Drawdown bitcoin: to blame USDT and Bitfinex?

For a long time there is a drawdown of the bitcoin rate. A number of analysts associate this with the approach of the Chinese New Year, some recall the Asian events connected with the pressure on the local exchanges .... However, there is our opinion, the bitcoine of course has been manipulated for a long time , and that the situation is more serious than many believe. Let's look at this interesting and important issue.

A few days ago, prominent economist Nouriel Roubini, who is known for his prediction of the 2008 crisis, attacked Tether and the USDT currency - a tokenized dollar. Using his Twitter, he stated that an unjustifiably large amount of USDT had been issued, and also a loan. Tether of manipulating the bitcoine course.

Necessary digression: what is USDT

Let us briefly recall what USDT is. There is a company called Tether Limited, and it is issued a crypto currency, called USD Tether (abbreviated - USDT). The creators position is the kind of the standard of the "crypto currency" - that is, as a coin, the value of which should be equal to the US dollar. USDT is present on Bittrex and a number of other crypto-exchange markets. Tether Limited, however, notes that USDT is not a copy of the dollar and an electronic version of the currency. However, according to the developers' assurances, the USDT is secured by the US dollars stored in the Tether Limited account. In other words, the coin works like this:

When a certain amount of money is paid to the company's account,

If dollars are withdrawn from the company's account, the same amount of USDT is withdrawn (extinguished).

Not a bad system! Of course, if everything is honest. To avoid any suspicion, in September 2017 Tether Limited entered into an agreement with the analytical company Friedman, and the latter conducted an audit of USDT. As a result, it was officially confirmed: USDT is provided with phi-dollar dollars in the amount of 442.9 million, which are kept in Tether Limited's accounts.

However, in recent months, a lot of USDT (for hundreds of millions of dollars) was issued, which caused legitimate suspicions of the insecurity of this coin. And the other day in Tether in general . Tether Limited in a statement on this topic. However, such a job looks rather ridiculous, because the auditor, in fact, had to compare literally several figures.

This reinforces suspicions that the USDT is not provided with the dollar in so far as its creators talk about it.

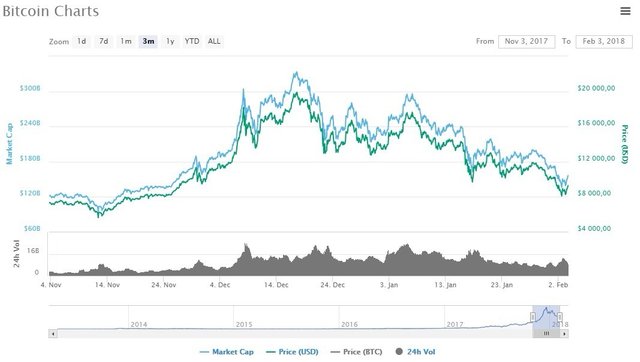

The essence of the alleged manipulation of the bitcoin

Let's return, however, to the subject of the article. As you remember, economist Nouriel Roubini began to suspect Tether in manipulating the bitcoine course. The essence of the claims is that the allegedly uncontrolled emission (that is, the issue of coins) of the USDT, which was not backed up by anything, caused a sharp increase in bitcoin at the end of last year. It is assumed that the first of a large part of the USDT was made on the exchange for the purchase of bitcoin for tens of millions of dollars. Naturally, this pampilo price, and bitcoin went up.

The pursuit of regulators and the discharge of documents

This was the US financial authority. Both companies were summoned to court by subpoena. Negative news background is still a little "dropped" and without that.

Bloomberg, which is the source of this news, received an email from Tether and Bitfinex, in which they refuse to comment on the situation.

However, a conspiracy between Bitfinex and Tether in order to manipulate the bitcoine course is entirely possible. Firstly, as noted by Bloomberg journalists, recently Ron Torosyan, a representative of both companies at once, admitted that they are connected (even if they even have a representative in common!). Secondly, as a result of the leakage of documents, it became clear that several leading employees of Bitfinex were formerly employees and shareholders of Tether. These strange coincidences were also reported in The New York Times.

Tether's accounts, because now they have been issued 2.2 billion. If Tether had nothing to fear, would they stop partnering with analysts from Friedman LLP?

Legal aspects of the situation

An interesting fact is that since November 9, 2017, the Bitfinex exchange is not working with US residents. In this light, the summons from the American financial regulator CTFC looks very strange. It is probable that the activity of the exchange, which was carried out until November 9, will be considered. So far, nothing is known about this.

What really happened?

For your information: the bitcoin rate is now in a very large drawdown and is $ 9,305.

Is it worth to believe in such news? Was the cost of bitcoin really overstated artificially? And after that, the pampa sank so much?

Yes and no. On the one hand, USDT is an important crypto currency is used for trading on several large exchanges, it is stably in the TOP-20 crypto-currency with the highest capitalization, it can (albeit not be) called a kind of analogue of the dollar the crypto currency. On the other hand, remember that a significant number of important events have been happening in the market in recent months.

Regulator attacks, shocking ordinary investors news from South Korea and China, various hacker attacks, forks, the appearance of futures for bitcoin ... Enumerate can be infinite. In this information flow, the news of Tether and Bitfinex looks important, but hardly decisive.

So it is unlikely that the drawdown of bitcoins is due precisely to the fact that the "grandiose manipulation" even if the manipulation took place - it could give small and short-term pampas, not a powerful upward trend, in which bitcoin was before the fall.

Resteemed by @resteembot! Good Luck!

Curious?

The @resteembot's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.

Great post

It's really happening right now.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by Maestro from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.