My Ketten Theory or Principle – Tsunami behaviour on coastlines and the relevance to Gold, Silver & Bitcoin

Tsunami is the Japanese word for Harbour wave. We all know what a Tsunami is.

But,

Ketten is the Japanese word for Drawback.

A Drawback is the phenomenon or anomaly of the sea of a coastline receding abruptly and more pronounced than a normal daily tidal ebb, just before a Tsunami strikes.

The Tsunami draws the sea back away from the shore as it builds the enormous wave.

As with a Tsunami so it goes for the behavior of Hedge Assets such as Gold, Silver & now Bitcoin

A significant noticeable drop in these asset prices occurs before the coming of a significant tidal wave up in price.

Like with a Tsunami were we seldom hear or a aware of a sub ocean fissure or earthquake far way that actually causes the Tsunami, Stock Market or Black Swan economic events are seldom known or seen at the time they happen, especially by the general public – until the event has already happened and truly under way.

We, and even professional economists in the know, have to thus, be on the look out for events that show something significant has happened and a massive price move is upon us.

In the case of Tsunamis, one very striking event people on a beach can lookout for is what is called an ocean ’Drawback’.

In the case of the Markets – a ‘Drawback’ would take the form of a sudden and noticeable drop in Hedge Asset prices such as Gold, Silver Palladium and now Bitcoin just before a significant move up.

Just after an event has occurred, prices of these Commodities have taken a noticeable plunge and then, after a short time they then go up like a Tsunami wave.

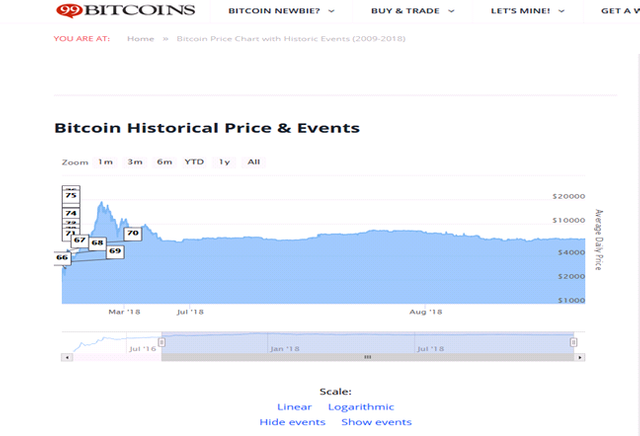

Lets look at some Logarithmic Bitcoin Charts – not the extreme Linear Charts most people use that make Bitcoin look like a freak with massive Bipolar Disorder, but the more accurate on the eye – the Logarithmic Chart.

The Red Arrows indicate Ketten Events.

They are most noticeable after a period of reduced volatility when the price has been ranging and not doing much.

They are also most applicable when the price has been steadily going down slowly.

(much like the period we are in now) #See Chart 3

I strongly believe we are building up to a Ketten Event for Bitcoin – a sudden drop and then a moon shot.

If we look at the period February - August 2011 we see a classic Ketten Event just before the moon shot.

Notice that from February 2011 through March till April 2011 Bitcoin ranged from 93 US cents to 90 US cents calmly going down slowly and then suddenly dropped to 76 cents before suddenly shooting to nearly US$15 at the beginning of June 2011.

Its also worth noting the catalyst that likely brought on the Ketten - The block with the 9 in it (when 3 new Bitcoin Exchanges opened in 2011) the price Kettened first before it went up.

In the next Chart we see less obvious Kettens at play for period July 2013 to December 2013 - but the principle still holds.

And, in the Chart below - where we are now - lowish volatility, steady depreciation in price and expecting an event!!!

This event could be the Approval by the SEC in the US of an official Bitcoin ETF or the rolling out of BAKKT by ICE or RootStock (RSK) mainstreaming Smart Contracts for Bitcoin or a major Pension Fund finally diving into Bitcoin & doing what they all need to do to save themselves or a Black Swan economic crisis.

All of which a very Bullish breakthroughs for Crypto in the pipeline.

Ketten behavior can also be seen in the Gold price from 1970 to 2015.

The Red Arrow shows what I would term a Ketten Bowl (much like a Cup and Handle Chart indicator)

Notice too, how very similar the Green Arrow area is to Bitcoins Chart from December 2017 to today, which incidentally is the same as Bitcoins price behavior in 2014.

History repeats itself, get your dry powder ready for Bitcoin purchasing

Yours Observably

Ptychadina Wealth

Congratulations @ptychadina! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

SteemitBoard and the Veterans on Steemit - The First Community Badge.