12/29/2017 The Market View and Trading Outlook

Overnight price action was somewhat uneventful in the grand scheme of things. As I noted in yesterdays analysis, we did have a small run up in price starting in the late evening which allowed me to make a few bucks. That said, I am playing my cards very close to the chest at the moment as I am not totally sure which path BTC wants to take. To be entirely honest at current we are just as likely to have a lower low in the sub $10,000 range as we are to reach and close above $16,400; the price we need to semi confirm the correction is over.

I am also still trying to figure out how the BTC vs BCH situation will shake itself out. Whether big money is going to suddenly see BCH as an extremely discounted BTC at its current price of $2400 and run it up to create the flippening or whether BTC will follow a correct charting path and slowly rise from the ashes as institutional and retail investors alike regain faith.

I can see a scenario where BTC does not die off or find itself replaced by BCH; a scenario where BTC becomes a store of value with little to no other intrinsic use, while BCH transforms into the payment conduit for Alt Coin purchases due to its substantially cheaper fees and faster transaction speeds. Take the above with a grain of salt as it is merely conjecture at this point and amounts to nothing more than the random musings of a somewhat conspiracy minded trader with an inflated cynical side.

O.k. onto the specifics, the good stuff, WTF is BTC going to do in the near/far term?

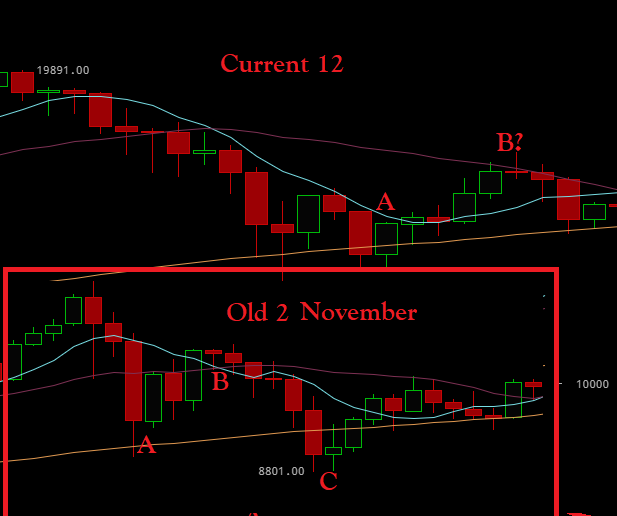

Starting with the 12 hour time frame, BTC is not in bad shape, in fact things look to be a bit bullish as the recent selling session has shown negligible conviction at best. If we take a look at the MACD histogram we will see that while we are in the red, there has not been extreme high volume selling in the last 36 hours or so; this point being evident if you compare the previous momentum (A) to the current momentum (B). This can be taken 1 of 2 ways, 1) This selling period will end uneventful and we are headed up. 2) This selling period has not actually started and the red is the last buying period fighting hard not to die off. In which case we will see another exciting drop to $10,000 or below which should be the end of a nested correction pattern. If we hit $9,000-$10,000 I will start buying in at the point most likely.

That said I am not betting on the fact that we will see lower lows as chart patterns repeat themselves over and over regardless of time frame. The longer time frames are nothing more than the same greed/fear cycles you see in shorter time frames manifesting themselves over a wider range. To be a bit clearer, in a 5 minute time frame you will see the same patterns emerge with generally the same results as you will in a, 1 hour, 4 hour, 12 hour etc. To illustrate this point, I pulled a 2 hour time frame from a couple months ago (the drop from $11,000 to $8,000). Notice any similarities?

It is entirely possible that the current 12 hour time frame is playing out the same pattern noted in that old two hour time frame where the price subsequently went to $20,000. The trick is to determine where relative to the older pattern we are in the current pattern. For me it is a bit too early to tell, but the result is the same in that we will (should, probably, maybe, this is crypto who the fuck knows) go up toward $23,000; longer time frames play by the rules of Fibonacci retracement just the same as the smaller ones do.

