Is Gold Going To Rival Bitcoin On The Blockchain? AAX Exchange Is Now Enabling Blockchain Gold Investment

Since the beginning of blockchain technology’s emergence on the scene of public consciousness, Bitcoin has been the undisputed king of cryptocurrency and the benchmark to which all other cryptocurrencies measure themselves against. Despite this kingly status, a new way of using cryptocurrency and blockchain may be on the horizon in the form of gold. In recent times, numerous gold oriented cryptocurrencies and blockchain projects have emerged in the market, all citing gold’s inherent value and economic traits as reasons why gold could be the future of blockchain.

Changing Gold Investment

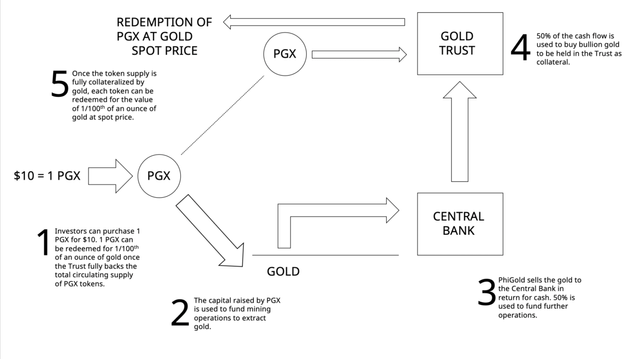

Blockchain technology has the opportunity to transform and democratize investment into gold. One such example of this can be found in PhiGold, which is a new blockchain project that offers its cryptographic tokens at $10 each and the owner of a token gets 1/100th of an ounce of gold value. This works as PhiGold owns a goldmine in the Philippines and the funds raised from the tokens go towards mining efforts. PhiGold will sell the gold to the central bank in the Philippines and then invests the cash is then invested in 995 purity bullion from LBMA.

(Source: AAX)

Once the trust reaches the value of each PGX token for 1/100th of an ounce of gold, investors will be able to cash in their tokens for the value of gold on the day, which is currently hovering at around $15. This represents a gold-buying discount of 33% for investors and makes it easier for the average person to invest in gold. The token has even appeared on Malta’s digital asset exchange AAX, with the launch being announced on the 31st of March in this year. Interestingly, Malta is the only digital asset exchange of its type to be using the London Stock Exchange Group’s technology platform.

The PhiGold platform provides an opportunity for both corporate and private investors, communities and one-man-bands’ to all have the same opportunity to get involved in the gold market, by allowing gold to be bought at a discount. The gold sector may normally be out of reach for a lot of these individuals. The 2019-born exchange made the reasons for their belief in PhiGold clear, stating “It provides a real-world example of how blockchain technology can be leveraged to disrupt a well-established industry. It provides an avenue for both institutional and retail investors to engage an area of investment, otherwise less accessible”.

Additionally, AAX felt that the success of PhiGold could prompt more exploration into other commodities apart from gold; potentially spawning blockchain projects that democratize investment into other items. This could lead to investment in other commodity markets from the average person, unlocking more doors to financial freedom.

Gold vs Bitcoin

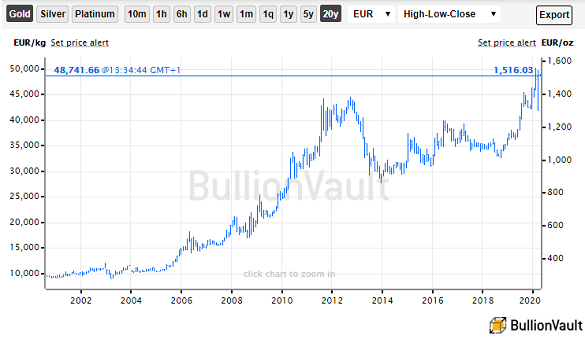

Gold, throughout history, has been known as an incredibly stable asset and whilst like all assets, it experiences price fluctuations; it still holds its value better than Bitcoin and fiat currencies. This can even be seen in recent events, with Bitcoin losing 20% of its value. Analysts have chalked this up to the worldwide COVID-19 outbreak. Alternatively, market stress has led to many investors flocking to gold, allowing it to hold its value and rally at this time. The comparison of Bitcoin price fluctuation and gold fluctuation can be seen below.

