Hydrogen: Q&A

1. Hydro specs and how this translates to English for non-crypto speakers?

Hydrogen is a technology platform building the Financial Web 3.0 — an open, global ecosystem for financial services. Hydrogen consists of Atom (core tools to build financial applications), Ion (machine learning and AI capabilities), and Hydro (blockchain and decentralization layer).

Hydro aims to decentralize financial services by bringing the public blockchain to traditionally private systems. It allows developers around the world to enhance their platforms and applications by leveraging blockchain technology. Below is an overview of Hydro’s features.

Current Products:

- Server-side Raindrop: Authentication layer to secure large databases and APIs that forces a completion of an on-chain micro-transaction before granting access to a private system. Leaves an immutable paper-trail of access attempts, helps prevent data breaches and identify breach attempts.

- Client-side Raindrop: Authentication layer optimized for securing user accounts. Similar to U2F authentication; biggest value-add here is that it prevents the need for a user to pass a website an entire public key to implement U2F authentication on a mobile device. U2F uses public key cryptography, unlike the shared secret used in most user-facing authentication protocols. Also, the Client-Raindrop smart contract generates a unique HydroID for each user, which is a gateway into using the broader suite of Hydro smart contracts.

Under Development

- Snowflake: Ubiquitous identity management protocol. Acts as a singular connector for a user to manage data from any smart contract. Snowflake allows different forms of on-chain data to be compatible with private systems from one source managed by the user, so programs can drive business logic from on-chain data, seamlessly tied to a user’s ownership.

- This means no single identity standard needs to be accepted globally; any number of standards can be defined and accepted around the worlds. This is analogous to how identity works right now, with different governments issue different identifying docs that contain different information; Snowflake makes all standards cross-compatible by linking data to a base protocol.

- Snowflake is based on a non-fungible token ownership model, similar to the ERC-721 standard.

In the Roadmap

- Ice: Document signing — allowing users to maintain on-chain records of signed documents tied back to their identities established via Snowflake. This will help to reduce corruption as well as to streamline off-chain business practices.

- Tide: Payments protocol — a ‘layer 2’ scaling solution in which transactions can be processed based on data tied to layer 1 Snowflakes. Layer 1 data queried from a user’s Snowflake can drive business logic to clear sidechain transactions on conditions programmatically determined by payment processors. This will streamline international transfer of funds, and it takes advantage of Hydro token transfer features already included in the Snowflake smart contract.

- Mist: This will be an AI-driven process to optimize business logic that leverages Snowflake.

2. Why Hydro is unique, better than the other coins and why it will thrive?

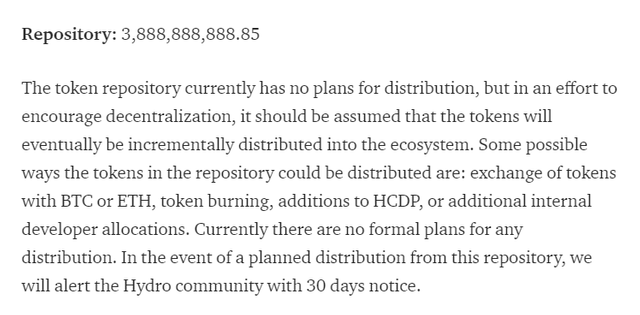

For one, we never did an ICO and we’ll never do one. We airdropped all HYDRO amongst developers who signed up for our site back in February. In as little as five months, we’ve grown our community organically to 9k telegram members and 8k twitter followers. We created a new approach to a bounty program called the Hydro Community Development Program(HCDP for short!) which aims to be a decentralized program where anyone can create tasks regarding the expansion of the Hydro technology ecosystem internally (dealing with core Hydro code) or externally (extending or implementing Hydro code). Members can also tasks others to get pieces of content (white papers, blog posts, etc) translated in their native language, create contest and giveaways. 10% of HYDRO total supply is allocated and distributed to the HCDP over the lifetime of the Hydro ecosystem.

