A 65% reduction in the bitcoin made whales more popular

Wassup Steemians, A warm welcome to all of you! :)

@oroujda - Last year, the bitcoin entered a great trading round that led to its all-time high of $ 19,000 for every single currency in mid-December. In the few weeks since then, the price has fallen to a very low level of $ 5,900 on Monday, February 5th, losing 65% of its peak in a short period. The decline has destroyed many of the bitcoin traders, but the richer digital currency owners have earned more thousands of bitcoin fully benefiting from these large price differences.

Major bitcoin investors take advantage of the large price fluctuations to accumulate more of their wealth

Digital currency enthusiasts realize that these currencies often fluctuate in price, and over the years traders have been able to take advantage of these fluctuations. Essentially, a trader can guess the best from selling a bitcoin , and then to adopt a system of maneuver by repurchasing it at its lowest price, a trader of this type can earn a lot of currencies. A group of bitcoin owners, who have benefited from these vicissitudes time and time again, are among the 100 most wealthy investors in bitcoin . Individuals and groups, known as the bitcoin whales, have large amounts of this digital currency and can sometimes use their assets to move the market.

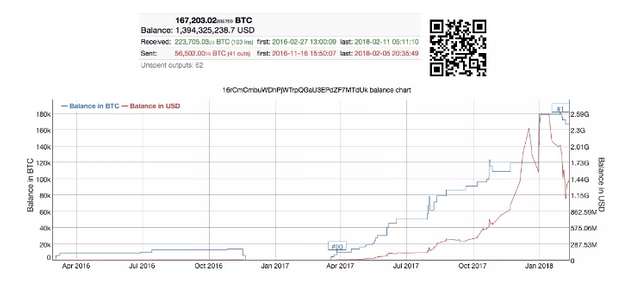

Richer bitcoin titles are gaining huge numbers of bitcoin since 2016

Take, for example, the largest number of Bitcoin in a single title, which includes 167 thousand bitcoin at the time of writing this article. The portfolio began to collect bitcoin almost two years ago, when the title recorded the first deposit of approximately $ 840. Now the portfolio has $ 1.4 billion in value, after thousands of currencies were raised after its creation. The bitcoin whale was a chance to collect more bitcoin during each rapid rise in value and typical declines that followed. In 2017 there were 6 major corrections, in which the bitcoin saw through which a loss of more than 30% of its value. But for this whale, he was earning more money every time!

"Whale market look" and the idea of the plot

Many of the more wealthy owners of bitcoin , in addition to the portfolios that remained idle for years, followed the same pattern. These bitcoin whales were able to accumulate more bitcoin by picking up heights and dips at just the right time. The tracking of the 100 richest titles shows that many of its owners sold thousands of bitcoin once between November and December last year. bitcoin traders have realized many "whale views", where you can see a lot of forum posts and tweets related to these market drivers during high price hikes and declines. For example, on November 12, 2017, when digital currencies were climbing to new price hikes, the inspectors noted that 25,000 homeowners had been sent to the "Bitfinex" trading platform.

The wealthiest bitcoin owners were a controversial subject for some time. Where major media prefer to assume that 1,000 titles have more than 40% of the market. Some speculators believe that whales can communicate with each other, which can lead to great market movements in the bitcoin. The managing partner of Multicoin Capital, Kyle Samani, believes in this theory and says:

"I think there are a few hundred people, and they're probably all going to be able to communicate with each other, and maybe they've already done that"

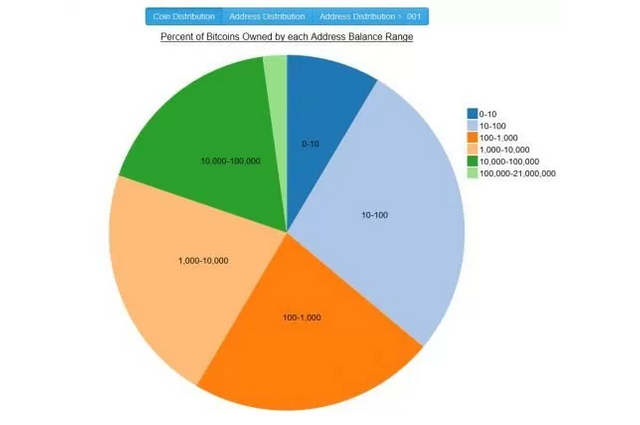

The data collected from the richer headlines to depict wealth distribution always fails

A research report published last fall reveals that the assumption that "1,000 people own 40% of the Bitcoin market" is a false assumption. According to data compiled by the Bambou Club, many models of distributing the current Bitcoin Revolution, which analyzes portfolios and titles, usually fail all the time. Bambou Club says that the problem facing most data evaluations is that they fail to recognize the relationship between the owner, the portfolio and the address. In this context, the report states that it is not necessarily based on 1: 1: 1. Bambou Club also noted:

"This means that in terms of definition, we can not consider that there is one person who owns one portfolio using one home address. In the beginning, a person can own many wallets of Betquin. The wallet can take advantage of many of the titles of Bitcoin. (In fact, it's a good idea to generate a new address each time you use your wallet, for reasons of anonymity.) So the elegance can be "

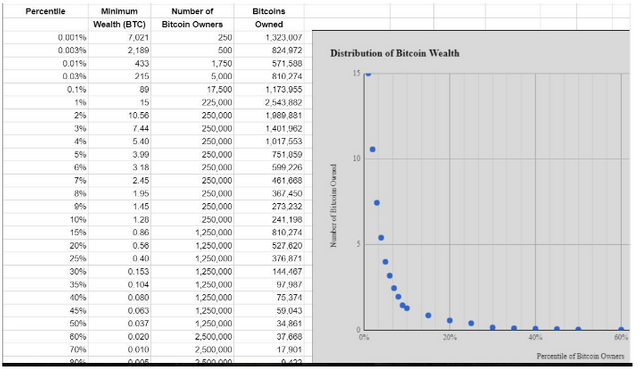

Whales become larger, but it takes only 15 petequins

Essentially, Bambou Club distributed global wealth and global ownership figures to the bitcoin , using a different method of data collection. The researchers then detailed the distribution of wealth to calculate the best analysis of the distribution of the bitcoinin. According to the study, more than 25 million petit owners need only 0.153 bitcoin to be placed in the 30 percent of the richer bitcoin owners. In addition, you need 15 homeowners to be within the 1% best rate, according to the data.

While real bitcoin whales continue to accumulate bitquin over time, the primary media portrayal of 1% deviates slightly from the line according to a different method of analysis. We do not know if whales are working hand in hand to really move prices, it's all just Internet speculation. But we know that during the various market fluctuations, especially the recent decline of 70%, many of them became a much larger fish than a whale in the sea of the distribution of the bitcoin wealth.

source: News.bitcoin

Please donot forget to Follow me -> @oroujda to get daily updates

Very interesting graphs! Gave me a lot to think about with these whales amongst other things!

This is true. What kind of things are these?

Just like other ways that the markets are just totally influenced. Bad ex🤣: Bitconnect promoters kind of changing people's opinion on bitconnect driving price upwards (before they were an official scam🤣).