Bitcoin before the 2024 Halving: An Overview

In this post, we look back at previous Bitcoin halvings and look ahead to the upcoming halving in 2024. What factors should be considered, and what general impact does a halving have on the Bitcoin market? What conclusions can be drawn from past halvings for 2024?

Basics of Bitcoin Halving

Before diving deeper into past halvings and their impacts, it's important to understand the basic concept of a Bitcoin halving. We'll also briefly discuss the relevance of the upcoming 2024 halving.

What is a Bitcoin Halving?

A Bitcoin halving is an event where the reward for mining a new block is halved. This typically happens every four years and has various effects on the market.

Relevance of the Upcoming 2024 Halving

The next halving in 2024 is already in the focus of many investors. Its effects can be significant both in the short term and the long term, regarding the price of Bitcoin and general media attention.

Historical Context of Bitcoin Halvings

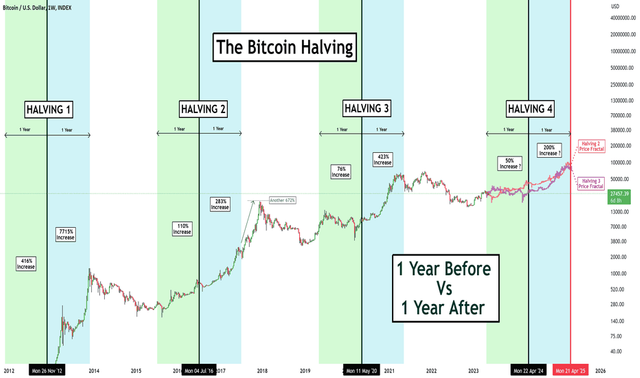

To better understand the potential impacts of the upcoming 2024 halving, it's helpful to examine past halvings. Each has had its unique characteristics and market impacts.

2012 Halving

The first halving took place in November 2012. The price of Bitcoin saw a significant rise in the months following the event.

2016 Halving

The halving in July 2016 had similar impacts but with a few differences. The price did rise, but overall interest and media attention were noticeably higher than during the first halving.

2020 Halving

The third halving occurred in May 2020. Unlike previous halvings, this event garnered significant media attention, contributing to a price increase on top of natural market dynamics.

Effects on Bitcoin Price

One of the most discussed aspects of a Bitcoin halving is its impact on the digital currency's price. We look at both short-term and long-term effects from past halvings.

Short-Term Effects

Immediately after a halving, the price can be volatile. Uncertainty and speculation often drive short-term price movements.

Long-Term Perspectives

Long-term, halvings have historically led to a Bitcoin price increase. This is mainly due to the reduced supply and increased demand.

Media Attention and Bitcoin

Besides price movements, media attention is another factor that should be considered during a halving. How do media outlets cover these events, and what impact does that have on general interest in Bitcoin?

How Media Covers Halvings

The media plays a crucial role in how a halving is perceived. With the rising popularity of Bitcoin, each halving receives more media attention, increasing public interest.

Impact on General Interest

High levels of media attention can boost general interest in Bitcoin and cryptocurrencies, often creating a multiplier effect on market dynamics.

Other Factors in Bitcoin Halving

Besides price and media attention, there are other factors that should be considered during a Bitcoin halving. These can range from technological developments to market dynamics.

Market Dynamics

Each halving occurs in a unique market environment. Economic conditions like interest rates and inflation can also play a role.

Technological Developments

Bitcoin technology isn't static. Network updates and improvements can also influence a halving and its impacts.

Looking Ahead to the 2024 Halving

With the next halving in 2024 on the horizon, it's important to prepare for its potential impacts. What can we learn from previous halvings, and what should investors keep in mind for 2024?

Expectations and Projections

Many eyes are already on the 2024 halving. Various forecasts range from another price increase to a market correction.

What Investors Should Know

The halving will not only influence the price but also has implications for miners and long-term investors. Important aspects like the cost of Bitcoin production and the general market sentiment should be considered.

Conclusion

The Bitcoin halving is a notable event in the crypto calendar, affecting both the price and media attention. Past halvings in 2012, 2016, and 2020 each had different market impacts, but the general trend leads to an increase in both price and media attention. Other factors like technological developments and global market dynamics also play a role and should not be overlooked.

For the upcoming 2024 halving, various expectations and projections exist. A better understanding of the history and potential impacts can help investors make more informed decisions. Therefore, it's important to fully understand both the risks and opportunities that this event brings.