Current Issues and problem with Bitcoin Network

I will be elaborating the issues with bitcoin's block-chain and network with following points

1. Scalability

2. Transaction Fees

3. Hashrate Distribution

4. Vulnerable to Quantum Attack

5. Computation Power Required

6. Politics

7. Single Use

8. Deflationary Currency

1. Scalability

The bitcoin scalability problem is due to limits of the maximum number of transactions and size of block the bitcoin network can process.

- Bitcoin was made for micropayments and making large number of transactions per seconds but the Bitcoin’s blockchain takes about 10 minutes to confirm the transaction. This website can show the average time to mine a block in minutes.

- Currently there are more than 250k unconfirmed transactions. These transactions can be seen in real time here .

- The block size of bitcoin is 1Mb is creating a bottleneck in network and thus there is increase in transaction fees and delay.

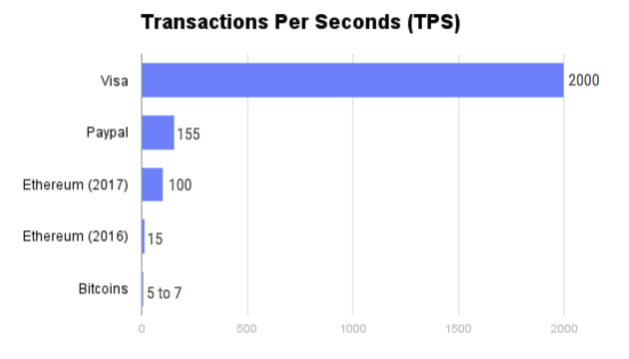

- A typical full 1Mb block in Bitcoin includes around 2000 transactions, or around 7 transactions per seconds at 10 minutes per block and 7 transaction per sec in the absolute maximum, calculated in the assumption that a transaction contains one input and one output.

- If we compare BTC Blockchain with visa payments, Visa on peak can handle more than 47k transactions per second where as the theoretical value of the BTC blockchain can handle 5 to 7 transactions per sec.

2. Transaction Fees

Scalability issues are the reason for increase in Transaction fees.

- It can be seen that there is significant increase in average bitcoin transaction fee from oct' 2017. The mean transaction fee has been above 1 USD. Currently while I was writing this article the average transaction fee is 54 USD. The avereage transaction fees graph can be found here

- 1 USD may not be lot of money but this may be lot for a network made for micro payments. So the transactions below

less than transaction fees may be virtually impossible or useless.

3. Hashrate Distribution

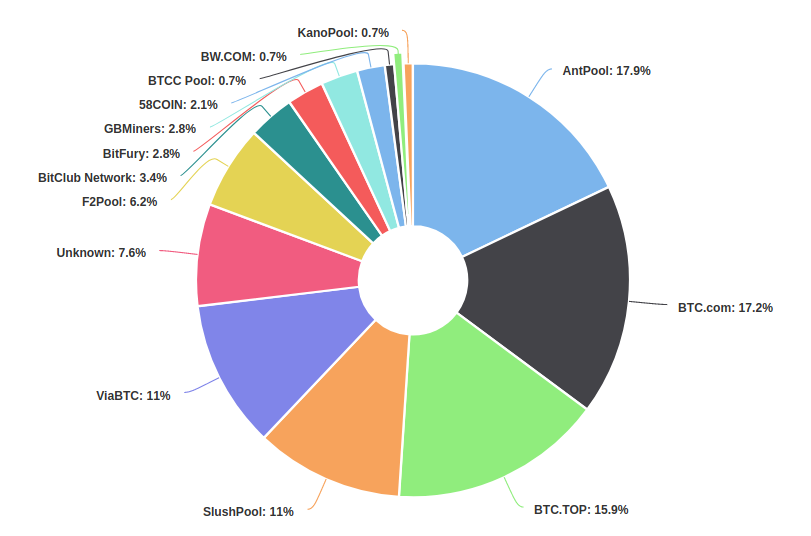

- All independent miners are merged into pools. The pie chart below shows 14 of the largest mining pools, but the top 4 control more than 51% of all computing power. You can see this here

- Gaining access to these top 4 mining pools will give someone ability to double spend bitcoins.