In terms of tech, our team has significant experience in blockchain development as well as financial services. We have carefully planned out our roadmap to create products that can add real value to existing systems while empowering users with control and transparency. Our modular approach to augmenting systems with blockchain tech offers us a realistic roadmap toward a grand vision to decentralize financial services while bringing value-adding products along the way.

3. How will Hydro simplify the usage of crypto for mass adoption?

- APIs: Our APIs allow businesses to maintain the integrity of their private systems while leveraging the benefits of a public blockchain without requiring an entire overhaul of their systems. This also provides a familiar interface for developers to access blockchain-based functionality while not dealing directly with smart contract code.

- UX: One of the main things that we focus on is ease of user experience. A large amount of dApps are not very intuitive or can be annoying for the end user. We have tried to eliminate that issue as much as possible while creating all of our products. A primary way we do this is through delegated transactions where we pay for end users’ gas costs.

4. Who is behind Hydro? Backgrounds?

Mike and Matt Kane: CEO & CTO

Hydrogen is a spinoff from Hedgeable, a robo-investment app, created in April 2009. Mike and Matt’s background with Hedgeable laid the groundwork for both blockchain and Fintech to become a part of what Hydrogen is today; Hedgeable was the first robo advisor platform to expose consumers to Bitcoin investments in 2015. Mike and Matt have been working with large financial institutions throughout this process and continue to do so with Hydrogen, which gives Project Hydro unique insight into the path toward adoption of blockchain products from the perspective of clients.

Shane Hampton: Blockchain Lead & Financial Engineer

Shane began as an early team member at Hedgeable, the fintech startup that eventually spun out Hydrogen. Over his career, he helped Hedgeable innovate in the consumer wealth management space with new features like venture capital investing, socially responsible investing, hedging, and cryptocurrency investing. At Hydrogen, Shane works on Project Hydro and heads the Financial Engineering department.

Anurag Angara: Product Manager

Anurag worked at Ernst & Young as a consultant in the financial services space prior to joining Hydrogen. In studying blockchain technology, he came to realize the ways in which it could alleviate many of the challenges large financial institutions face, and accordingly create a world in which users are in control of their own information within a decentralized global economy.

Andy Chorlian: Blockchain Engineer

Andy worked at eMoney Advisor prior to Hydrogen. There he worked as a software developer using mostly C#. Andy joined Hedgeable in 2017 and was part of the team that spun out into Hydrogen. He works on creating smart contracts and facilitating interaction with them through the Hydro API suite.

Noah Zinsmeister: Blockchain Engineer

Noah came to Hydrogen from the Federal Reserve, where he worked as a research analyst. He’s also the founder of ProveIt, an Ethereum DApp, and currently spends his time developing cutting-edge smart contracts for Project Hydro.

Nahom Yemane: Community Manager

Nahom worked at a boutique PR firm called Channel V Media (that’s the letter V, not five) before joining Hydrogen. After a minor exposure to bitcoin back in 2014 (and didn’t buy the dip, tsk tsk!) his intrigue for blockchain slowly built throughout the years. After learning more about the space and leaving his previous position, he joined Hydrogen as the first hire for Hydro to build out the community and introduce new approaches to spreading the word of Hydro.

5. How is/was Hydrogen funded?

We generate revenue from clients who use the Hydrogen platform, including large financial enterprises.

6. Plans for exchanges?

Hydrogen is a technology project that is built by and for developers and technology enthusiasts. We do not have any comment outside of that.

7. What is/will be Hydro marketing plan?

Our Twitter, Medium blog, and video content strategy have done a fantastic job educating and spreading the word about our project. Our Medium blog just expanded to include our Ion (A.I), Atom (financial), and Element (design) teams so you should hear more updates on our other projects outside of blockchain. We will be planning an AMA on our Reddit focused on Snowflake soon, with the team reaching out to other communities as well. We recently had an AMA on the BitcoinMarkets Slack. During Blockchain Week, we held the first annual Blocktank event, which was a massive success for us.

