cons Of Centralized Exchange :

1-Exchange goes about as intermediator so Trading expenses is high

2-Very high possibility of trade getting hacked and loosing all assets

3-Personal archives required for confirmation and to begin exchange (KYC Needed )

Though now we should discuss Decentralized Excahnge :

What Is Decentralized Exchange?

A trade which doesn't require outsider or intermediator to hold the financial specialists support ,here exchange happens between 2 clients of the stage which you can even call as P2P (Peer to peer) .

For instance if Mark need to purchase 5 Bitcoin and Alia need to offer 5 Bitcoin then both will exchange amoung themself on stage so there is no need of outsider impedance in such trade .

Case of Decentralized trade are Etherdelta , IDex , switcheo and Nex .

Professionals Of Decentralized Exchange :

1-Very Low or almost no exchanging charge .

2-Users controls there private keys so no dread of trade hack and loss of assets .

3-No Kyc Required for confirmation you can straightforwardly begin to exchange by opening a wallet .

Cons Of Decentralized Exchange :

1-Difficult to use for amateurs .

2-Low volume of trade so liquidation is huge issue until the point when full appropriation of these trades come .

3-For exchange need to hold up long to coordinate with particular exchange esteem in light of low volume .

4-No edge or stop misfortune accessible till now .

So for the time being this is it about both the trades yet now the fundamental inquiry arrises are the Decentralized trade Future of crypto trades ? Would they be able to supplant concentrated trade ?

For me what I feel is Decentralized trade like switcheo - https://switcheo.exchange/can be comparable like Binance and the early adopters of this trade and coin can have the maximum favorable position to get it at most reduced cost .

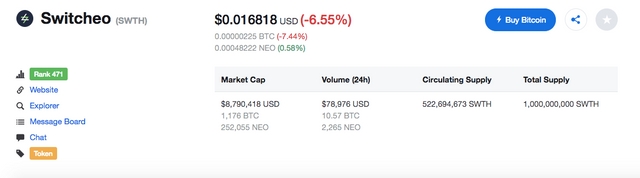

At the present time on the off chance that I discuss the coin cost is just about $0.0168 and once it is received by masses its esteem can rise simply like binance coin also .

![Screen Shot 2018-07-20 at 5.04.33 PM.png]

( )

)

So for me Decentralized trade can be the future and for me I am in for switcheo coin and in addition you never know when we will see this to be mass embraced and thus acquire enormous benefits over it too .

Whats your thought about them pls comment down below so i can know what you feel about it ?

Thanks

Rahees Ahmed

@raheesahmed