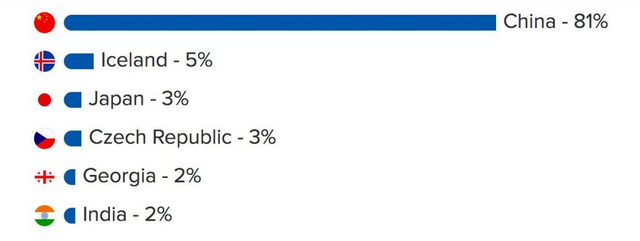

- There is one more threat because the majority of pools, along with their computing powers, are located inside one country, which makes it much easier to capture them and gain control over Bitcoin. This can be seen below

Image Source

4. Vulnerable to Quantum Attack

The only way to exploit bitcoin network is to calculate the private key using the public key, which is extremely hard with conventional computers. But with a quantum computer, it is easy.

- Quantum computers pose a risk to all encryption schemes that use a similar technology as of bitcoin network, which includes many common forms of encryption.

- A quantum computer would need Θ(√ N) operations to solve a problem that needs Θ(N) operations on a classical computer.

- There are public-key schemes that are resistant to attack by quantum computers. So Bitcoin community should also work to implement these protocols in Bitcoin network. Currently there are no plans of the community to implement these protocols.

- “The elliptic curve signature scheme used by Bitcoin is much more at risk, and could be completely broken by a quantum computer as early as 2027,” say Aggarwal and co.

5. Computation Power Required

- Transaction speed declines as the network increases in size as more transactions compete for the limited block spaces.

