Hyperdeflationary Monetary Systems: why they should be owned and utilized

Traditional fiat money is designed to decrease in value steadily over time, in a means to hold the carrot just in front of the working man and women in order to stimulate demand in an economy at scale. We seek to examine this methodology and propose an adjustment we believe will improve the quality of life for a larger portion of the population if and when coupled with current stimulus methodologies.

Introduction

John Maynard Keynes in his 1936 book, The General Theory of Employment, Interest and Money essentially stated that a market economy left to its own devices is less effective than one that has assistance when it veers too far up or down. Up being when an economy begins overheating and down when there is a recession or a period of low demand. Although there are other known methods to stimulate a down economy, or cool off an overheating economy, for this article we will focus on monetary policy.There are two ways in which central banks implement monetary policy.

The first is by adjusting the Federal Funds Rate, or basically the short-term interest rates charged to banks for overnight borrowings of cash between each other. For example, institution A is slightly over-extended on credit and needs to meet reserve requirement X. A second bank, Institution B, has higher reserves and ample supply of cash available to loan institution A an amount sufficient to cover A’s reserve requirements. In return, Institution B receives interest for the length of one day on this loan, making the short term aspect of this transaction quite literal.

The second way a monetary authority can implement monetary policy is by affecting the Monetary Base. This concept can best be imagined as what people talk about when they refer to “money supply” in macroeconomic terms. For this paper we will refer to an economy’s monetary base as its “liquid money supply”. In this second scenario, when the propensity to save is higher and demand is lower, a central bank may buy up large quantities of bonds from its country’s commercial banks, or issue loans in order to add liquidity to these banks holdings. With the banks having more holdings, they can decrease interest rates to borrowers in hopes of raising demand for loans. These loans equal new money in an economy. For example, a large land developer decides to build and expand, as lower interest rates make an investment less risky on their end. That developer then needs workers and new money finds its way in. This is one of the things people are referring to when discussing trickle down economics.

What is the problem with these strategies? In general, the problem in this equation is that the bulk of assistance goes to the commercial banks and the land developer. Although work is created, workers get no added benefit, for example as higher earnings that will support them in times of one of the regular economic crisis. The land developer buys a new Range Rover and the construction worker just lands a new low wage paying job. This is only one example of how trickle down economics favors those higher on the ladder. One could also argue it is potentially more profitable for some banks to have these conditions, as opposed to conditions in a stable or overheating economy.

Hyperdeflationary Monetary Systems

As an alternative to these systems, the technical innovations inherent to cryptocurrency now present the possibility of creating Hyperdeflationary Monetary Systems (HDMS). A currency that increases in potential buy power, as opposed to slowly decreasing, will naturally benefit adopters of the currency.

Furthermore, owning an HDMS gives exposure to an appreciating asset while retaining higher liquidity. Higher liquidity tends to lead to a higher velocity in an economy. Velocity is the rate of use money gets in a period of time i.e. spending and receiving. A higher velocity is a major characteristic of a healthy economy. An HDMS built on blockchain or another digital currency framework will be noticeably cheaper and easier to use than traditional methods of money transfer for value set aside for interest or appreciation through other investment vehicles when liquidity is needed. The point is that cryptocurrency is assistive to an economy’s velocity, where an investment account is not.

Essentially, to qualify as an HDMS an asset should have the following attributes: liquidity, acceptance as payment for goods or services and debts both in person (paper wallet) and digitally, as well as a yearly increase in buying power of average 10% or more over any considerable period of time. These attributes make a HDMS an attractive currency option to couple with fiat in today’s economy. The idea is this: use fiat where needed, hold and spend HDMS currencies where and when possible.

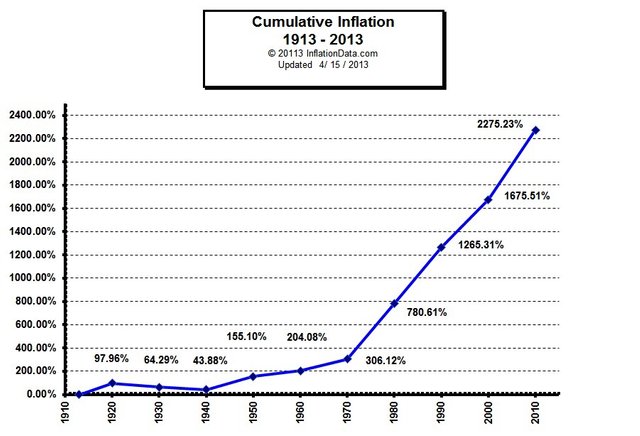

Current inflationary method utilized by the majority of global economies. Note: especially from the 1970’s onward.