Shouts out to Huobi, General Assembly, and Blockchain Founders Fund for making it possible, special thanks to Wan Chain for coming in clutch! We can’t wait to do our second event! You can expect Hydrogen at a lot of conferences this year as well, and since we’re on the topic, Mike will be at InVest NYC 2018 July 10th. Our community members have reached out to us asking to be a rep. for Hydro in their country and we are pleased to announce we working on a brand ambassador program right now, we’re still getting the details together would love to help us get more developers worldwide contributing to the project.

8. What the governance of Hydro will be like by 2020?

As Hydro continues to grow and evolve, we want to push towards decentralization as much as possible. In the end, we envision a platform that is build and maintained by its community and users. Hydrogen would always be a part of that group, but we would like to be just one of many stewards. We have taken several steps to achieve this goal. First, we airdropped our token to developers in order to create a more technologically-minded community than other blockchain projects. Second, we have built our blockchain products to act as a base layer to tie users into a sophisticated range of activity. This allows Hydro to be an ecosystem rather than an individual product that requires management by just one entity. Finally, we have created a very technologically-driven community development program (HCDP) in which any party can create task requests to be completed in exchange for Hydro. In the coming weeks, as Snowflake is released, we plan on publishing specifications for several dApps to be built on top of Snowflake as part of the HCDP. This will allow developers to derive value from the Hydro ecosystem through their own applications, leaving Hydrogen as just one actor that partakes in the ecosystem.

9. Who are Hydro’s closest competitors, how different are they?

Since we are targeting financial services, we often get compared to blockchain projects like Ripple and Stellar. However, from a product point-of-view, those projects are not direct competitors. Hydrogen, as a platform, most directly competes with technology/consulting firms like IBM who have blockchain initiatives building on top of private blockchain technologies like Hyperledger. These firms differ from Hydrogen because Hyperledger, Chain, and similar technologies are implemented with private and permissioned architectures, while Hydrogen’s mission is to merge private systems with the benefits of a public blockchain. We believe this focus on public chains, specifically, is critical to realizing our vision of developing the Financial Web 3.0, and ultimately introducing a much-needed decentralization layer to the financial services arena.

10. What current partnerships Hydrogen has and what will be its purpose?

Hydrogen partners with financial services firms who leverage our technology as users of the Hydrogen platform. This can include many kinds of institutions like banks, investing firms, and insurance companies. We actively work with several financial services clients, but do not have permission to make announcements about them yet.

11. Please explain Hydrogen products.

Hydrogen has three core products:

1. Atom — A suite of tools and libraries that helps developers and enterprises bring digital financial solutions to market.

2. Hydro — A blockchain & decentralization layer that connect private systems to the public blockchain, allowing any application to easily leverage the power of smart contracts.

3. Ion — Machine learning capabilities to make financial applications more intelligent, by using the power of data for better and more informed decisions.

12. What’s the ballpark figure of a heavy implementation on a large enterprise?

Pricing for large enterprises is custom and based on a wide range of factors, but a relationship with a large, global financial institution could be in the range of $1 million to $10 million USD per year to use the Hydrogentechnology platform.

13. What the airdrop distribution looked like?

Developers had until February 16th, 2018 to sign-up on the Hydrogen website for the airdrop. We reviewed users’ GitHub profiles for repo activity and implemented a variety of checks to prevent spammers and duplicate entries. If approved, devs received 222,222 HYDRO. In the end, approximately 11,200 participants received the airdrop; 2,632,330,741.57 HYDRO was distributed in total.