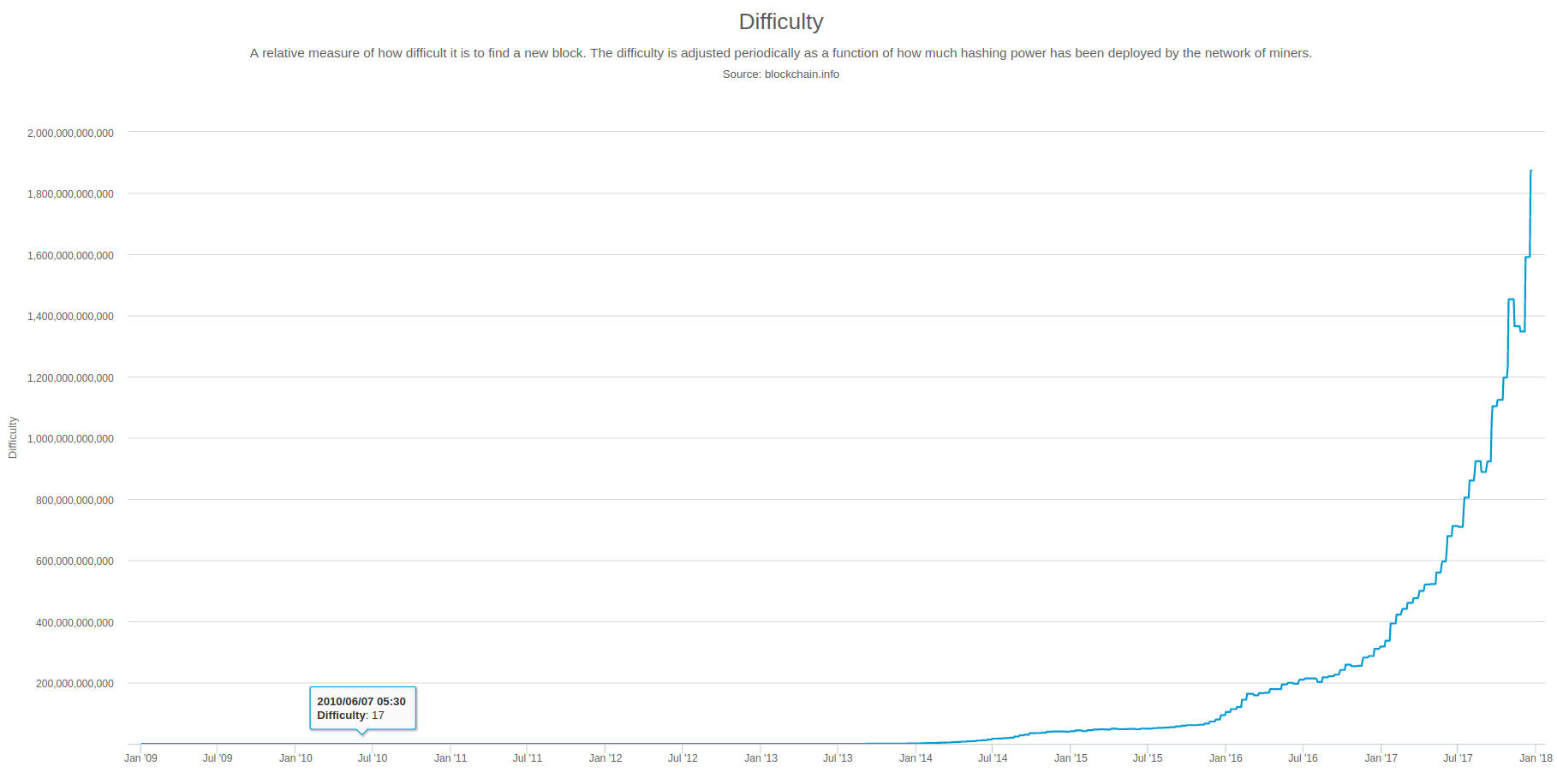

- It will take more and more computing power to mine the same amount of Bitcoin.

- The picture below shows a relative measure of how difficult it is to find a new block. This can be seen here.

6. Politics

- Politics between miners, developers and investors consider the technical aspects of the blockchain and effects the technology used in bitcoin.

- The bitcoin protocol and software are technical, in that they involve the application of technology to interesting challenges. How to configure bitcoin is political, though, because it involves choices made by groups.

7. Single Use

Every cryptocurrency tries to solve a real world problem and Bitcoin solves Double spending problem

- The bitcoin has proved to be valuable asset but not many concrete real world applications have been developed on network.

- So the Bitcoin blockchain has to prove its uses by implementing applications for users.

8. Deflationary Currency

People hoard on Deflationary currency

- There is limited supply of Bitcoins i.e 21 Million.

- As bitcoin is a Deflationary currency people tend to hoard the currency as the price increases. People don't spend this currency and it is the main problem of Deflationary Currency. So an amount of inflation is good for economy so as people are willing to spend the money on network.

Considering these Issues The question is

Why do Bitcoin has more value than other cryptocurrency?

- Bitcoin has a large lead as a store of value over every altcoin in having existed 8 years without failure.

- Bitcoin is more accessible, with more exchanges, more merchants, more software and more hardware that support it.

- Bitcoin has the largest developer ecosystem with more software and more implementations than any cryptocurrency.

4.The security of Bitcoin has been proven. - Bitcoin community is also trying to fix issues of scalability, transaction and considering sigwit,lightning Network to solve these issues.

Thanks for the reading

Comments your views about Bitcoin network and there Issues.

If something is missing add your comment so that I can Edit the article.

If there are any mistakes in article please comment below

Upvote and Resteem The post

References and further Readings

[1]https://blockchain.info

[2]https://www.kaspersky.com/blog/bitcoin-blockchain-issues/18019/

[3]https://bitcoin.stackexchange.com/questions/57452/what-is-the-maximum-number-of-transactions-per-seconds-on-bitcoin-cash

[4]https://www.technologyreview.com/s/609408/quantum-computers-pose-imminent-threat-to-bitcoin-security/

[5]https://medium.com/@jimmysong/why-bitcoin-is-different-than-other-cryptocurrencies-e16b17d48b94

[6]https://www.coindesk.com/understanding-bitcoins-scaling-debate-politics-comes-first/

[7]https://github.com/llSourcell/IOTA_demo/blob/master/How%20to%20Buy%20IOTA.ipynb

[8]https://www.coindesk.com/information/blockchains-issues-limitations/

This post has received a 0.88 % upvote from @booster thanks to: @pps.

@originalworks

The @OriginalWorks bot has determined this post by @pps to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

Congratulations @pps! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Congratulations @pps! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!