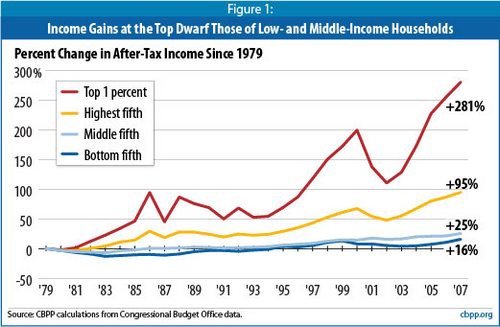

Income disparity since 1979

If you compare the charts above you will see that the top income levels are the only levels that effectively adjust and cope with accumulative inflation over time. This type of high risk and high reward hedging can and should be very attractive to the “construction worker” we spoke about earlier.

Potential Issues with Hyperdeflationary Monetary Systems

Problems that exist for an HDMS are similar to those of cryptocurrencies in general.

- Scalability

This is certainly one of the main issues affecting crypto today. However, this is due to the fact that we are in the infancy of the technology behind it. We believe innovative solutions are deep in development and we give mention to the following projects and believe they should continue to lead innovation in the space. Bitcoin, Ethereum, Stellar Lumens, BitcoinCash, Ripple and Tezos are the clearest examples.

- Regulation strangulation

If one considers strangulation by regulatory bodies due to over reaching legislation as a real threat, then it is best to perhaps utilize only Bitcoin and Ethereum. This is due to the declaration of the SEC that these assets are not securities. This essentially gives them a different classification than any other cryptocurrency. Although other regulatory bodies can still rule, the SEC for now will not be doing so. That being said, remember the SEC is a U.S. governing body and although they often set the standard for monetary authorities in other countries, they ultimately have no power over the rest of the world’s use of cryptocurrencies.

- Adoption

Money is only money if people accept it as such. That is the only requirement. Someone can write “this piece of paper is legal tender for all debts private or public” on a sheet but that doesn’t make it money.

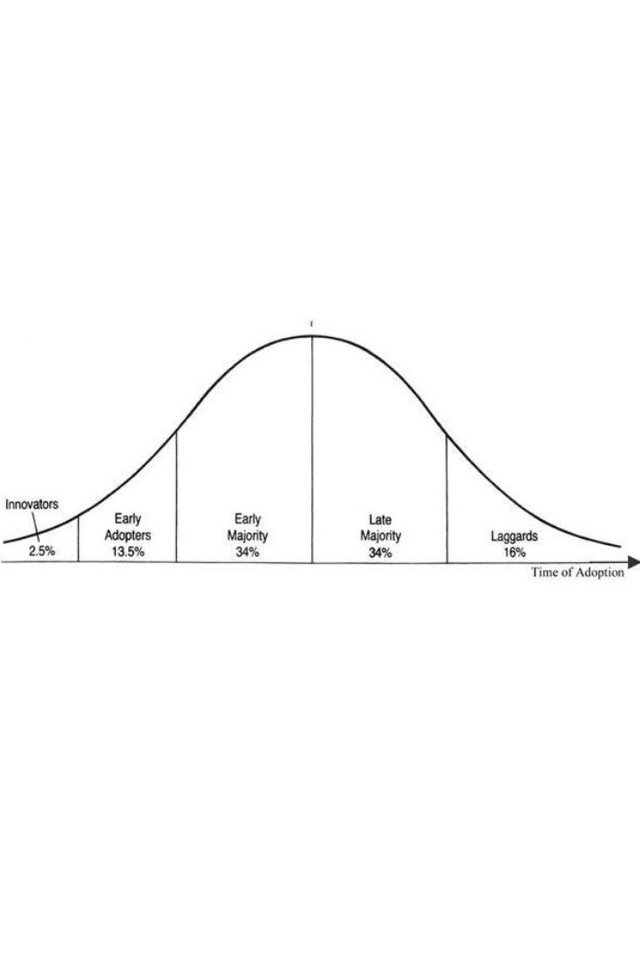

If someone accepts it as payment for a debt, then it becomes a form of payment and eventually money. At the same time, a carpenter can accept gold bullion in exchange for services rendered to a client. The gold likely won’t contain any wording about ‘legal tender’, but since it is accepted as a form of payment it serves as money. At first glance, adoption in crypto may seem slow, but if you look at the numbers you can see Bitcoin is paving the way solidly. One year alone has seen more people educated about cryptocurrency than the 3 previous years combined. This is an excellent sign for adoption. Using the ‘Bell Curve’, from an analytical standpoint, we should be still in the “Early Majority” stage. How far we are up that curve is still debatable.