What can we expect today? Much of the same most likely, ranging behavior, bulls and bears fighting it out and investors trying to gain a firm sense of where the floor is. On a positive note, the longer we stay in this range, the more the moving averages from the longer time frames will catch up and act as support toward higher highs. Investors will also gain more confidence and slowly start buying on the chance that we are near the bottom. For me, I’m going to make some micro purchases on the shorter time frames to test the waters with close stops in case I need to bail out. I feel it is too early to go all in as we do not have confirmation of uptrend.

Ethereum/Litecoin

DO NOT GET TRAPPED IN THESE. I all capped it as this is important. There is really no need to go heavy in either of these at the moment as the most probable path is uneventful at best. In the event that BTC takes a dive, ETH and LTC will follow so you lose. In the event that BTC takes off with confirmation of recovery ETH and LTC will MOST LIKELY not follow. For those of us that were around during the $3000 to $1700 crash of BTC and corresponding crash of $400 to $130 for ETH, you will remember ETH shooting to $212 as BTC bottomed out, and then down to $185 as BTC took off on a tear back up to $3000 and beyond. A great many people were left sitting on ETH hoping that it was about to shoot back up to $400 as BTC made its recovery; didn’t happen.

Money cannot be in two places at the same time. People started pulling from ETH and LTC to jump on the BTC train. I would not look for super gains again in either of these till BTC full corrects and trades sideways. This is not to say that there are not gains to be made. The current price of LTC at $250 seems to be a pretty safe bet to go up at some point, and will likely craw to $315 or better before leveling out while BTC does its thing. It is also just as likely to range in the $250-$300 area for the next few weeks in much the same fashion as it did in the $40-$60 ranges a few months ago while BTC was tearing up the charts.

Previous Analysis:

https://steemit.com/bitcoin/@pawsdog/12-28-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/12-24-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/12-19-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/12-17-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/12-15-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/12-12-2017-the-market-view-and-trading-outlook

Oh man I was not even looking at your posts for a few days but look at how much you will be earning soon. Amazing work. Congrats on the comeback. So steemit is working hhhhmmm.

It's like survivor, you have to make alliances, vote people off the island, find immunity idols etc. It's something. I think I'm not so excited about what's coming as much as I will be at $5000 when I see what's going and get to give away $500 to a follower. Steemit is not necessarily how I support myself and I am using it as a way to share with others and hopefully pay it forward.. :)

kudos to you for helping out the follower. It definitely changes the one's perspective when a whale upvotes. I hope to one day have a post very similar to yours. Again great comeback.

A post similar to mine? I just gotta work on building my reputation now I think.. I want that 70... :)

$300+ in rewards regarding to berniesanders and haejin. I know you put your effort into that post and it was desrving to get a payout. But what a payout. That is even bigger than my account insane. Yeah I definitely can see you at 70. Please remember little red fish like me when you are there ;) Thanks.

It was just luck I think, we shall see I have some other interesting articles to release once I collect the payout on that one. No need to piss folks off and get downvoted before going to the bank.. :)

So true. Money talks bullshit walks. ;)

True, but oddly bullshit seems to make money..lol

Love the amount of effort you have put into this analysis. Thank you.. helps develop awareness of the situation..

Why thank you.I try and keep an open mind and look at the bigger picture. It is so easy to focus in and get tunnel vision

Great job, you don't sound too cynical when suggesting the storage of value for bitcoin. Only time can tell. I am enjoying reading these for sure. Gives me some good insight as I just started the trading game. Started small. Had little gains with some loss and now I'm waiting on an upwards spike so I don't lose. A very intense game to play

thanks... :)

I'm pretty much just holding tight at this point... I have no idea what to make of this market... except to watch Ripple either take a dive. The Market Cap of $601M is considerable... and yet all the major players still have fairly low prices.

It is interesting that is for sure.. LTC took a hit.. ETH seems to be holding the 700 quite well

Here is an extremely well written analysis regarding some of the questions you discussed.

https://s3.eu-west-2.amazonaws.com/john-pfeffer/An+Investor%27s+Take+on+Cryptoassets+v6.pdf

That was a very solid, long, but solid article.. I think I will print it out and read it again so I can digest the wealth of information therein