$80 billion question, Why Bitcoin and Ethereum both are growing so fast?

Barely two months prior, Bitcoin accomplished a representative development: After an escalated time of development, the cost of one Bitcoin outperformed the cost of an ounce of gold.

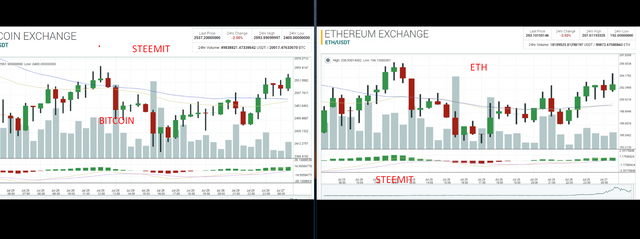

That appears like antiquated history. The cost of Bitcoin has almost multiplied from that point forward and the cryptographic money is at present exchanging at about $2,500. Bitcoin's cousin Ethereum is exchanging at about $200, its cost expanding by a cool 1400% over the most recent three months.

Yet, is the rally over, or has it just barely started? Also, what has impelled the touchy development in any case? In the realm of cryptographic forms of money, noting these inquiries is definitely not simple.

Another type of digital forms of money

To begin, it's vital to comprehend that Bitcoin, while still the greatest digital currency around, is by all account not the only — apparently not even the greatest — driver of development any longer. As indicated by Coinmarketcap, the aggregate vale of all real digital currencies set up together now remains at around $79 billion. Bitcoin represents not as much as half of that, with a $35 billion market top, while Ethereum and Ripple have developed to $17 and $13 billion, individually.

A few years prior, one Bitcoin was justified regardless of a little finished a hundred dollars. Presently, it broke the $2,000 hindrance and is developing like a weed.

Two or three years prior, one Bitcoin was justified regardless of a little finished a hundred dollars. Presently, it broke the $2,000 hindrance and is developing like a weed.

The computerized coin advertise top is an often cited number that amounts to nothing and everything, contingent upon your perspective. On the off chance that you trust that Bitcoin will eventually supplant cash, at that point $35 billion is take change. However, it might never happen, and regardless of the possibility that it does, Bitcoin may be deserted.

Bitcoin is still by a long shot the most encouraging as both a computerized money and an installment stage. Be that as it may, the new type of computerized coins are altogether different. Litecoin, an early Bitcoin contender, has by and by taken the spotlight in the wake of having as of late received SegWit, a product refresh that takes care of the scaling issue that has been partitioning Bitcoin's people group for a considerable length of time. Ethereum is a cutting edge digital money which guarantees propelled components, for example, keen contracts. It needs to end up plainly a blockchain-based establishment for what is basically another kind of web. How's that for aspiration?

The estimation of (computerized) cash

At the point when the cost of an item or a stock ascents, you can as a rule point to some kind of reason. At the point when Apple has a decent quarter, its stock cost for the most part goes up. At the point when fiasco strikes, instability in worldwide markets ordinarily builds interest for what are seen as more secure speculations, for example, gold, driving costs upward.

Yet, in the realm of Bitcoin, the advanced digital money that serves as a decentralized installment framework, you have significantly less to go on.

A great deal of the current Bitcoin news wasn't great. In April, the U.S. Securities and Exchange Commission declined an offer by the Winklevoss siblings to get their Bitcoin ETF recorded on the Bats BZX trade. The move would have made it far simpler for the normal speculator to theorize on the fate of Bitcoin.

What's more, finished the most recent few years, the Bitcoin people group has been intensely isolated over an inquiry on whether the extent of pieces on the digital currency's blockchain — the key innovation whereupon the Bitcoin convention depends — ought to be expanded or not (perused a basic clarification of the square size open deliberation here).

In any case, the cost of Bitcoin went from generally $400 to more than $2500 in a year, and different cryptographic forms of money stuck to this same pattern. Why?

So what's occurring?

Digital money specialists we've reached say improvements in Japan are the imaginable reason at this most recent cost surge.

"The Japanese have given bitcoin the green light as a money and are hoping to build the thoroughness that their trades are liable to," said Charles Haytar, CEO of market examination stage CryptoCompare. On an absolutely specialized level, the present value contrasts in the Japanese markets and somewhere else offer the likelihood of arbitrage, Hayter claims, yet there's a lot of plain old covetousness going on, as well.

Congratulations @raheelaslam111! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP