Starters guide for CRYPTO Trading

BEFORE you start reading, if you want to be a profitable crypto trader, you must be willing to spend considerable hours learning the skills of the trade. NO ONE WILL SPOON FEED YOU. You might join a pump and dump group (might see profits, but not in the long run), or a paid group to teach you the skills (might not fulfill your thirst of knowledge). At the end of the day, there is nothing more satisfactory to learn on your own.

I am mesmerized by the ability of Bitcoin and also crypto-currencies to polarize general public opinion. Most say its a fad, a Ponzi scheme; the rest of us see it as the future of interchanging goods through a digital asset (also many other applications which I will omit).

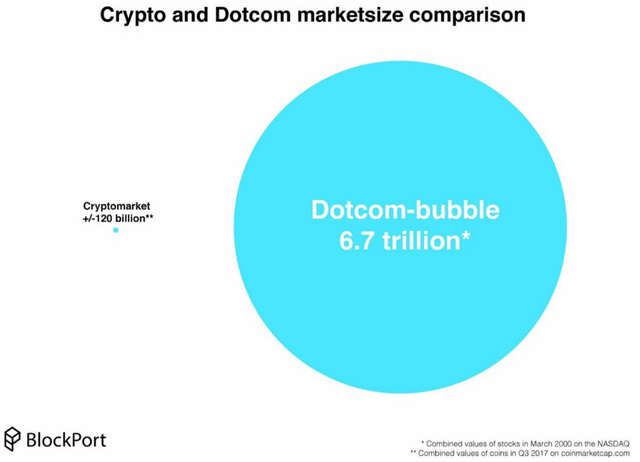

When I decided to actively trade crypto, noticed there is no quick guide to tackle this profitable monster. So I decided to contribute my 2 cents to the crypto cause, and make this “short” guide for noobies, that I think might help newcomers to have a good head start, more than I had when I started. The image below always reminds me why is it that I am in crypto.

DISCLAIMER: more than obviously, I do not know it all about crypto, and am very far from knowing it all, BUT in the time I have been trading crypto these 10 points will definitely will help out one way or the other to find those profits in crypto.

Learn basic crypto terminology, so scammers don’t bull shit you. Wallet, ICO, DYOR, FUD, FOMO, SHILL, mining, staking, stacking, POS, POW, master nodes, TA, FA… the list could go forever, but don’t worry, if you invest time in crypto you will learn these fast, and WILL get rewarded for it, eventually.

Learn to do basic Technical Analysis (TA), so you don’t buy the FOMO (Fear Of Missing Out), or sell the FUD (Fear Uncertainty Doubt). You could start with http://www.investopedia.com/university/technical/ or https://steemit.com/cryptocurrency/@wolfofpoloniex/bare-basics-of-trading-cryptocurrency.

Use common sense when buying a project, if its too good to be truth, might not be that good. Dig deep. Do plenty of Fundamental Analysis (FA) before jumping in. Look for stuff that looks OFF in a project. Check the specs, web, social media. Check http://www.investopedia.com/university/fundamentalanalysis/ for FA reference.

Investigate the project digital footprint: Twitter, Facebook, Github, Slack, Telegram, bitcointalk.org or their forum, email news letter. When/about what was recent update. What was ICO price vs. current. 99% of all tokens are in Coinmarketcap, if not yet, be wary.

Fiat to crypto? Use Cex.io. Need a credit card to get those first Bitcoins or Ethereums to start trading. Fees there are steep, but I’m confident they wont rip you off (have used it for couple years now), even if their support takes more than 48 hours to respond.

Start crypto trading, get your Bittrex, Cryptopia account. Those two are the ones that I use the most, but there is also Poloniex (shitty support, laggy AF), Kraken (Trading UX is crap), Liqui, Bitfinex, Coinexchange, Novaexchange, and many other. None of them is perfect, but by far Bittrex is the best IMO.

Get TradingView or Coinigy for proper Technical Analysis tools. Once you get comfortable trading you will start getting demanding of how you do your TA, charts in exchanges mostly all of them are really bad.

Always but always get 2FA = Two Factor Authentication in all your accounts = email, exchange, social media, don’t be an easy target.

Get a hardware wallet for your gains: Ledger, Trezor, KeepKey. Keep those Bitcoins/crypto in a safe place. Keeping your crypto in exchanges is NOT a good idea.

Twitter is a good crypto jewel detector, follow the good guys that have been in the game for a while, they USUALLY know best. I might be biased because I have done short interviews to them or have followed them for a while now. These are my top picks:

https://twitter.com/cryptomocho

https://twitter.com/CryptoYoda1338

https://twitter.com/onemanatatime

http://twitter.com/loomdart

https://twitter.com/petersinguili

https://twitter.com/bitcoinmom

https://twitter.com/notsofast

https://twitter.com/bitcoin_dad

https://twitter.com/ZeusZissou

https://twitter.com/WolfOfPoloniex

https://twitter.com/crypto_rand

https://twitter.com/SecretsOfCrypto

https://twitter.com/Tcorp_

https://twitter.com/MediciCrypto

https://twitter.com/Yorkyor30444439

This might be THE only chance in your life to gain financial freedom, DO NOT waste this opportunity.

If you enjoy the read, follow me on Twitter https://twitter.com/Panama_TJ, its good for Karma.

Congratulations @panamatj! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPI agree that its not easy for the average Joe to get on their feet. It took me several months of watching and reading (yes no one spoon feed me). Then when I was ready to invest I found out about exchange deposit/withdraw restrictions and had to wait (I didn't want to pay credit card fees). A lot of this has to change to capture the broader market money.

Anyway - your write up is a good intro primer. Well done.