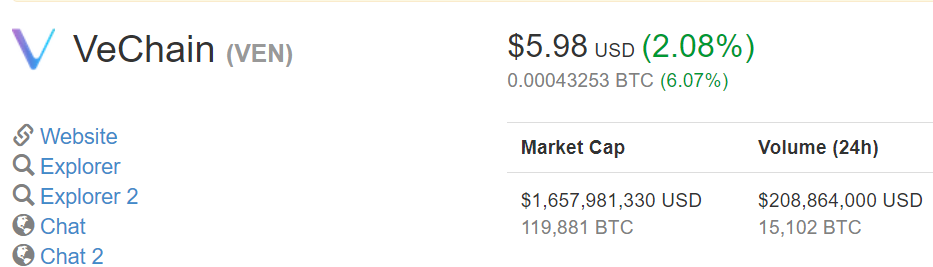

VEN VeChain Jan 14 Analysis - Next Target $9.84-$14+, 96% Profit After Consolidation

Another 2,000%+ Coin in 40 Days. VEN Sky Rockets and People Are Just Talking About It Now

We see a beautiful 5 wave elliot wave form with ABC in process with two possible support regions obtained from the parabolic lows.

If support 1 between 33K and 38K satoshi holds, which is at 0.382 fib, and C finishes there, we attempt an impulse up.

If support 1 doesn't hold, we drop to support 2, which is between 0.5 and 0.618 fib region range between 21.6k t 27.2k satoshi.

From the parabolic move up and especially the strong B move up, almost even a double top, we can assume a bullish VEN sentiment and retracement will not be much. We look for key signs of reversal such as counting the 5 elliot wave C waves down, a candle on high time frames that is supportive such as a hammer or doji, look for bullish signs of bullish divergence on histogram, rsi, and macd, and other indicators to help us time our entry.

Assuming worst case scenario but combined with still a fairly bullish VEN market sentiment, retracing to 0.618 lvl 2 support regions between the 21.6k and 27.2k satoshi region, we can use a fib extension target accordingly with 1 and 1.618 fib extensions for target 1 and target 2

Target 1 = 72K satoshi ($9.84 range)

Target 2 = 103K satoshi ($14 USD range)

Always be cautious, take high probability trades, plan entries and exits, stick to high reward low risk R:R setups. Good luck traders

Really appreciate the upvote and support on steemit.

Twitter - https://twitter.com/PhilakoneCrypto

https://www.youtube.com/user/philakone1

If you enjoyed this video, please like, subscribe, follow, share, upvote, on YouTube, Twitter, Steemit. If you specially liked it, please donate Tequila to Luna's cryptocurrency/vodka/tequila fund.

Luna's personal bitfinex account:

BTC address: 1PruhmsYXU2gPkNw574xZSMyBG4YW5Wnq9

Ethereum: 0x2538b728f9682fc1dc2e7db8129730f661753850

LTC: LPeaZpGiF3XdCw5XPN7LXztDagTEZAMgYd

Bitcoin Cash: 1AY2FPANCe5URB71Nvy6tkCgoTS8iHgmZD

Please always remember we trade using probability and not all trades are winners. We manage our risk with stop losses and try to win over time. Those that don't understand this, and expect only to having winning trades, will always lose money over time.

The ultimate goal is to help the crypto community because I think there's a lack of these type of videos. I want to share everything I've learned because knowledge is only power if passed on. These are educational videos intended to teach how to think through thought-out rationalization.

DISCLAIMER:

I'm not a financial adviser, nor am I giving you any tips on when to buy, sell, etc. I'm simply stating my opinions and what I personally look for. Those that follow my trades blindly and don't understand risk management, will always lose over time. I manage risk differently. Not all trades are winners. We manage our risk with stop losses and win over time. Even if we've entered at a similar price, I can micro manage my risk, by shedding, adding, reducing, etc, but those calls aren't made. Therefore despite entering near the same price, I may come out well ahead while you may take a loss, even if we exit at the same price when the market goes against my call. Remember, I always profit OVER TIME, and am not focused on winning every single trade. As long as we win more than we lose over time. I want to be very clear so you understand the outcomes will always be different even if we take the same trade. I MANAGE RISK and see this game as a probability. Therefore, be forewarned.

Coins mentioned in post:

Keep it with the videos , Always watching them like if it was my drug haha.

I'm learning more and more from you , Thanks alot!

Hi man, love your content. I have been learning Elliott Wave and your vids are really helping. Can I ask you to do a longterm supercycle analysis on bitcoin? It would be useful to know where we are in that cycle. Also, how do you know a trend has reversed and its not an ABC or ABCDE correction it it a change in the main trend from up to down?