How to recognize that crash is coming in any assets?

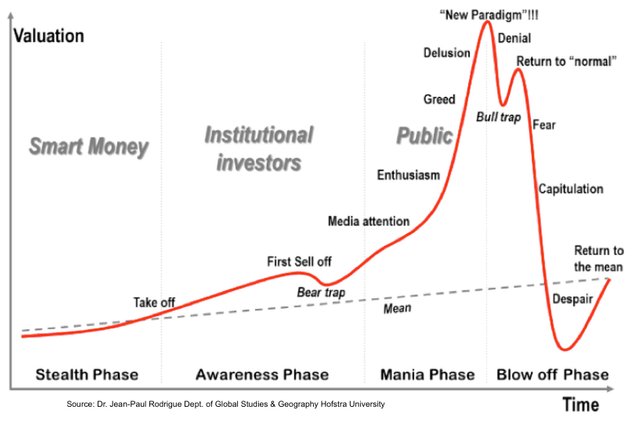

Each speculative bubble has the same course - from an undervalued asset perceived by a few to the asset overvalued by everyone - as you can see in the chart above.

But why are the bubbles created? There are many causes, and most are due to human nature. Well, to be a good student you need to learn a lot, and to be a good employee you need to work a lot and gain new knowledge - and so throughout your life. Simply, to achieve a given goal in life, we must devote a lot of time and work to it - nothing falls from heaven. There are no free dinners or free money!

I. "Thunder from the sky"

The situation in investing is similar - it means a lot of work and learning. But sometimes there is an "opportunity" - the price of an asset grows all the time and everyone starts talking about it. Everyone can hear about the lucky ones who have invested in pennies, and after a while, they are millionaires - it seems that the literary story from a slumdog to a millionaire is becoming a reality and that there are new, wonderful times in which everyone can become a rich man. It seems to everyone that the times of our parents and grandparents, where hard work was the only path to success, are times gone - they lived in the old "dark" times, and we have the honor of living in the era of economic enlightenment, which multiplies our bank accounts with magical ease.

II. Nobody asks: why?

The popularity of a given asset grows, and at the same time the price. Everyone is of the opinion that this will always be the case. The amount of newspaper articles and TV reportages are increasing at an alarming rate - and over time their tone is changing: from curiosity to surprise through admiration to euphoria. With time, when the price rises, the number of questions decreases - everyone starts to treat this situation like something normal - like everyday sunrise and sunset. Meanwhile, a rational investor should ask about the actual value. In accordance with the investment rules, it is necessary to invest in undervalued assets so that their price increase will increase the balance of our account and avoid overvalued assets, so that their decrease will not expose us to unnecessary losses. For example, before we invest in shares of company X, we try to find out as much as possible about it - what it sells, whether sales grows, whether the management manages rationally. In a word - we want to know everything to have a holistic picture.

But in the case of a bubble, the vast majority ignores it - they invest because the price grows and grows because they invest. And that's enough for them. And this is a pernicious way of thinking - because if they do not know the rational ones, why something is growing, they will not know when it will go down and why. It's just a matter of time when the "black" day will happen - maybe it will be a Black Monday, or maybe Black Tuesday, maybe Black Wednesday, etc? But it will happen for sure.

III. Mathematics vs the speculative bubble

As we well know, the money supply rises on average from a few to a dozen percent annually (depending on the country).

Therefore, an increase in a given asset several percent annually is often a natural influence of inflation. But in the case of a speculative bubble, the increases are much higher than a dozen or so percent annually and in order to maintain such spectacular increases in the direction of space, more and more money is needed (to increase in market capitalization). But in the end, the money runs out, because each of us has expenses - for food, housing, studies, etc. Each of us has a fair amount, which can be spent on investments every month. And here an example: an average investor named John Smith. Well, John Smith is a plumber and has about $ 1,000 each month to invest. John decided to gradually buy shares of the company Y, which is becoming more and more popular among investors - below is a list of his monthly purchases:

- First month - purchase of shares of the company Y 1000 for $ 1 each.

- The second month - the price of the shares increases to $ 2 - purchase of 500 for $ 2

- Third month - the price of the shares increases to $ 4 - purchase 250 for $ 4

- Fourth month - share price increases to $ 8 - purchase of 125 for $ 8

- Fifth month - share price increases to 16 $ - purchase of 64 for 16 $

- Sixth month - the price of the shares increases to 32 $ - the purchase of 32 for 32 $

- Seventh month - the price of the shares increases to 64 $ - purchase of 16 for 64 $

- Eighth month - the price of the shares increases to 125 $ - purchase of 8 for 125 USD

- Ninth month - share price increases to 250 $ - purchase of 4 for 250 $

- The tenth month - the price of the shares increases to $ 500 - purchase of 2 for $ 500

- Eleventh month - the price of the shares increases to 1000 $ - purchase of 1 for 1000 $

- Twelfth month - the price increases to $ 2,000 - John can no longer afford another purchase. Now he can hold or sell his shares.

IV. Let's not forget about John!

What does John's story teach us (except that he is of few rich lucky person)? Well, as the price of a given asset grows rapidly, the investor can buy fewer and fewer units of assets until he can not afford to buy more. But in the market, his declining purchase is overshadowed by the growing demand from new investors. But in the end, the law of large numbers gets everyone and the number of investors who are holding and not buying begins to prevail. And then an impulse will suffice when someone finds out that he has to sell because the price will not grow any more (it is called "Minsky moment"). And then a big sale will start and more and more people will start selling for fear of further declines. Fear will drive fear - everyone will think that only the price will drop. And then the bust begins.

So whatever you invest in, do it rationally and after a thorough analysis.

Watch the movie about the Crash of 1929, which shows how bubble looks like.

Have nice day!