Cycles in a Bull Market: When Does Altcoin Season Arrive?

In the world of cryptocurrencies, a bull market signifies a period of growth and optimism, characterized by sustained price increases. This market is of particular importance to investors, as it offers significant profit opportunities. A deep understanding of market mechanisms and cycles is crucial to capitalize on these opportunities. In this context, Bitcoin, being the largest cryptocurrency by market capitalization, plays a key role. The onset of a bull market is often marked by a rise in Bitcoin, which strengthens market confidence and lays the foundation for the development of the entire crypto market. In this early phase, investors primarily focus on Bitcoin, while altcoins tend to stay in the background. This article sheds light on the cycles in a bull market and examines when and how the transition from Bitcoin dominance to an Altcoin Season occurs.

Bitcoin Dominance in the Early Phase of the Bull Market

The initial phase of a bull market in the cryptocurrency world is often characterized by the strong dominance of Bitcoin. This phase is crucial for understanding the entire market cycles. It sets the framework within which later movements of altcoins unfold. During this time, Bitcoin becomes the primary focus for investors, reflected in a significant increase in both its price and market dominance. Observing this phase provides valuable insights into market sentiment and the future development of other cryptocurrencies.

Rise and Dominance of Bitcoin

In the early phase of the bull market, Bitcoin typically experiences a significant increase. This rise is reflected not just in the price, but also in the increased attention from investors and market observers. Bitcoin's dominance is a key indicator of the overall market state and sets the stage for the later development of altcoins. It's a time when the groundwork for the subsequent Altcoin Season is laid, and therefore central to understanding the entire market.

Impact on the Overall Market

While Bitcoin dominates in the early phase of a bull market, this significantly affects the entire crypto market. In this phase, investing in Bitcoin tends to appear safer and more trustworthy, often leading to a concentration of market liquidity in Bitcoin. This tendency can temporarily lead to stagnation or even a slight decline in the performance of altcoins.

However, it is important to recognize that this phase of Bitcoin dominance is not static. It paves the way for the next phase of the market - the Altcoin Season. This transition is often initiated by a saturation in the price of Bitcoin, as investors begin to seek higher returns in alternative cryptocurrencies.

Transition to Altcoin Season

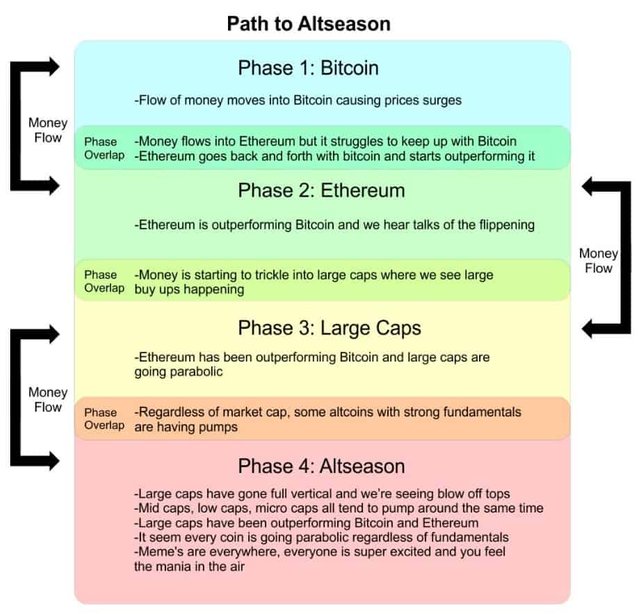

Following a phase of Bitcoin dominance, the transition to what is known in the crypto world as "Altcoin Season" often occurs. This period is characterized by a shift in investor interests from Bitcoin to alternative cryptocurrencies, the so-called Altcoins. Understanding the signs and indicators that announce this transition is crucial for investors to adjust their strategies accordingly and capitalize on the opportunities presented.

Patterns and Indicators for the Start of Altcoin Season

One of the main indicators for the start of Altcoin Season is a slowdown in growth or a saturation in the price of Bitcoin. When Bitcoin reaches a high price level that shows some stability or even signs of plateauing, investors start taking their profits from Bitcoin and reinvesting in Altcoins.

This shift is often accompanied by an increase in trading volume and market capitalization for various Altcoins. Such movements indicate that the market has recognized the maturity phase of Bitcoin and is now looking for new growth opportunities in less explored areas of the crypto market.

Dynamics of Altcoins

When the market transitions into the Altcoin Season, the dynamics and investment strategies change significantly. Altcoins, which previously stood in the shadow of Bitcoin, now come into focus. This phase is marked by increased volatility and a broader spectrum of investment opportunities, as each Altcoin has its own unique characteristics and technologies.

Investors who invest early in Altcoins can benefit enormously from this phase, as many Altcoins experience considerable price increases during this time. However, it is important to note that with the increased potential for high returns comes a higher risk. Analyzing and selecting the right Altcoins requires thorough research and a good understanding of the underlying technologies and market conditions.

Strategies for Altcoin Season

An effective strategy for Altcoin Season requires diversification and careful risk management. Investors should consider spreading their portfolio across various Altcoins to distribute the risk. It is also important to pay attention to market indicators and news to make the right investment decisions at the right time.

Altcoin Season offers an exciting time for crypto investors, but it is crucial to make informed and strategic decisions to make the most of this market phase.

Case Studies and Historical Patterns

Examining historical patterns and case studies from past bull markets can provide valuable insights into the cycles of Bitcoin and Altcoin Seasons. By analyzing these data, investors can recognize recurring patterns and better understand how different phases of the market develop and interact.

Analysis of Past Bull Markets

The history of the crypto market shows that after a phase of strong Bitcoin dominance, an Altcoin Season often follows. This pattern repeats in various market cycles, although the specific details and timing can vary. By studying past bull markets, investors can learn to recognize the signs of an impending Altcoin Season and respond accordingly.

The analysis of historical data also shows that not all altcoins are the same. Some altcoins have performed significantly better during the Altcoin Season than others in the past. These differences are often due to factors such as technological innovations, community support, and market acceptance.

Strategies for the Bull Market

Studying the history of bull markets provides important insights that investors can use to develop their own strategies. Such a strategy could involve diversifying investments during the Bitcoin dominance phase and focusing on selected altcoins with strong fundamental data and growth potential.

Risk Management and Timing

An essential part of a successful investment strategy in the crypto market is risk management. Investors should be aware of the inherent volatility of the market and develop strategies to minimize their risk. This includes timing investments, especially during the transition from Bitcoin dominance to Altcoin Season. Well-timed engagement can maximize the potential for high returns, while entering too early or too late can unnecessarily increase the risk.

Conclusion

The patterns and strategies discussed in this article highlight the importance of understanding market trends and responding to them. Investors who can adjust to the changing phases of the market have the opportunity to efficiently diversify their portfolio and benefit from the various market phases.

In conclusion, the crypto market is dynamic and constantly in motion. The ability to adapt to these changes and learn from historical data is crucial for success in crypto trading. While Bitcoin plays a significant role in the market, altcoins offer a world full of opportunities to explore. Prudent risk management and a flexible investment strategy are key to success in this exciting and constantly changing environment.