14. Close to 75% of total supply is share between 5 accounts? Who does these accounts belong to?

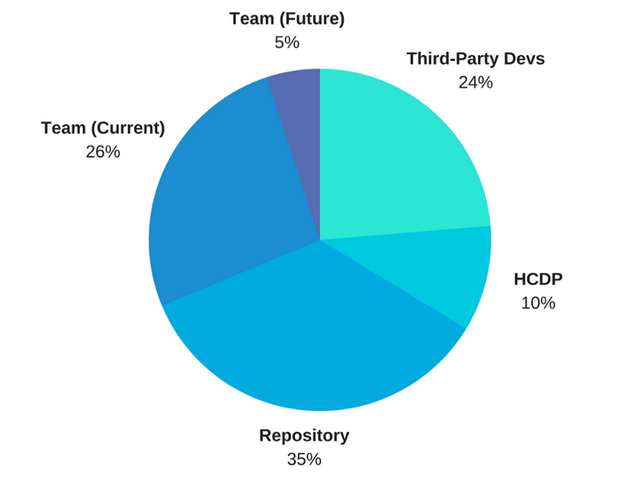

We aim to pass all tokens into the ecosystem in a way that fosters incubation and development on the platform. You can see our detailed token distribution plan for more details.

15. Please share the tokenomics for Hydro.

Tokens are required to call functions on our Smart Contract and build products in the Hydro ecosystem. For Server-side Raindrop, an on-chain micro transaction must be conducted in Hydro before access to a system is granted. For Client-side Raindrop, any party that wishes to onboard users into the Hydro ecosystem by creating HydroIDs must maintain a balance of Hydro. You can see more detail on how this works here. Our API is currently the only party that does this, but anyone else could do the same.

For Snowflake, in order for a Smart Contract to be able to be set as a resolver, it needs to pay a fee in Hydro. Since Snowflake acts as a passport for identification information, the Hydro is a gateway fee for dApps into the network which streamlines user interactions with dApps and apps. Additionally, users are able to encode Hydro withdrawal and transfer permissions with their resolvers, allowing resolvers to seamlessly integrate conditional token-transfers between user accounts into their apps. A basic example of this would be a rewards service that deposits Hydro to users whenever they complete certain surveys.

16. How clients pay for Hydrogen services? Client buy Hydro fromHydrogen? Clients buy Hydro from Exchange and then pay to Hydrogen?

Hydrogen is intended to be just one actor in the decentralized Hydro ecosystem. Hydrogen charges clients in USD to use its APIs; the APIs interact with the blockchain so that businesses don’t need to have blockchain developers or build blockchain infrastructure. We’re agnostic about how Hydro users secure their tokens.

I stumbled upon Hydrogen on Twitter, as most of my findings. A bunch of people that replied to my tweet from below, said Hydrogen without a doubt. I thought my tweet and the answers from people were just to compete for a bounty, but since it was an overwhelming I had to check out.

Went straight to official Hydrogen community Telegram, +9.4k members, I thought thats huge for a non-ICO coin this young.

Starting looking at what they offer… “mind blown”, they have WORKING products (read question #1) and some other under development to offer to enterprises, not your traditional, hey-you-need-an-expert-to-deploy. They provide end-to-end deployment of their products.

Team wise, one word, robust. Hydrogen team could put to shame most top 50 cryptocurrencies, due to their diverse expertise and experience.

And last but not least I checked out token distribution, initially it raised a red flag for me, such a large quantity of tokens under the core team it usually is not good. Core team graciously pointed me on the right direction, brought to my attention the explanation to this “red flag”, they had previously wrote an article on it, Understanding The Hydro Token Distribution.

The biggest chunk that needs the most explanation is the “Repository” which has 35% of total supply.

A 10M USD Market Cap coin, that caters to enterprises, brings blockchain and fintech adoption to large corporations, has top tier financial institutions as clients, has WORKING products, and the expertise and team to make it happen, — silence, you make the math.

If you enjoy the read, follow me on Twitter, is good for Karma.

Posted from my blog with SteemPress : http://panamatj.vornix.blog/2018/07/03/hydrogen-qa/

Coins mentioned in post: