Is Inflation Protection the Holy Grail for Cryptocurrency Acceptance?

Why do we have bitcoin, ether and ripple? What is the economic need? First let’s exclude the pure speculative element; speculators will buy and sell anything and the greater the price volatility, the better it is. So why do we need cryptocurrency? Let’s start with bitcoin, because this is basically the genesis of accepted cryptocurrency.

Bitcoin was initiated to allow peer-to-peer money transfer without control by a centralized government. But what is incredibly exciting about bitcoin is that supply is controlled and the known quantity of bitcoin is predetermined. In other words, no one can just print more bitcoin to get out of a budget deficit. We know how much there is and how much there will be in the future.

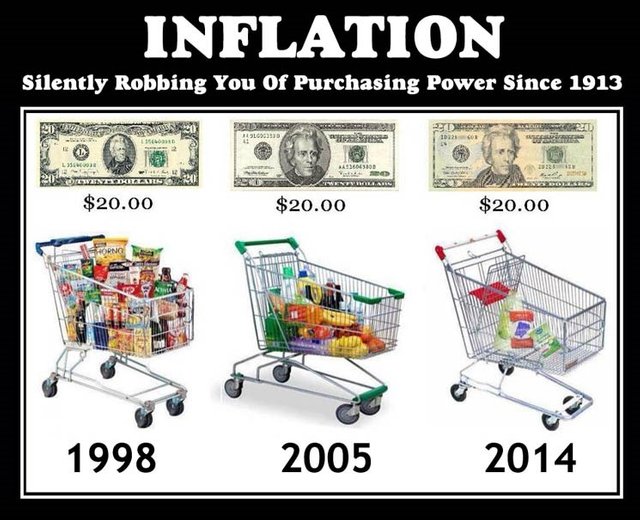

So how does this protect us from inflation? One of the surest ways to create hyper-inflation is to “print” more money. Think of countries like Weimar Germany, Venezuela and Argentina for instances in which wholesale money printing has led to hyper-inflation. So how can we prevent inflation? By limiting the supply of money. Let’s look at a hypothetical situation to illustrate this.

Suppose you and I are the only two people on an island and we use seashells as a medium of exchange (medium of exchange is a fancy way of saying money, it’s what we use to transact without bartering). There are only 100 seashells on this island and so all goods and services are priced with 100 seashells. I give you 2 fish and you give me 2 seashells. You sell me 5 hours of farm labor and I give you 5 seashells in return.

Now what happens if 100 seashells miraculously wash up on the beach? Each of us is 50 seashells richer!! Hurray! We’ve just increased the money supply by 100% and we both feel rich. But now when it comes to buy 1 hour of farm labor from you, instead of 1 seashell I give you 2 sea shells. And when I sell you two fish, I now receive 4 seashells instead of 2 seashells. Everything just went up by 100% Why? Because the supply of money has increased by 100%.

Increasing money supply, aka printing money or quantitative easing, simply increases cost of goods and inflates asset prices. This is one of the reasons we’ve been having an everything bubble; central banks have printed enormous sums of money and this money needs to be invested somewhere. We’ve had incredible build up in prices in stocks, bonds, commercial real estate, artwork, collector cars, etc. because this money needs to go somewhere. If you had already owned a bunch of stuff, you’ve gotten even richer. If you didn’t own anything, then you’ve watched everything increase in price faster then your wage.

Because bitcoin is one of the few cryptocurrencies to take into account money supply, it explicitly avoids the possibility of hyper-inflation. There are other cryptocurrencies and specifically stablecoins which take money supply into consideration, but bitcoin is the most accepted and widely used.