- Offline Functionality

If the grid shuts down tomorrow, what would happen to HDMS’, let alone all cryptocurrencies? This is something that paper wallets partially solve, but is still imperfect in its current form. The supply of paper wallet currency is tiny compared to the currency of even the smallest economies in the world. A problem of ‘change’ exists as well. It is not easy to create change without a mass supply of bills denoting different denominations. This is a less talked about but very real risk. One thing that may ease people’s worries is that fiat money doesn’t guarantee value in these times either. Although fiat paper money should continue to function if the grid went down, eventually people may move away from it toward traditional bartering or trading of goods and services. Essentially, what we can take from this is that money is only symbolic, no matter what shape it takes. In conclusion, perhaps gold is still the best hedge in this situation.

- Volatility

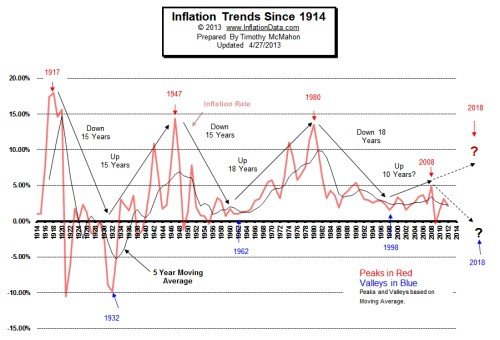

Bitcoin was by far the most valuable global currency of 2017. In 2018, it is high on the list of the worse. This is an issue, whether we like it or not, and one of the reasons that we believe cryptocurrency is still best accompanying fiat currency. The store of value bitcoin offers is immense. As a currency it is still highly volatile, but that is something that would stabilize if fully adopted as a global currency. It is important to note that the USD and Euro are also volatile, in that they can fluctuate gradually by as much as 2% — 5% for example. It is easy to imagine that they fluctuated in greater percentages when first introduced as payment notes for debts. That being said, bitcoin has the issue of max supply, which by nature will make it more sensitive than the USD, for example, as the the latter’s supply or monetary base can be affected to adjust for volatility too far in any direction. Another valid argument is that inflation is volatile as well, but over a span of time. If you look at a period of 10 years or more the moving averages are accomplishing what monetary authorities seek. A short view is reminiscent of one of the characteristics people complain about with bitcoin. Below is a chart of non-accumulative inflation since 1914. One could argue there’s there is no perfection in the inflationary model which should then give leeway for HDMS’ to be viewed and measured in the same light.

Conclusions: New Opportunities for Accumulation, Saving and Spending

The innovative solution proposed in this paper is based on a reinterpretation of economic theory, that states that there is a point where the increase in purchasing power raises the Marginal Propensity to Save (MPS) tremendously. However, if you study the behavior of wealthy people, you will find there is a point where their spending and saving behavior changes again. They feel they have a sufficient amount saved or an expected income high enough to serve as a sufficient “cushion”, and they then begin purchasing more, especially luxury items or products or services that they may have never consumed in the past. Investment increases as well: take a look at the old saying “it takes money to make money”. Past a certain point, the money that was saved due to a higher MPS becomes new investment in the economy, and eventually higher demand for products and services again. When the demand rises and prices follow, it should eventually restart the cycle. In a sense, the trickling effect happens but not just from the top. The middle class and even the lower classes can stimulate investment and spending among their respective sub-groups. This should take effect along with the normal traditional trickling down inherent to economies at scale.

The idea that holding the carrot just enough in front of people as a way to raise labor output and GDP should not be the only solution to a healthy economy. We argue that coupled with more liquidity, an appreciating asset class such as bitcoin, ethereum, or HDMS’ such as Optitoken may actually be a way to sustain a healthy economy, while also increasing quality of life for more members of society.

In general, there are two different ways people store value or attempt to accumulate it. The most popular in the 21st century are the following; equity (public or private), gold, real estate and bonds. None are extremely liquid, the most liquid of these is public equity and gold. Lower income people tend to be able to save less, which means a greater portion of their savings and accumulation (cash heavy) tend to devalue over time due to inflation, while upper middle class and upper class people tend to be able to enjoy interest, dividends or appreciation over time on a larger portion of their savings and accumulations of wealth. The bottom line is that middle and lower class people tend to be forced to swim against the stream, more so than upper classes of society.

Bitcoin introduced in 2009 and is a cryptocurrency, a form of electronic cash. It is a decentralized digital currency without a central bank or single administrator. Bitcoins can be sent from user to user on the peer-to-peer bitcoin network directly, without the need for intermediaries. Transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain. Bitcoin was invented by an unknown person or group of people using the name Satoshi Nakamoto and released as open-source software. Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services, which offers a very liquid asset which presents opportunities to accumulate low and spend/sell higher assuming its volatility continues as it has so far. Bitcoin offers perhaps the most liquid form of value storage ever in the history of money. We argue that assets like this, or others created to be even more deflationary in nature, such as OptiToken offer a completely new opportunity for people to participate of economic prosperity, despite their socioeconomic backgrounds.

By Sean Donato and colleagues

Sources:

Wikipedia.com

https://apt11d.com/2014/02/14/the-01-percent/