Source: BullionVault

Source: Forbes

As can be seen from the above charts, Bitcoin is incredibly volatile and can lose a lot of its value quickly, further evidenced by the crash in 2018. Whereas, gold has maintained a constant increase, except for a crash of 13% in 2013. Digital asset exchange AAX, have pointed out that both gold and Bitcoin are driven by the same economic forces, with gold maintaining value more effectively.

Additionally, gold has a strong track record and has been performing better than any fiat currency in the 20th century. Gold has also seen investment demand growth of 15% per year, for nearly two decades. As a result of this, gold is normally an incredibly safe investment for traders and businesses alike. By contrast, Bitcoin offers investors a great opportunity to make a large amount of money from their investment, even more so than gold. However, the same price fluctuations that cause people to win, can also cause people to lose much more substantially.

Gold-Backed Stablecoins

There have been attempts to digitize gold, even before the emergence of blockchain technology. Despite this, in the blockchain and cryptocurrency world; gold has seen itself become the pegging asset for a number of stablecoins. Stablecoins are cryptocurrencies, which align their value based on being backed by an asset, usually fiat currencies. Gold is beginning to show promise in this area, due to it having greater stability and growth potential for would-be investors, with a commonly cited flaw of stablecoins being limited investment potential. Stablecoins seek to remove the risk of price fluctuation for investors of cryptocurrency and increasing the earning potential makes it much more viable.

Examples of Gold-Backed Stablecoins

Digix Gold

Tether Gold

Pax Gold

GoldMint

Wow, how is you getting so many votes? Wow. Can you teach me how to earn as much money on Steemits? I love Justin and TRON.

oh checkout or @beemengine

I'm not sure with this.

Yeah this is dangerous advice

Many crypto projects will keep up poping and then will be drowned forever, the need is to become a solid long-living blockchain project that users can trust on, Crypto community needs new projects like AAX Exchange but the community lacks trust which should be given more by these projects

You contradict yourself in this comment I think

I agree with your thoughts. I write an article for this week's coin. This week ETH getting bull run. If you want to check how I am sure that it will take a bull run then read my article @analizo https://bit.ly/2VnDWDj .

I analyzed the ETH past few days data and you can read it.

ETH has a lot of room to run you think?

Thanks for this post.

Thank you too

yo considero que el btc no se podra rivalizar con nadie ya que el no esta atado a nada par mantener su precio. en cambio una cripto que este basada en el precio del oro va a ser como un ancla para su precio. lo mismo paso con el petro aqui en venezuela.

Maybe not though.

I'd be careful. There's really nothing special that blockchain adds to gold. The vault can already give you an account and a balance and let you buy tiny shares of gold. Putting it on a blockchain seems kind of pointless to me. Maybe it avoids KYC regulations, but then I bet it's way more likely they'll eventually be dishonest and not pay out the gold they owe people.

Nothing against gold, but I'd stick with reputable and regulated vaults if you want digital shares.

gracias por la informacion del post

The consequences of the subsequent bitcoin halving could be significant. History may repeat itself (Price increase), or something else may happen.I have an optimistic view of the future of digital currencies after halving.since 1971, when the dollar was no longer backed by gold, the value of the dollar has fallen and the price of gold has risen against the dollar. Gold rose from $ 35 per ounce in 1971 to $ 1,500.If the lack of gold makes it superior, Bitcoin is far superior to gold.Gold shortages and high demand from global institutions, individuals and central banks are the main reasons why the value of the gold market has reached more than $ 8 trillion. Now imagine that there was a basic metal that was as small as gold and had another special feature; [Bitcoin] could be transmitted through communication channels.

But history may all be different this time. Important to be safe.

Physical gold is the only investment will last long. Crypto and blockchain are just for short time. They are only used in govt an private sector in future.

Physical gold may be on the way out.